What’s powering this market isn’t speculation

The Sandbox Daily (1.21.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

you can’t look at valuations in a vacuum

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.00% | Nasdaq 100 +1.36% | Dow +1.21% | S&P 500 +1.16%

FIXED INCOME: Barclays Agg Bond +0.33% | High Yield +0.30% | 2yr UST 3.593% | 10yr UST 4.249%

COMMODITIES: Brent Crude +0.52% to $65.26/barrel. Gold +1.23% to $4,823.8/oz.

BITCOIN: +0.69% to $90,085

US DOLLAR INDEX: +0.15% to 98.789

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: -15.88% to 16.90

Quote of the day

“I never won a fight in the ring. I always won in preparation.”

- Muhammad Ali

You can’t look at valuations in a vacuum

Over the last year, we’ve harped on a simple truth: valuations need context. They’re also a terrible market-timing tool.

Markets can stay “expensive,” “overvalued,” or “in a bubble” far longer than most investors expect. As the saying goes, beauty is in the eye of the beholder. So are valuations.

What consistently gets lost in the shuffle is why investors are willing to pay higher multiples in the first place.

Time and again, markets have shown a willingness to pay a premium for quality and predictability – and these two factors tend to show up in the same places: returns on equity, margins, and earnings durability. When those metrics are rising or structurally higher, multiples don’t collapse. They evolve.

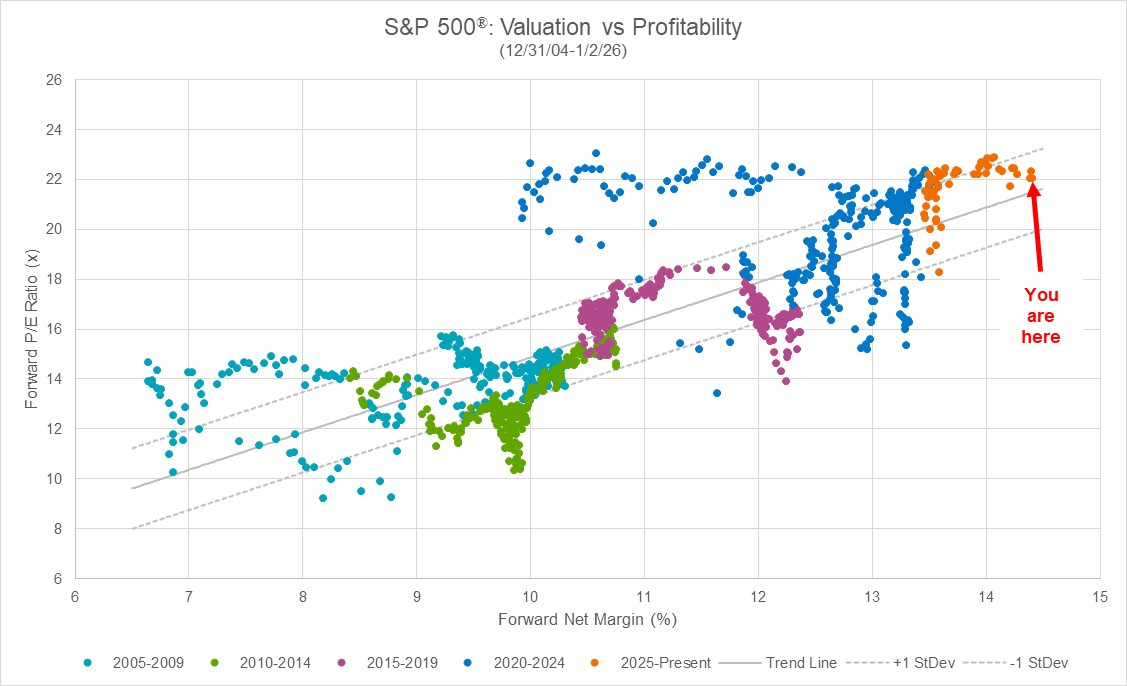

That’s why simply pointing to a 22x forward multiple on the S&P 500 and declaring “bubble” misses the mark. You have to look at valuations alongside profitability.

The scatter plot below shows the forward P/E multiple against forward net margins for the S&P 500 index, broken into four-year intervals going back to 2005. The relationship is remarkably consistent: as margins expand, multiples drift higher.

Where are we today? Right near the trendline that’s defined the last 12 years.

A bubble? Expensive? Not from where I sit.

Right on target, actually.

And that brings us to a second misunderstanding about today’s market.

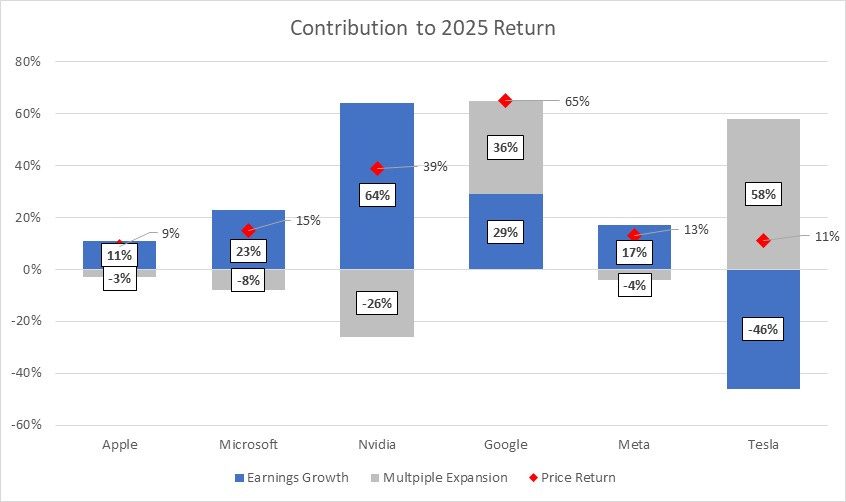

If this were a bubble, you’d expect returns to be driven primarily by multiple expansion – investors paying more and more for the same dollar of earnings.

But that’s not what’s happening. Earnings have done the heavy lifting.

The chart below deconstructs the 2025 returns for the “Mag 6” (Nvidia breaks every model, so we’ll set it aside).

In four of the six names, multiples actually compressed last year. Price gains came from earnings growth, not speculative fervor.

Google and Tesla were the exceptions, and even there the story isn’t mysterious. Google benefited from renewed optimism around Gemini and the AI chatbot race, while Tesla disciples continue to discount optionality around autonomy and robotics. In both cases, the market was pricing future earnings potential.

The broader takeaway matters: this is not 1999. Not even close.

Fundamentals are supporting this market. Not multiple expansion.

When good, hard earnings are driving returns – and multiples are effectively flat – it’s extremely difficult to argue you’re in a classic bubble.

Valuations don’t exist in isolation. And neither do markets.

Sources: Jurrien Timmer, FactSet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)