What's driving interest rates higher, plus bitcoin's smashing success and icebergs

The Sandbox Daily (11.19.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Higher rates? I thought we were cutting rates!

bitcoin already a smashing success

how investing is like an iceberg

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.80% | Nasdaq 100 +0.71% | S&P 500 +0.40% | Dow -0.28%

FIXED INCOME: Barclays Agg Bond +0.14% | High Yield +0.15% | 2yr UST 4.278% | 10yr UST 4.392%

COMMODITIES: Brent Crude +0.22% to $73.46/barrel. Gold +0.79% to $2,635.2/oz.

BITCOIN: +1.89% to $92,279

US DOLLAR INDEX: -0.08% to 106.188

CBOE TOTAL PUT/CALL RATIO: 0.82

VIX: +4.94% to 16.35

Quote of the day

“I will seize fate by the throat; it shall certainly never wholly overcome me.”

- Ludwig van Beethoven

Higher rates? I thought we were cutting rates!

The post-election rally seems to have lost some steam – temporary or not, we shall see – amid rising interest rates and less dovish commentary from Fed Chair Jerome Powell.

The relentless backup in yields since the Federal Reserve initiated its rate cutting cycle on September 18 is quite remarkable. From 3.6% to 4.4% on the 10-year U.S. Treasury while the Fed begins its easing cycle with 75 bps in cuts to their policy rate – just the way strategists drew it up.

A popular narrative is that rates have been climbing as the unified Republican Party sweep takes hold of the market. Campaign promises like deregulation and tariffs bring about more growth and more inflation, and the bond market is repricing these prospects accordingly. The market could be signaling a growth re-rating from this fiscal impulse, the so-called Trump Bump.

Another narrative emerging more recently is monetary policy expectations, which we all know is a powerful driver to changes in both sentiment and positioning. “The economy is not sending any signals that we need to be in a hurry to lower rates,” Chair Powell stated during a speech in Dallas last week. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.” Hmmm, from a supersized 50 bps rate hike in September to a we’re-in-no-hurry statement in November. Quite the pendulum shift for the Federal Reserve’s most powerful tool, it’s public signaling/guidance or “Fedspeak,” for short. Make no mistake, Powell’s speech last week leaned quite hawkish and supports the higher-for-longer camp.

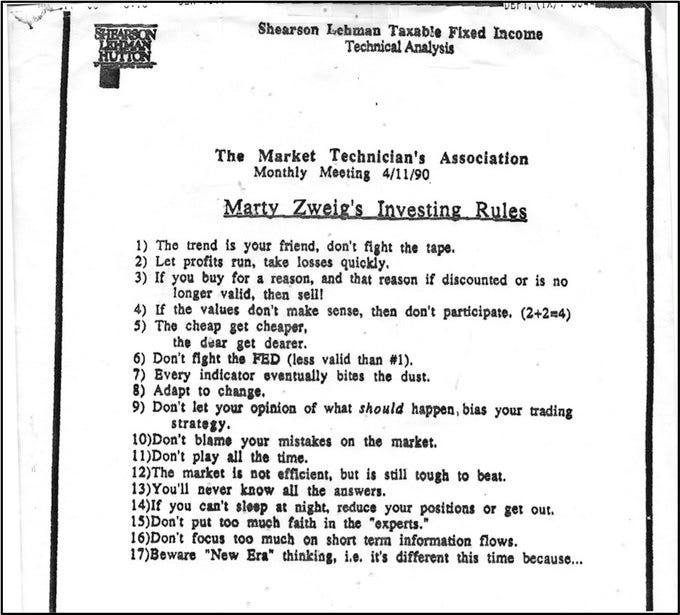

And, as we learned from famed investor and market forecaster, Marty Zweig, all the way back in 1990, rule #6 says “Don’t fight the Fed.”

What’s also not immediately clear to me is how much current economic conditions are in part responsible for higher rates. The CITI U.S. Economic Surprise Index – which measures how strong the reported data comes in vs. expectations – has been climbing higher throughout 2024. Its significance is confirmed by the market because yields are often moving higher on days in which strong economic data is being reported. Remaining above-trend for economic growth does, in fact, support higher yields over the long-term.

Maybe the yield story reflects rising risks from the enormous balance of the U.S. debt load, the ongoing fiscal deficits, and our deeply-entrenched standing as the reserve currency in global markets. Not to discount the size or importance of these issues but investors have been worrying about these same matters for decades. One day they will be proven right, but that day is not today, or even tomorrow.

Like most things in life, it’s not just one thing or another. It’s a mix of them.

Ultimately, investors should maintain a flexible stance on the future path of interest rates and understand risks to both higher and lower rates exist on either side.

Source: The Chart Report, Yardeni Research

Bitcoin already a smashing success

Bitcoin printed a new all-time high of $94,000 today as Wall Street rolled out its latest crypto offering, options trading on spot bitcoin exchange-traded funds (ETFs).

Today, options contracts for the wildly popular iShares Bitcoin Trust ETF (IBIT) from BlackRock began trading on the Nasdaq.

While the CME already offered bitcoin futures products, the spot bitcoin ETF options are a big deal for financial institutions and retail participants alike, proving a deeper onshore derivatives market with greater flexibility, deeper granularity, and increased market volume and liquidity. In short, options provide another way to trade, hedge, and speculate on bitcoin.

Demand was quite strong. $1.9 billion in notional exposure exchanged hands over 353k contracts.

This massive launch in the options market comes just a week after the iShares Bitcoin Trust ETF hit the $40 billion mark in record time (211 days), besting the previous record of 1253 days held by the iShares Core MSCI Emerging Markets ETF (IEMG).

$IBIT is now in the top 1% of all ETFs by assets under management.

Looking more broadly to Digital Assets, inflows across exchange-traded vehicles have ushered in this new asset class in a big way.

Per CoinShares: “Recent market activity has propelled total assets under management (AUM) to a new peak of $138bn earlier in the week.”

The velocity of records being broken by bitcoin standardized products is truly remarkable. At this point, the ecosystem’s move away from the dark pools of yesteryear and the pivot/launch of crypto into the traditional banking system has been a resounding success.

Source: CNBC, CoinTelegraph, CoinShares, James Seyffart, Eric Balchunas

One simple graphic

Investing is hard.

Price is only the tip of the iceberg, which itself cannot be understated. One can learn a lot from just looking at price, including but not limited to understanding a stock’s general trend, its momentum, relative strength, and consumer sentiment around the market/sector/company. These tools are critical for shorter-term time horizons.

However, there are many other important fundamental considerations lying underneath the surface that drive long-term value and stockholder returns. Understanding these quantitative and qualitative metrics are the foundation for building long-term positions with a higher degree of confidence.

Source: Brian Feroldi

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: