What to expect from stocks in June

The Sandbox Daily (6.4.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

what to expect in June

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.27% | S&P 500 +0.01% | Russell 2000 -0.21% | Dow -0.22%

FIXED INCOME: Barclays Agg Bond +0.60% | High Yield +0.19% | 2yr UST 3.869% | 10yr UST 4.357%

COMMODITIES: Brent Crude -1.20% to $64.84/barrel. Gold +0.63% to $3,398.5/oz.

BITCOIN: -1.08% to $104,664

US DOLLAR INDEX: -0.44% to 98.791

CBOE TOTAL PUT/CALL RATIO: 0.93

VIX: -0.45% to 17.61

Quote of the day

“The quality of your life is directly related to how much uncertainty you can comfortably handle.”

- Tony Robbins

Seasonal trends for June

The springtime recovery in risk assets remains in gear.

U.S. markets have largely recovered from their post-Liberation Day waterfall declines. The Dow Industrials, S&P 500, Nasdaq 100, and Russell 2000 indices all sit above their April 2 levels. The VIX is quiet under 20. Bitcoin is back above $100k.

This period of calm provides an opportunity for digestion (of recent gains), consolidation (in positioning), and reflection (assess outlook and risks).

While recent price action implies some exhaustion and favors consolidation over the near-term, it’s constructive to review seasonal trends that might support the next leg higher in trading.

So, as we turn the calendar forward to summer (!!!), what does history portend for June?

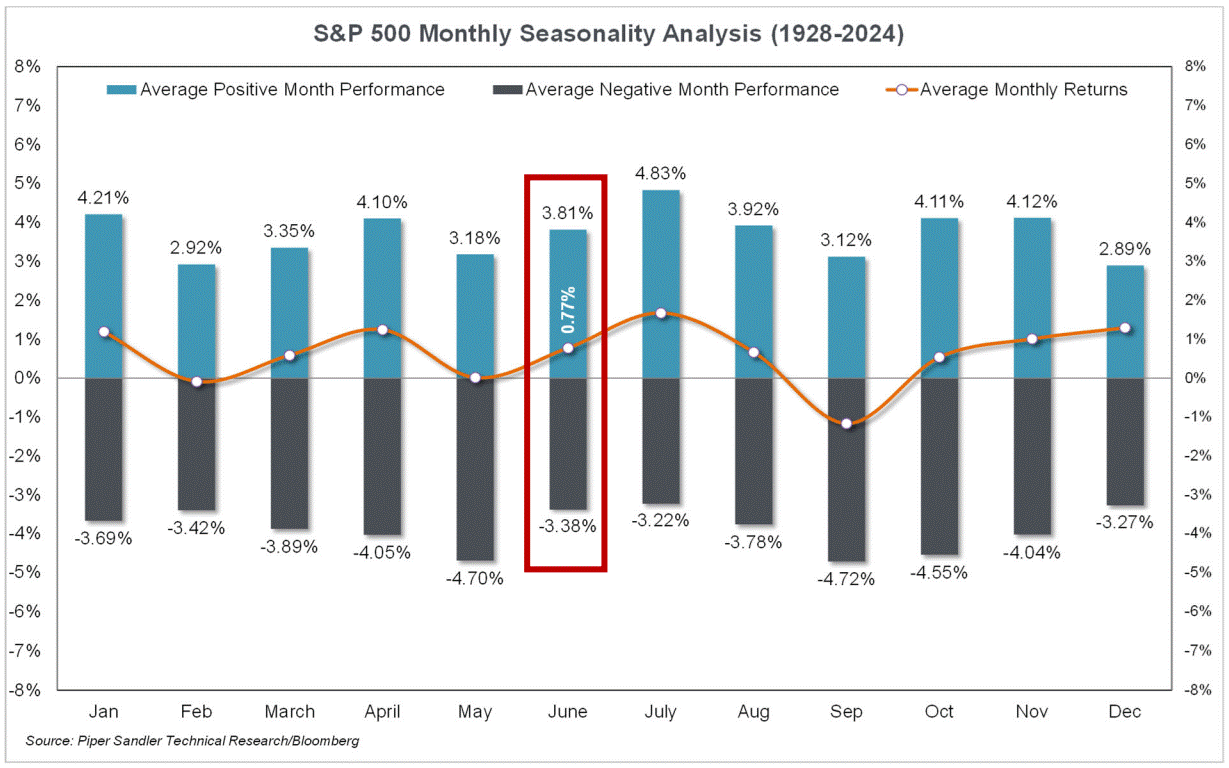

The chart below shows the average monthly performance for the S&P 500 since 1928.

Historically, the index has generated average returns of +0.77% in June and finished the month in positive territory 58% of the time, or 56 out of the last 97 years.

When returns were positive during the month, they historically averaged 3.81%. Conversely, SPX declined by an average of -3.38% when June was down.

For context, the S&P 500 has posted average monthly returns of +0.7% and finished positive 61% of the time for all months since 1950.

Meaning, June is a run-of-the-mill month for markets.

Source: Piper Sandler

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)