What Trump 2.0 means for the economy

The Sandbox Daily (1.21.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

how Trump’s second term agenda could affect the economy

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.85% | Dow +1.24% | S&P 500 +0.88% | Nasdaq 100 +0.58%

FIXED INCOME: Barclays Agg Bond +0.33% | High Yield +0.26% | 2yr UST 4.276% | 10yr UST 4.572%

COMMODITIES: Brent Crude -0.82% to $79.51/barrel. Gold +0.27% to $2,756.1/oz.

BITCOIN: +2.42% to $106,245

US DOLLAR INDEX: -1.23% to 108.001

CBOE TOTAL PUT/CALL RATIO: 0.69

VIX: -4.74% to 15.06

Quote of the day

“Capital goes where it is welcome and stays where it is well treated.”

- Walter Wriston, Former CEO of Citicorp

How Trump’s second term agenda could affect the economy

President Trump’s inauguration marks a significant political shift amid market and economic uncertainty.

The stock market had rallied as much as ~5.5% in the month following the November election, before giving up all those gains in the back half of December and the start of this year. As President Trump begins his second term in the Oval Office, both Wall Street and Main Street are wondering what the next four years may bring.

Investors face a complex environment in 2025 with steady economic growth balanced against fewer rate cuts from the Federal Reserve and elevated valuations. This is one reason investors could be more sensitive to growth policies than the past. So, while the president has already signed a dizzying array of executive orders, many of the new administration’s policy details are still uncertain and much could change in the coming weeks. However, key areas will certainly include taxes, fiscal spending, trade, energy, and immigration – all of which could impact the economy.

Let’s explore several different areas that could affect investors:

Tax Cuts and Jobs Act of 2017 will likely be extended

With a new Trump administration and Republican control of Congress, it is likely that much of the Tax Cuts and Jobs Act (TCJA) will be extended beyond its 2025 expiration.

The political details of how this makes its way through Congress are still being debated, but this means that tax rates will likely remain low for individuals and businesses. This includes a top marginal rate of 37%, corporate tax rates of 21% or lower, a higher estate tax exemption, and more.

U.S. will continue running a deficit

Many economists and investors expect the federal debt to continue to grow. Tax cuts and other policies only worsen annual deficits. In 2024, the government spent $6.75 trillion resulting in a funding gap of $1.83 trillion, ballooning the national debt to over $36 trillion.

Neither party has made serious efforts to rein in the deficit in recent years, especially as the country has dealt with various crises such as the pandemic and inflation.

That said, President Trump has established the Department of Government Efficiency (DOGE), a non-governmental agency tasked with identifying unnecessary spending from the federal government. While many Americans would prefer the government to operate with a balanced budget (the last ones were in the late 1990s), it is unclear whether Washington or DOGE will be successful.

Tariffs could have a real economic impact

It’s important to remember that campaign rhetoric can differ from actual policies. Nowhere is this potentially more relevant than with trade. President Trump spoke on many occasions about his plans to impose a 10-20% tariff on all imported goods along with an additional 60% tariff on Chinese goods. More recently, he has discussed 25% tariffs on Canada and Mexico, saying on Inauguration Day that he will enact them on February 1. He also plans to establish an External Revenue Service (ERS) to manage this tariff income.

During his first term, the Trump administration did in fact raise tariffs for many trading partners. This led to negotiations and trade deals including the United States-Mexico-Canada Agreement (USMCA) and the “Phase One” agreement with China. Many of these tariffs were then continued under President Biden.

The U.S. currently has the largest trade deficit in the world. As of November 2024, the U.S. imported $78.2 billion more than it exported. This is not necessarily a bad thing – it reflects the strength of the U.S. dollar and healthy consumer demand among Americans. However, this does mean that the country is effectively borrowing from the rest of the world.

Tariffs are a minimal source of government revenue, making up less than 2% of federal receipts each year. Many also worry that tariffs could contribute to inflationary pressures by raising the cost of imported goods entering the domestic market. From a political perspective, these concerns must be weighed against protecting sensitive intellectual property and preserving domestic manufacturing jobs.

Energy policy will promote drilling

“Drill, baby. Drill.”

Another key component of Trump’s agenda is the focus on energy security and dominance. He has already declared a national energy emergency and will create a National Energy Council to expand drilling in places like Alaska.

According to the U.S. Energy Information Administration, the U.S. has produced more crude oil than any nation at any time for the past six years. The U.S. is also the world’s biggest gas producer and exporter of liquefied natural gas (LNG).

Oil and gas drilling is naturally a politically divisive policy. The Biden administration recently banned drilling in parts of the Pacific and Atlantic Oceans, the Northern Bering Sea, and part of the Gulf of Mexico. Some of these bans have already been reversed, and Trump’s Interior Secretary has already vowed to reverse the rest.

For markets, greater energy supply could mean more stable prices, especially as geopolitical conflicts continue to rage around the world. Energy prices are also a primary driver of overall inflation. Recent increases in oil and gasoline prices have pushed headline inflation higher than the Fed would like.

Immigration will affect the job market

Politicians and the news typically focus on undocumented immigrants, especially with Trump’s immediate declaration of a national emergency on the southern border. After all, roughly one in four immigrants living in the United States – legal or not – was born in Mexico. However, immigration policy changes could impact legal immigrants as well, especially highly skilled workers. A reduction in immigration could have implications for the labor market, particularly in areas where worker shortages are already a concern.

There is disagreement within the Republican party over visas for skilled foreign workers, and the H1B visa program which enables companies to sponsor these workers has been a particular point of contention.

Recent jobs data show that there are still 1.2 million more job openings than unemployed individuals, so immigration policy could have a significant impact on the economy in the coming years.

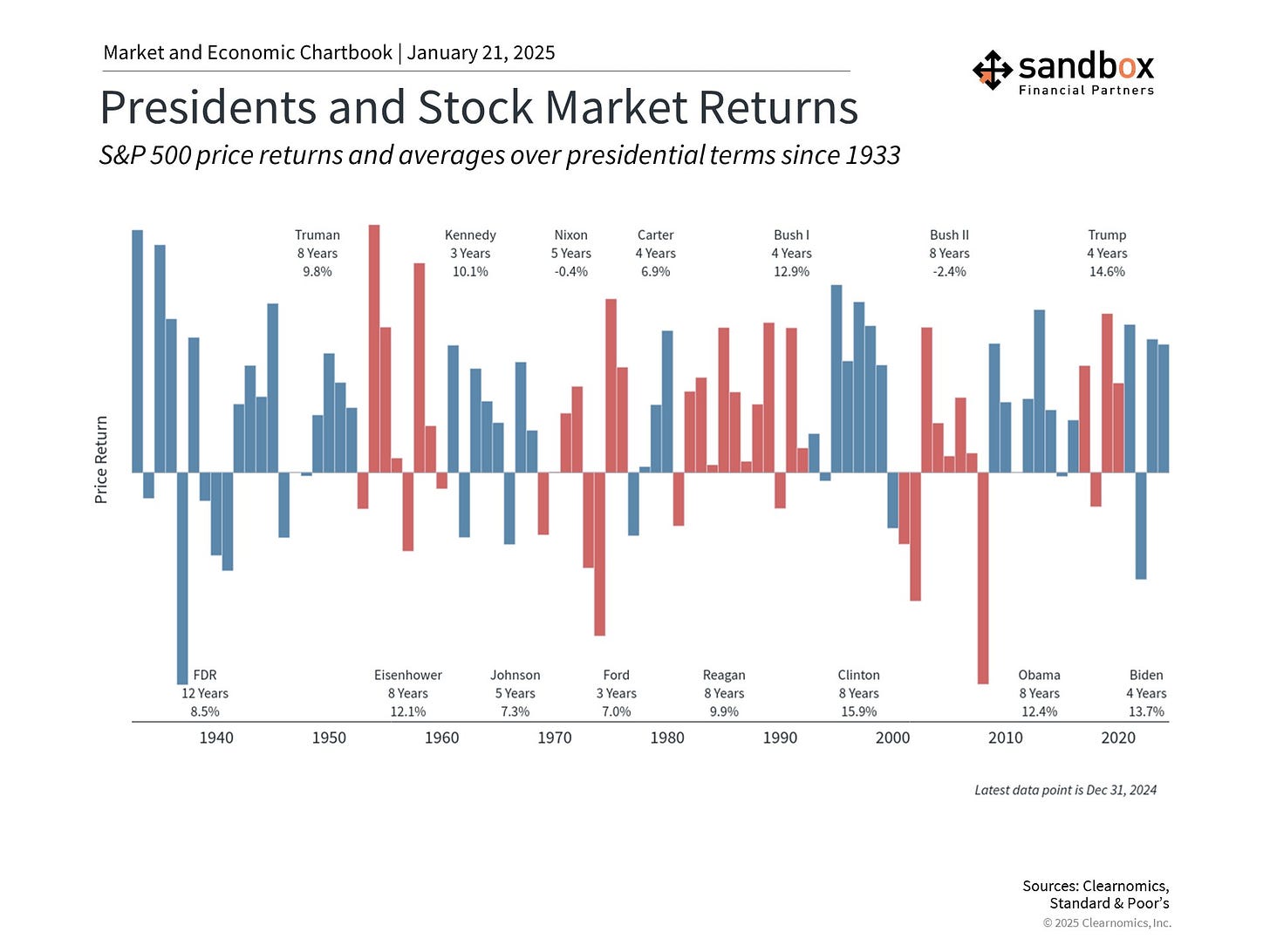

The market has grown under both parties

When it comes to markets and the economy, presidents tend to receive too much credit when things go right and too much blame when things go wrong.

History shows that economic growth and market rallies have occurred across both parties. This is because who occupies the White House is often less important than the decades-long business and market cycles that happen to be taking place.

So, while good policies do matter and can drive productivity and growth, there are many underlying factors that impact investors more than which party happens to be controlling Washington D.C.

Source: Clearnomics, Marquette Associates, Bloomberg, Axios

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: