Why is everyone so nervous?

The Sandbox Daily (10.17.2024)

Welcome, Sandbox friends.

I love handpicking thoughtful quotes across all walks of life for a handful of reasons. Each one is carefully selected. Every now and again, one really grabs hold of me. Today’s Nick Saban speech absolutely blew me away. Enjoy !

Today’s Daily discusses:

when in doubt, zoom out

Let’s dig in.

Markets in review

EQUITIES: Dow +0.37% | Nasdaq 100 +0.08% | S&P 500 -0.02% | Russell 2000 -0.25%

FIXED INCOME: Barclays Agg Bond -0.49% | High Yield -0.15% | 2yr UST 3.965% | 10yr UST 4.089%

COMMODITIES: Brent Crude +0.36% to $74.58/barrel. Gold +0.46% to $2,719.9/oz.

BITCOIN: +0.59% to $68,151

US DOLLAR INDEX: -0.09% to 103.735

CBOE EQUITY PUT/CALL RATIO: 0.57

VIX: -2.40% to 19.11

Quote of the day

- Nick Saban, former Alabama Crimson Tide football coach on The Importance of Nothing

When in doubt, zoom out

A chorus of investors have been doubting this economy and market for the better part of two years now.

Remember this outlook heading into 2023?

The consensus forecast by Wall Street strategists in 2023 called for an outright fall in the stock market. That’s right – for the first time this century, the average forecast coming from Broad and Wall predicted a loss for the S&P 500.

Unfortunately, reality set in and caught everyone offsides as the S&P 500 ran up +26% that year.

Fast forward a year and the outlook remained nearly as tepid.

Heading into 2024, the median probability of recession remained as high as ~50% as reported by a Bloomberg survey of economists.

Surely the Federal Reserve could not thread the needle by creating a policy outcome that combined milder inflationary pressures alongside slow-and-steady employment growth.

As it turns out, half of the items in the CPI basket are now below their pre-pandemic average.

And yet, rather than the economy slowing gradually or even rapidly, it seems poised to keep growing as it is, at a moderate pace or better. Outside of the textbook technical recession in 1H22, this economy seems to be at trend growth or stronger.

Looking ahead to economic growth for the 3rd quarter, the Atlanta Fed’s GDPNow model nowcast of real GDP growth is 3.4%.

In fact, this measure isn’t softening or taking a breather. Rather, it’s been gaining strength for three consecutive months.

While doom scrolling my Twitter feed at my daughter’s field hockey practice tonight, I uncovered this gem that succinctly wraps up the post-covid cycle in 280 characters.

Take it away, Ben !

This tweet reminded me of a wonderful quote from Callie Cox in which she said:

Pessimism makes for good stories. Optimism makes for good portfolios.

Often times, it’s so easy for humans to nitpick everything that’s wrong with the world. We get caught up in the trees and lose sight of the forest. We’re always waiting for the next shoe to drop. That’s why pessimism sells.

The current bear narrative can’t make hay of stock market all-time highs and a 20-handle on the VIX.

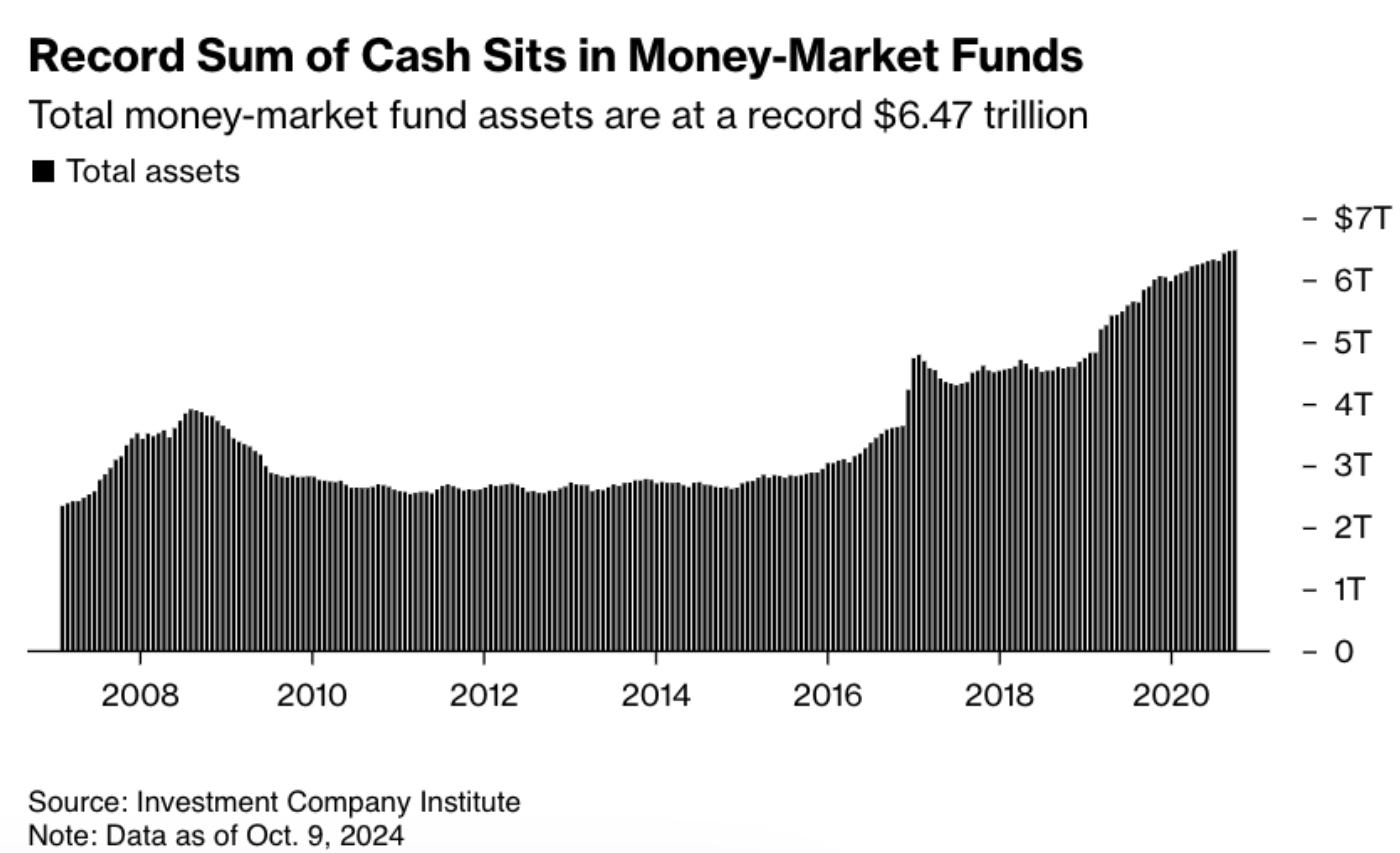

Before that, it was investors scared of X, Y, and Z that had them piling cash hand over fist into record levels of money market funds.

And, don’t forget the small-cap divergence! Why aren’t the junkiest stocks working, they asked?

Whoops!

Even my friend J.C. Parets seems fed up:

With Q3 earnings season kicking off, investors are more focused on fundamentals than the next macro print.

All of the big banks have reported solid-to-strong earnings over the past week, which reinforces the foundation of this bull market. If the proverbial shit is hitting the fan – because of loan loss provisions or credit creation issues or a run on the banks – then Financials would not be your market leadership group.

We have price at all time highs. Price is being confirmed by breadth, while sentiment is neutral.

U.S. households have never been in a stronger financial position.

The Fed is cutting rates proactively, not reactively to a crisis. The rolling recessions across housing, manufacturing, and tech did not sink the economy. There is no credit bubble lurking around the corner.

One more thing about this current bull. As Ryan Detrick puts it:

Want some more good news? This bull market is actually quite young. That’s right, a two-year bull market historically has plenty of life left, with the average bull market since 1950 lasting more than five years and gaining more than 180%.

Wash your hands clean of the doomer Rapture and keep your eye on target.

Why is everyone so nervous?

Source: Ben Carlson, Goldman Sachs Global Investment Research, Irrelevant Investor, Bloomberg, Atlanta Fed, J.C. Parets, Saturday Morning Chartoons, Ryan Detrick

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: