When markets price presidential elections, plus the vibecession, a conversation with Ryan Detrick and Sonu Varghese, the AI boom, and 60-40 is not dead

The Sandbox Daily (6.17.2024)

Welcome, Sandbox friends.

A few key strategists have boosted their year-end targets for the S&P 500 index (Goldman Sachs upgrades its forecast to 5600, while Evercore ISI is up to 6000 – highest on the street), Nvidia is projected to be assigned a 20% weighting (up from 6%) in the Technology Sector SPDR Fund (XLK) in State Street’s upcoming rebalance, and Pixar’s Inside Out 2 notched the 2nd highest opening weekend for an animation film and scores a big victory for Disney.

Today’s Daily discusses:

when markets price presidential elections

consumer sentiment remains oddly depressed / a convo with Ryan Detrick and Sonu Varghese of Carson Group

AI boom driving data center boom

Is 60-40 still dead? Absolutely not!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.24% | Russell 2000 +0.79% | S&P 500 +0.77% | Dow +0.49%

FIXED INCOME: Barclays Agg Bond -0.36% | High Yield +0.06% | 2yr UST 4.768% | 10yr UST 4.285%

COMMODITIES: Brent Crude +2.31% to $84.53/barrel. Gold -0.66% to $2,333.5/oz.

BITCOIN: +0.23% to $66,424

US DOLLAR INDEX: -0.21% to 105.333

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +0.71% to 12.75

Quote of the day

“Too often our efforts to manage risk creates further risks. Whether in combat or in day-to-day life, we encounter situations that call for us to assume a reasonable amount of risk to achieve our goals, and if we try to make ourselves ‘bulletproof,’ we may ultimately collapse under the weight of our gear.”

- General Stanley McChrystal, Author of Risk

When markets price presidential elections

We are less than two weeks away from the 1st presidential debate of the 2024 election cycle, and focus on the election’s outcome – a clear event risk this year – has increased in recent weeks. As recent events in various EM countries and in Europe have reminded us, election surprises have the potential to disrupt the recent calm in macro markets.

Historically, the 1st presidential debate occurs within the 1-2 month period before the election in early November. That is not the case this year, with the 1st debate slated for June 27th and the 2nd for September 10th.

Next week’s debate is a clear event that could, as it has in the past, shift asset markets and perceived probabilities around election outcomes. Even if not on the night itself, it is reasonably likely that the 1st debate serves to crystallize attention more clearly over the summer on the election, potentially much earlier than usual.

This elongated timeline of events for the upcoming U.S. election cycle creates a greater window of opportunity to disrupt what is a largely benign macro backdrop at the present moment, as evidenced by low equity volatility, falling Treasury volatility, tight credit spreads, and low option protection-seeking trades.

Elections naturally create an emotional overhang that weighs on investors. One major challenge in positioning for or hedging against elections outcomes is deciding when to do so, with the election ~4.5 months away.

Historically, the market has tended to react later in the year. The exhibits below show changes in measures of U.S. equity and interest rate volatility in the five months before and three months after the election – indexed to Election Day – across six U.S. elections since 1992; Goldman removed 200 and 2008 for this analysis given the tech bubble collapse and financial/mortgage crises occurring simultaneously in those cycles.

This simple framing shows that markets tend to start pricing higher volatility in the 1-2 months preceding the vote. A similar but more modest pattern is visible in major currency markets (using FX crosses).

Source: Goldman Sachs Global Investment Research

Consumer sentiment remains oddly depressed

Last week’s Reuters/University of Michigan Consumer Sentiment Index fell 3.5 points in the preliminary June survey to 65.6, the lowest level in 7 months and well below the consensus estimate of a pickup to 71.5. This was the 4th decline in the past 5 months, as consumer attitudes have mostly soured this year.

Both current conditions and expectations worsened this month, with current conditions falling to the lowest level since December 2022.

And yet…

The stock market is at all-time highs. Gold is near all-time highs; same with bitcoin, or digital gold. Cash is earning 5%. Home prices have risen materially since the pandemic. Household net worth is at a record high. There was no economic recession or major job losses across the economy. The Fed, to this point, has successfully managed a soft landing. In other words, the consumer is doing quite well financially.

So, how do make sense of this gap between perception (economic outlook down/bad) and reality (finances up/good)?

One reasonable explanation is how the compounding effect of inflation over the last 4 years is still infuriating American consumers. If there’s one lesson to learn from all of this, it’s the simple notion that people hate paying higher prices.

Kyla Scanlon called this a Vibecession that is plaguing a vast majority of folks.

When I look at consumer sentiment and surveys across financial and news media and we keep hearing all this negativity, my basic view is that it’s all about “core necessities.”

I like to view/measure living standards in part by how much it costs to buy necessities; of which, the four principal categories – shelter, food, gasoline, and cars – have outstripped any price growth we’ve experienced in decades. These are the everyday necessities to real consumers – items we purchase and engage with on a regular basis – and I think this is where the problem exists.

While many pundits tell us that everything is great, the reality is that many people feel like their living standards have moved mostly sideways for the last 5 years because our incomes don’t buy the same quantity of “core necessities” as they once did.

I discussed this, and much more, with Ryan Detrick and Sonu Varghese of Carson Group last week. Check out the conversation below.

https://x.com/i/spaces/1DXGyjvaqVPJM

Source: Ned Davis Research, Axios, Twitter

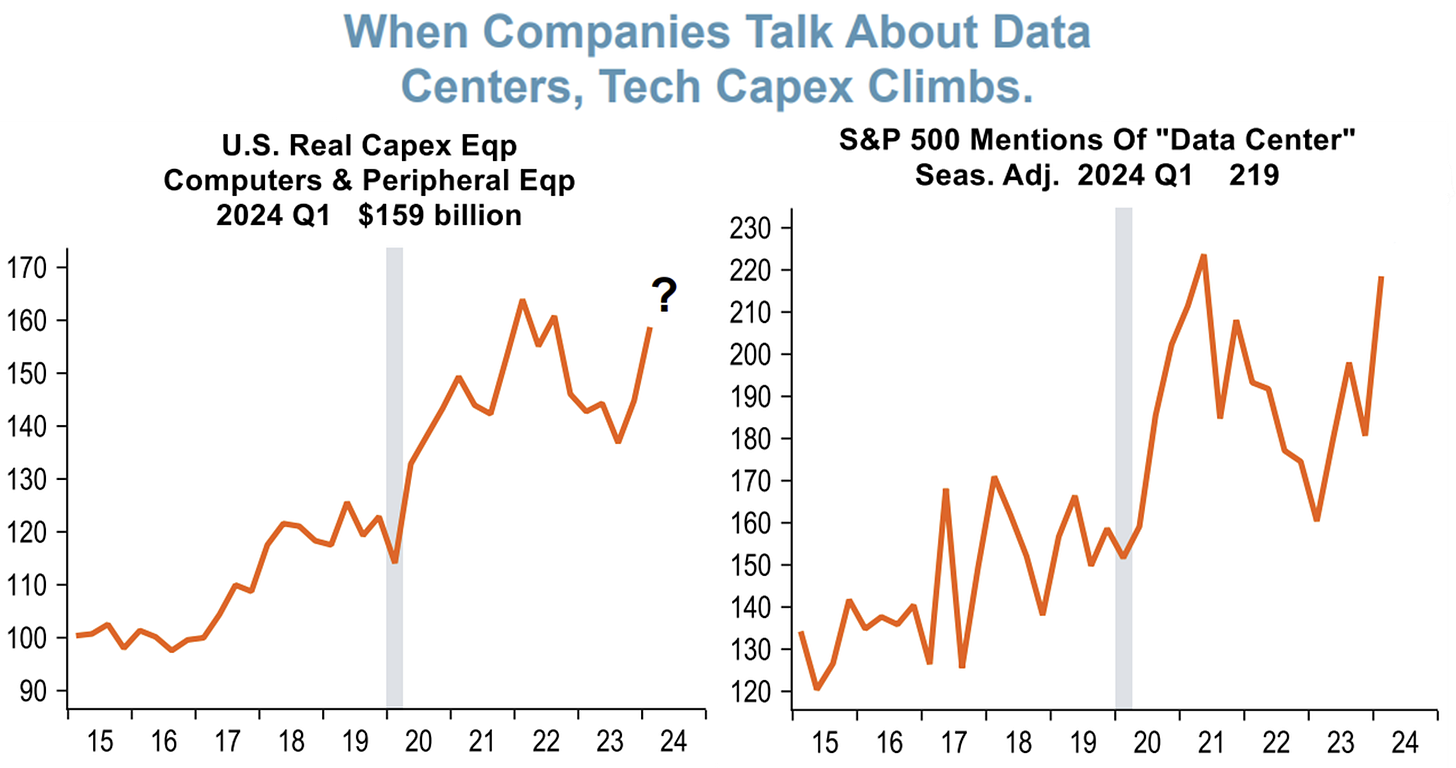

AI boom driving data center boom

As artificial intelligence (AI) becomes more entrenched in our 24/7 digital economy, the demand for power is highly likely to surge from the data centers processing AI.

According to a new study released by EPRI, data centers could consume up to 9% of U.S. electricity generation by 2030 – more than double the amount currently used.

AI queries require approximately ten times the electricity of traditional internet searches and the generation of original music, photos, and videos requires much more. With 5.3 billion internet users, rapid adoption of these new tools could increase power demands substantially. At the same time, computing facilities are becoming more concentrated, with single facilities now requesting power consumption that can range from the equivalent of 80,000 to 800,000 homes, exacerbating power delivery challenges.

Between the CHIPS act and this enthusiasm wave of AI, the tech manufacturing buildout is booming. Companies are talking the talk AND walking the walk.

Bottom line, the AI craze is driving CapEx – particularly data centers – and electricity demand.

Source: Electric Power Research Institute, Piper Sandler

Is 60-40 still dead? Absolutely not!

The iShares Core Growth Allocation ETF (AOR) is BlackRock’s simple solution to build a globally diversified portfolio using a single low-cost fund so investors can easily access a 60-40 portfolio (60% stocks, 40% bonds).

Despite the significant drawdown in fixed income that resulted from central banks synchronously raising interest rates in 2022-2023, the recovery in equity markets has been so powerful that it has propelled the 60-40 portfolio back to all-time highs. This is welcome news for investors who utilize this fairway shot when choosing an asset allocation strategy at a moderate level of risk.

As Mike jokes: “60/40, which died long ago, closed at an all-time high (on a total return basis).”

Source: BlackRock, Mike Zaccardi, CFA, CMT

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Great stuff Blake!