What to know about Fed independence, plus New York City photo dump

The Sandbox Daily (7.21.2025)

Welcome, Sandbox friends.

What a week in New York City – always so much fun ! Below today’s featured topic is a photo dump highlighting a happy hour with Sam Ro, Kai Wu, and Josh Schafer, a tv spot with Fox Business for Making Money with Charles Payne, another happy hour with the All Star Charts crew, and finally a tv spot live from the NYSE floor with Schwab Network TV for Trading 360. Oh ya, can’t forget Zach Bryan !

Today’s Daily discusses:

what to know about Fed independence

New York photo dump

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.50% | S&P 500 +0.14% | Dow -0.04% | Russell 2000 -0.40%

FIXED INCOME: Barclays Agg Bond +0.28% | High Yield +0.14% | 2yr UST 3.861% | 10yr UST 4.382%

COMMODITIES: Brent Crude -0.43% to $68.98/barrel. Gold +1.55% to $3,410.3/oz.

BITCOIN: -0.94% to $117,049

US DOLLAR INDEX: -0.61% to 97.881

CBOE TOTAL PUT/CALL RATIO: 0.74

VIX: +1.46% to 16.65

Quote of the day

“I used to be impressed by people who had a lot of money, but now I'm impressed by people who have a lot of free time.”

- Anthony Pompliano

What to know about Fed independence

Recent tensions between the White House and Federal Reserve have brought the topic of Fed independence into focus.

This is because a natural friction can exist between elected officials and the Fed, since they each have unique goals and incentives.

For instance, the President and Congress often prefer lower interest rates to spur economic growth and help fund the federal budget. In contrast, the Fed may need to make difficult choices around issues such as inflation and financial stability, based on longer-term considerations.

The Fed is not without its critics, and there are countless history books detailing both the successes and failures of different Fed chairs.

Still, Fed independence has been an important aspect of the financial system for decades. Today, much of the discussion on this topic centers around the legality of whether the President can fire a sitting Fed chair, the mechanics of what happens in that situation, and speculation over who would be nominated next.

However, what truly matters for investors is whether monetary policy remains appropriate and the economy remains stable. Regardless of how the administration chooses to act, Jerome Powell’s term as Fed Chair will end by May 2026.

Fed independence has evolved over the years

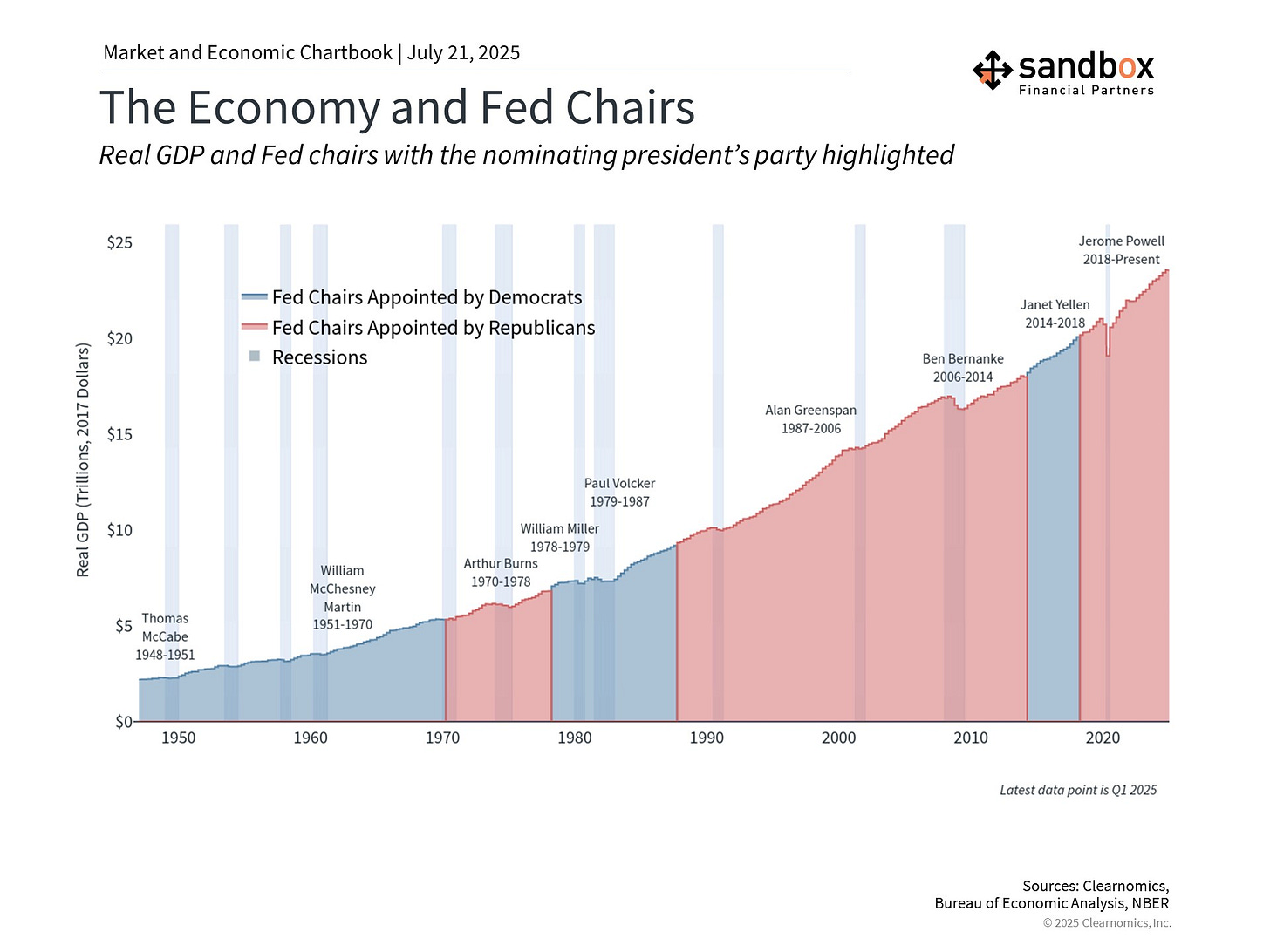

Nine Fed chairs have been appointed during the post-World War II modern era. Nearly all served under presidents of both parties, including re-nominations by other presidents. Jerome Powell, the current Fed Chair, was originally nominated by President Trump in 2017, and re-confirmed for a second term under President Biden.

The concept of Fed independence is often taken for granted, so it's helpful to briefly understand its history.

The Fed was not established by the Constitution, but rather by the Federal Reserve Act of 1913 passed by Congress.

As the country's central bank, the Fed sets monetary policy and oversees the stability of the financial system. Independence means the Fed is free from political pressure, allowing it to make decisions based only on the economy’s path and financial system’s health.

The Fed’s dual mandate is often interpreted as 1) maintaining low unemployment, and 2) targeting an inflation rate of 2%.

And yet, like many other aspects of policy, market structure, and economic progress, the Fed’s monetary policy goals conducted today are influenced by historical economic events including recessions, inflationary periods, war, interest rate cycles, and more.

Following the Great Depression, the Banking Act of 1935 restructured the Fed, centralizing power within the Board of Governors and removing the Treasury Secretary from the Board to reduce political influence.

During World War II, the Fed surrendered some independence by maintaining low interest rates to help finance the war effort. This continued until the 1951 Treasury-Fed Accord, which is widely regarded as re-establishing Fed independence by ending its obligation to support government bond prices.

The inflation and policy environment remains complex. Very complex.

Perhaps the best parallel to today’s environment is the 1970s and early 1980s.

Ahead of the 1972 election, President Nixon sought to ensure that easy monetary policy would support his campaign. Fed Chair Arthur Burns, who had been Nixon's economic advisor, accommodated this by loosening monetary policy, which economists believe contributed to the inflationary pressures of the following decade.

It wasn’t until the early 1980s, under Paul Volcker, that the Fed regained control of inflation by aggressively raising interest rates to induce recession. While most economists agree this is what ended the “stagflation” of that period, it came with its fair share of political challenges. In his memoir, Volcker recounted pressure from the Reagan administration to not raise rates before an election.

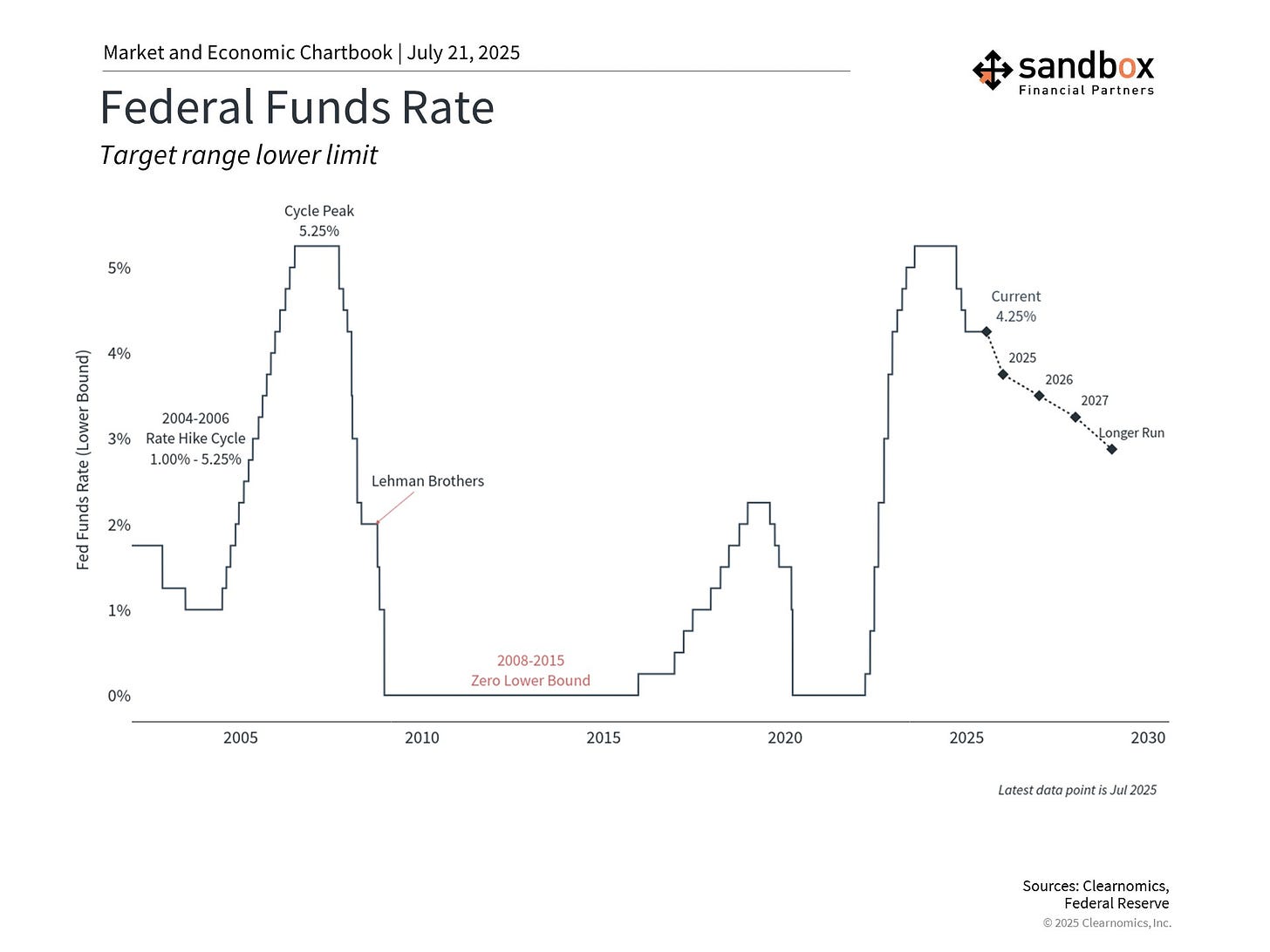

In many ways, today’s economic environment echoes that of the 1970s since there are tensions between holding higher rates to ensure inflation improves, and lowering rates to spur growth. While inflation has been trending closer to the Fed's 2% target, headline CPI remains at 2.7% and core inflation at 2.9%. Additionally, the Fed is taking a “wait-and-see” approach on whether tariffs will raise prices for consumers.

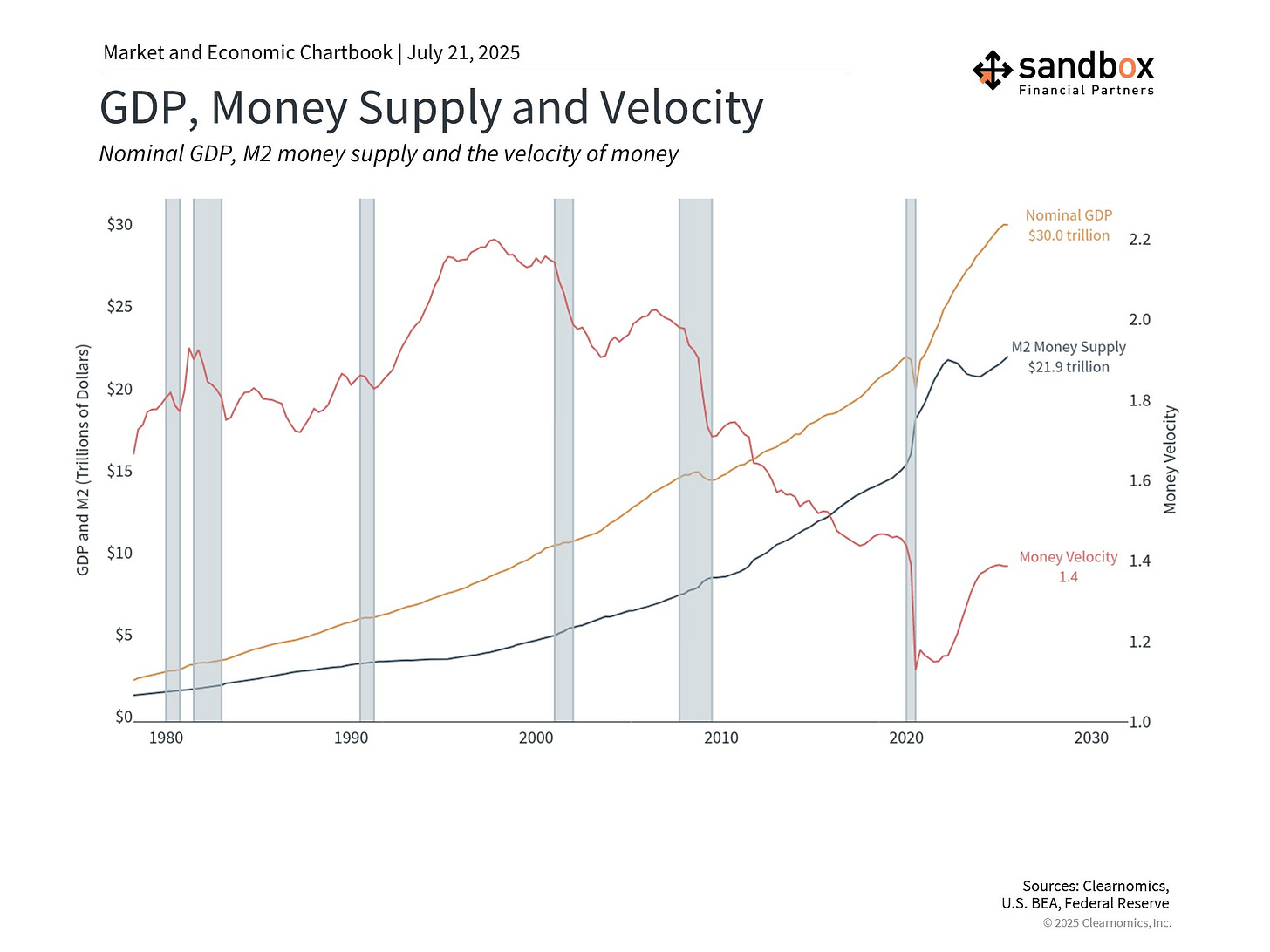

One way to understand this challenge is via the money supply, as seen in the chart below.

The money supply, which is managed by the Fed, typically increases steadily, supporting both stable growth and inflation. During crisis periods, such as in 2020, the money supply is used to support the economy. However, money supply growth has been flat in recent years as policymakers focused on combating inflation.

Naturally, this can conflict with what some elected officials might prefer.

The Fed is still expected to cut rates in 2H25

Setting political gamesmanship aside, the Fed is expected to cut rates further this year. It has been on hold following several cuts in late 2024 due to uncertainty around tariffs.

The reality is that Fed policy exists to support long-term growth trends. When the economy is strengthening, the Fed's job is to make sure it does not overheat – sometimes described as “taking away the punch bowl.” When the economy is weak, lower rates may be needed to jumpstart growth.

This balancing act is challenging, even in the best of times.

In hindsight, the Fed is often accused of being “behind the curve.”

For instance, Alan Greenspan, who served as Fed Chair for nearly 20 years, did not properly react to the housing bubble forming at the end of his tenure. More recently, most will argue the Fed raised rates too slowly in 2022 when there was already clear evidence of inflation.

What matters for investors and their portfolios is not to debate what the Fed should or should not have done. Instead, it’s to respond properly to the current investment environment with a long-term plan.

History shows that changes in Fed leadership and shifts in policy can create uncertainty, but markets have performed well in spite of these challenges.

Source: Federal Reserve Board, Clearnomics

New York photo dump

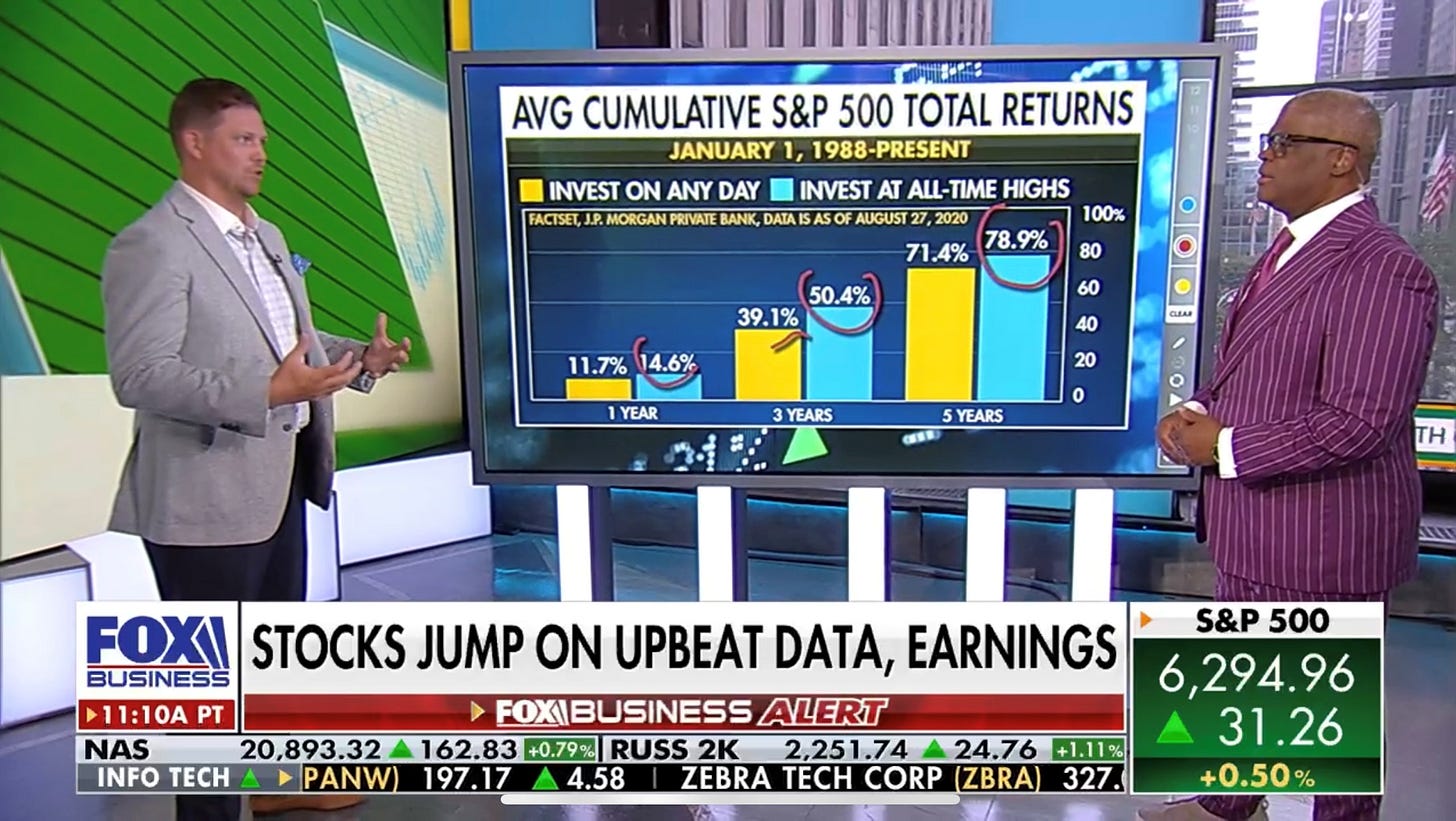

Making Money with Charles Payne

Joe’s Pizza (with the wife) for an incredible New York slice

Me, Sam Ro, Kai Wu (L-R)

Trading 360 on Schwab Network TV

Jen, Me

Ran into Frank Holland before Halftime Report on CNBC

The Dead Rabbit

All Star Charts

Zach Bryan (If you have a chance, don’t walk. RUN to get tickets!)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)