Why has job growth slowed?

The Sandbox Daily (11.11.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

why has job growth slowed?

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +1.18% | S&P 500 +0.21% | Russell 2000 +0.11% | Nasdaq 100 -0.31%

FIXED INCOME: Barclays Agg Bond +0.30% | High Yield +0.11% | 2yr UST 3.595% | 10yr UST 4.122%

COMMODITIES: Brent Crude +1.51% to $65.03/barrel. Gold +0.35% to $4,136.5/oz.

BITCOIN: -3.16% to $102,692

US DOLLAR INDEX: -0.13% to 99.457

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: -1.82% to 17.28

Quote of the day

“Don’t beat yourself up over past mistakes – learn at least a little from them and move on. It is never too late to improve.”

- Warren Buffett, Berkshire Hathaway in Thanksgiving Message from Warren Buffett

Why has job growth slowed?

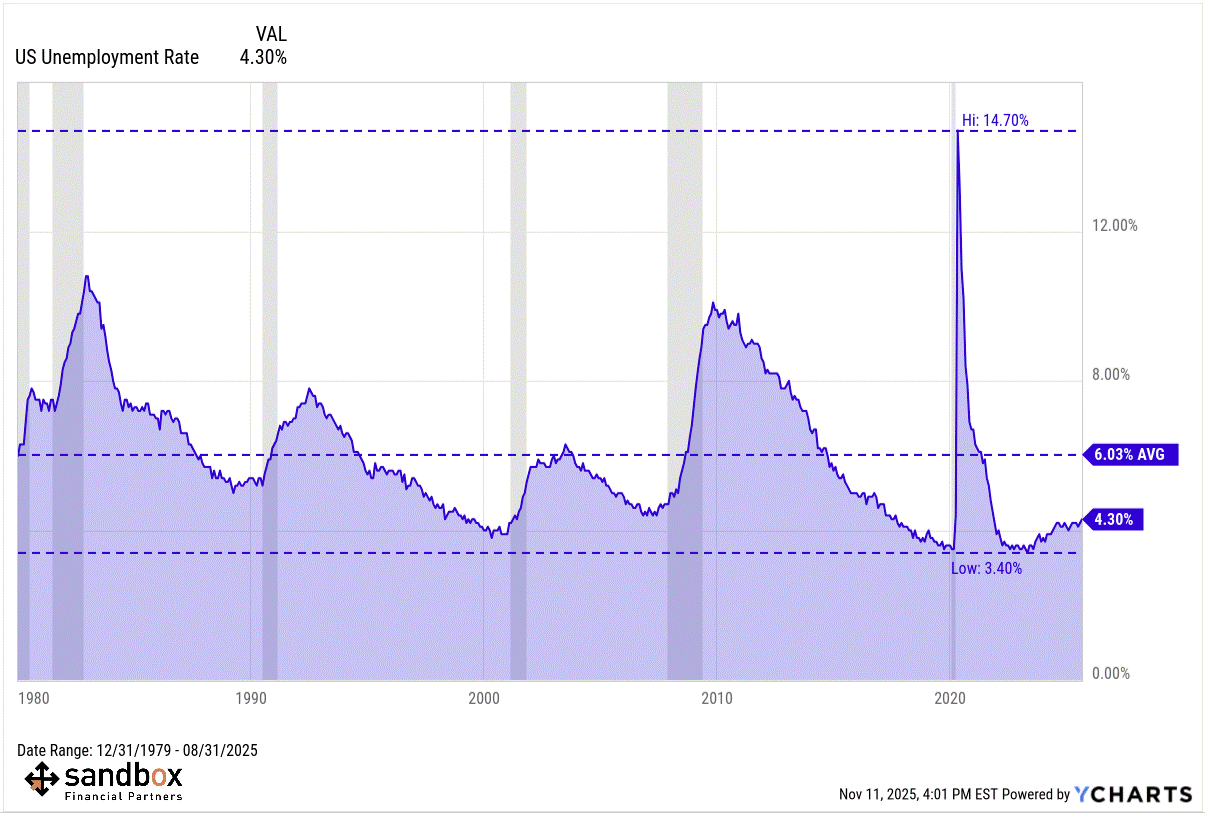

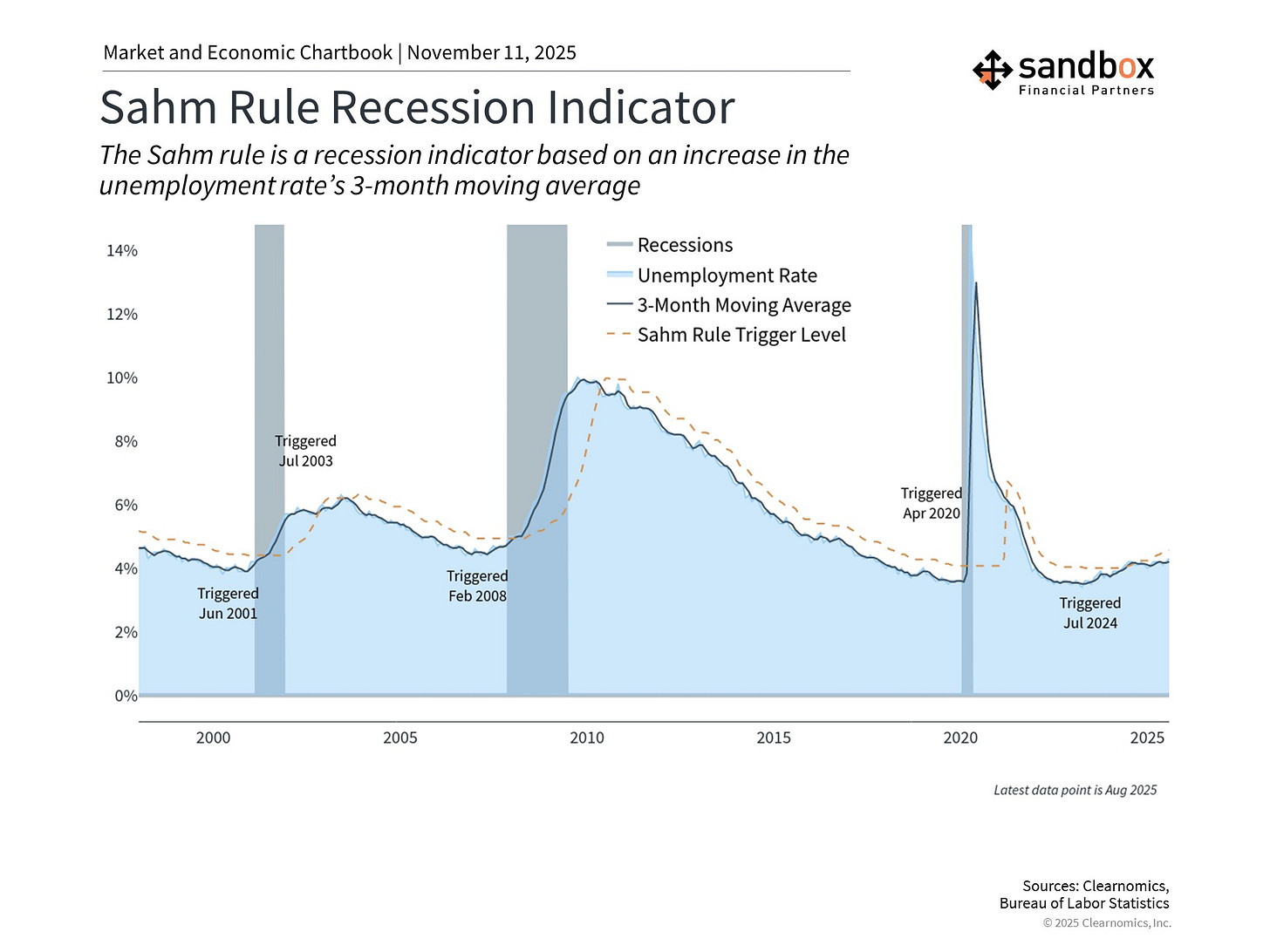

U.S. job growth has slowed sharply this year, with the underlying trend falling from 167k/month in 2024 to 111k/month at the start of 2025 to 30k/month using the most recent 3-month moving average, which unfortunately is below the estimated breakeven rate needed to stabilize the unemployment rate at its current rate of 4.30%.

Let’s explore some of the possible drivers to the stagnant labor market that many are labeling “low-hire, low-fire.”

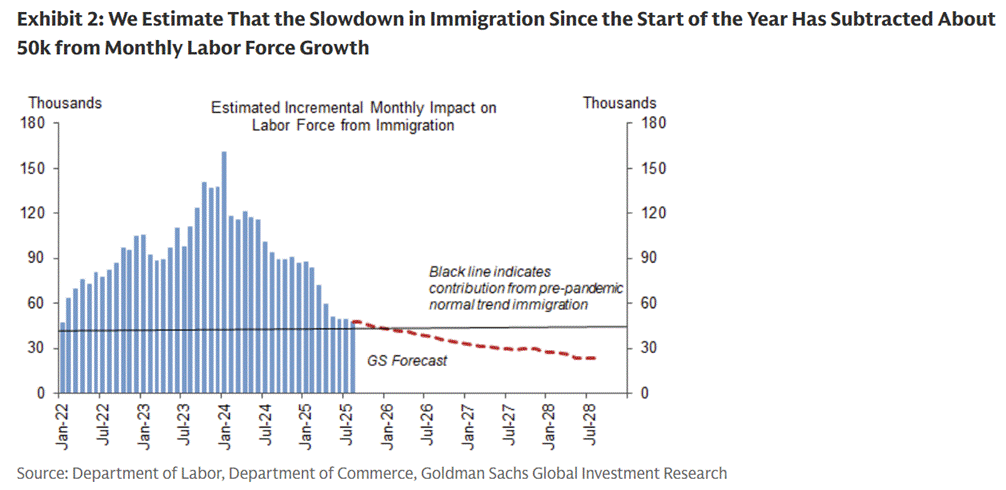

Slowdown in immigration. Goldman Sachs estimates the contribution to monthly labor force growth from immigration alone has fallen from 90k at the start of the year to 40k in August, and that monthly employment growth in industries relying heavily on immigrant workers has declined by 30k since the start of the year. This suggests that part of the recent job growth slowdown is due to a less concerning slowdown in labor supply growth.

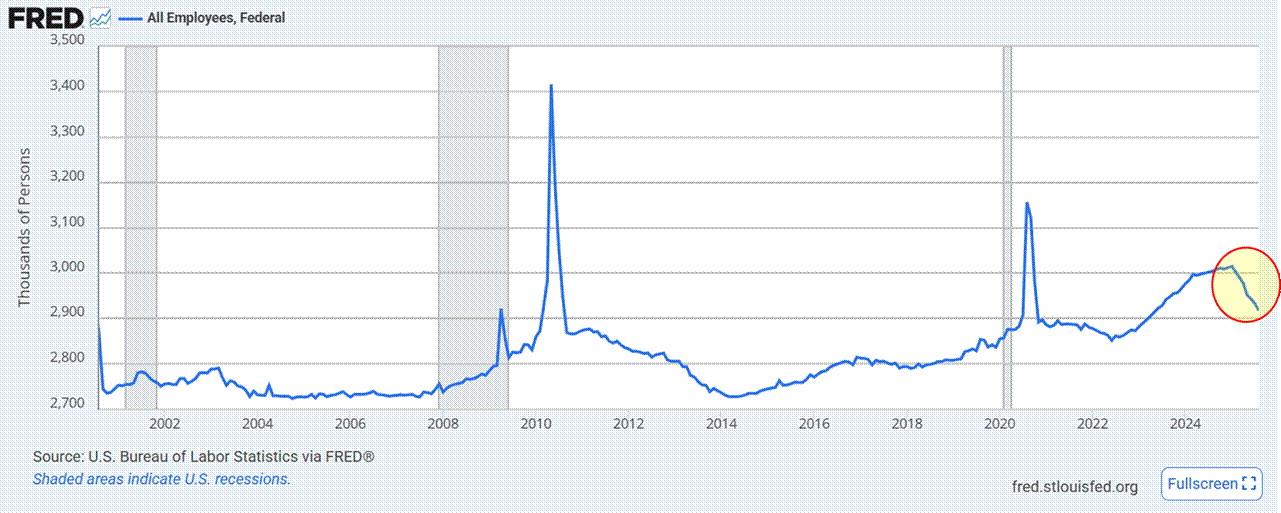

Reduction in government hiring and funding. Payroll growth for the federal government has turned negative this year, and payroll growth for state and local governments has also fallen sharply from 30k/month at the start of the year to 10k/month by August. While still early, the Trump administration has reversed federal labor growth in its tracks.

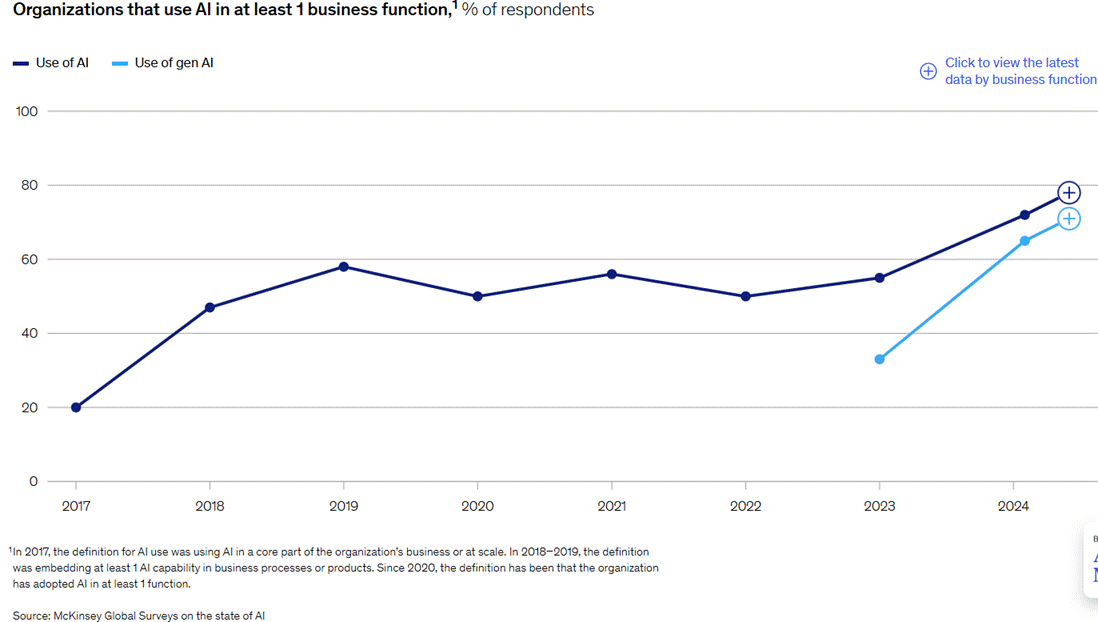

Adoption of AI technology. To date, little empirical evidence suggests increased AI adoption, or even the prospect of adoption, is weighing meaningfully on the overall labor market. But job growth in select industries in which AI is reportedly substituting for labor – such as marketing, call centers, and graphic design – has been falling. Surveys show that many companies are experimenting with AI. A 2024 McKinsey survey showed that nearly 80% of companies are using AI in at least one business function. This likely means it’s only a matter of time for more meaningful, widespread adoption.

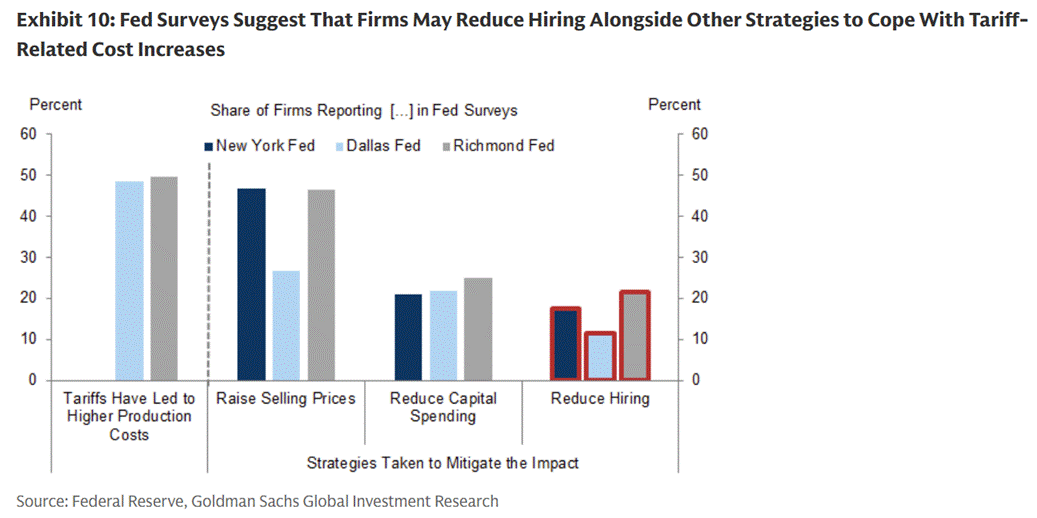

Tariff-related costs and uncertainty. Some companies have said in Fed surveys that they are reducing hiring as one of several cost-saving strategies to cope with tariff costs. But the direct impact of higher tariffs on hiring appears to be more limited than other corporate tactics, such as raising prices or reduce CapEx spend.

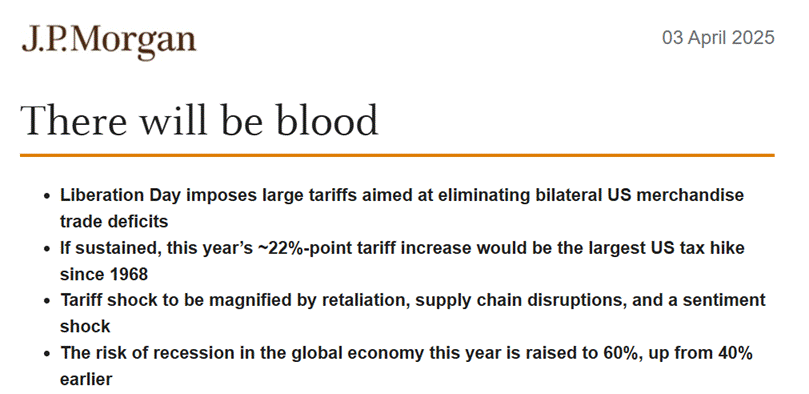

Macroeconomic risks/uncertainty. Consensus GDP growth forecasts collapsed this spring as recession probabilities rose. JPMorgan proclaimed “there will be blood” from the Liberation Day tariff announcement. While the outlook has improved since, these concerns likely made companies in all industries more cautious about hiring. After all, labor is often a company’s greatest cost center.

Taken together, this suggests that slower immigration, reduced government hiring and federal contract funding, and elevated uncertainty have contributed meaningfully to the recent job growth slowdown.

While everyone sees some evidence that AI adoption and tariff-related costs have had a localized impact in a few industries, these effects look fairly small so far.

So far, the Sahm Rule signal that triggered in the summer of 2024 has yet to materialize into a broader economic recession.

Sources: YCharts, Goldman Sachs Global Investment Research, St. Louis Fed, McKinsey, JPMorgan Markets, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)