Why is no one talking about earnings, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (2.28.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

earnings season delivers the goods

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.62% | S&P 500 +1.59% | Dow +1.39% | Russell 2000 +1.09%

FIXED INCOME: Barclays Agg Bond +0.45% | High Yield +0.28% | 2yr UST 3.989% | 10yr UST 4.210%

COMMODITIES: Brent Crude -1.16% to $73.16/barrel. Gold -1.04% to $2,866.8/oz.

BITCOIN: -0.04% to $84,086

US DOLLAR INDEX: +0.30% to 107.562

CBOE TOTAL PUT/CALL RATIO: 0.84

VIX: -7.10% to 19.63

Quote of the day

“It's only after we've lost everything that we're free to do anything.”

- Tyler Durden, Fight Club

Earnings season delivers the goods

Stock prices move up and down for many reasons, but over the long run, what really matters is how much money a company makes. This is called earnings, and it’s the fuel that powers stock market growth over longer time frames.

Think of the stock market like a sailboat. Headlines about interest rates, supply chains, or two presidents shouting over one another during peace talks are like the shifting currents that can rock the boat, but strong earnings are the winds that keep it moving forward.

When companies grow their earnings per share (EPS), their stocks become more valuable. In turn, investors are willing to pay higher prices for a business that’s growing.

While short-term waves can cause disruption, it’s earnings that ultimately determine a company’s long-term direction.

That’s why we should care about earnings – it’s fundamental to understanding where the market is headed, setting expectations for future returns, and whether your investments are on the right track.

At present, there are a growing list of concerns that have investor’s attention. We covered a number of key headwinds yesterday.

During intense periods of fear, we quickly develop amnesia and forget all the underlying drivers that were in place. Panic casts all logical thought aside.

Lost at sea among the chaos is the earnings strength we are seeing from corporate America right now. Healthy revenue growth and a strong U.S. consumer reaffirm that economic activity increased at a solid pace.

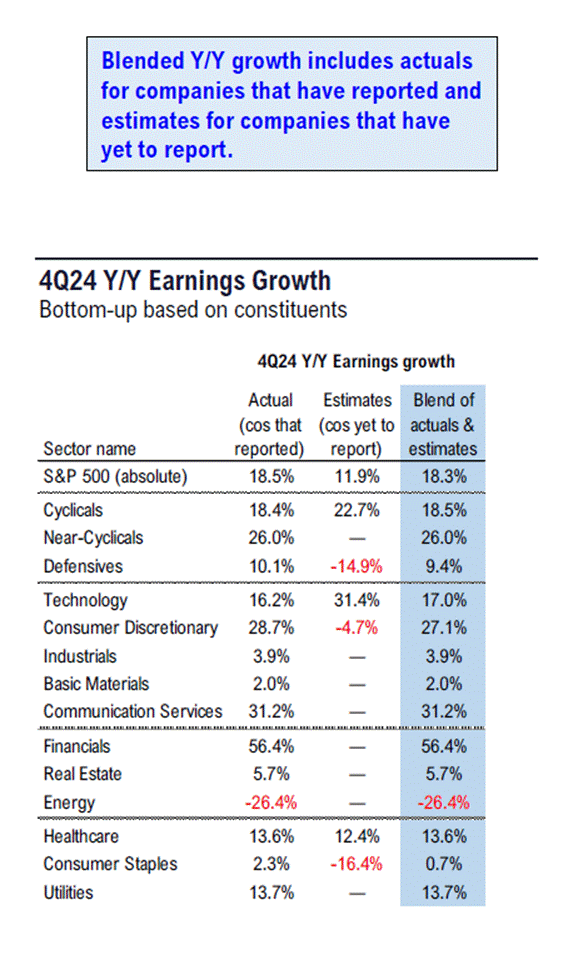

With 97% of the S&P 500 having reported, the index is reporting year-over-year earnings growth of +18.3%.

Excluding the volatile and idiosyncratic Energy sector, corporate revenues grew at a solid pace. Real revenues rose +3.2% YoY in Q4, roughly in line with the average pace during expansions.

This aligns with C-Suite commentary that generally indicated consumer spending remains resilient.

There is a risk that fundamentals soften and earnings do not hold at these levels. Profits have expanded rapidly since the start of the 2020s, running above the historical average since 1990.

S&P 500 companies forecast 14% earnings growth in 2025, raising concerns that valuations are vulnerable if reported results fall short of target.

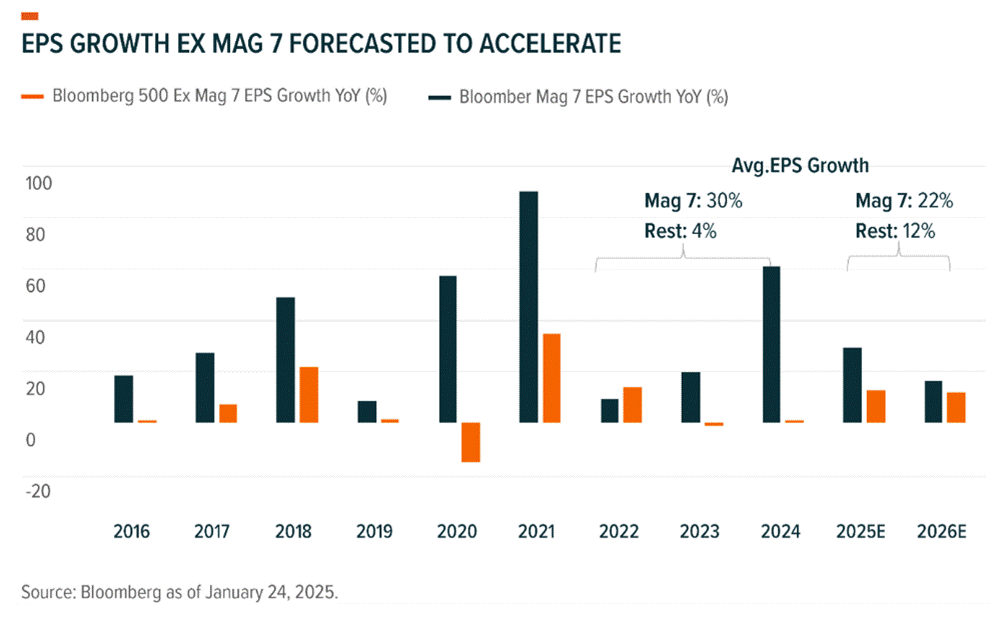

The good news is the earnings story is expected to broaden out.

Beyond the Magnificent 7, the S&P 493 averaged just 4% EPS growth the past three years, compared to the Mag 7 at 33%. In 2025 and 2026, EPS for SPX493 is expected to reach 12%, closing the gap as mega-cap earnings slow to 20%, which would help improve ballast and balance from a fundamental perspective.

Whether the last three months are a consolidation phase within an ongoing cyclical bull, or the start of a bear market, will depend in part on the future trajectory of earnings.

Currently, EPS growth supports the argument that it is a bull market until proven otherwise.

Sources: Goldman Sachs, First Trust

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Verdad Cap – Skewness and Kurtosis (Yukoh Shimizu)

Oblivious Investor – A CPA’s Perspective on Minimizing the Financial Risk of Cognitive Decline (Mike Piper, CPA)

Humble Dollar – Never Enough (Jonathan Clements)

The Big Picture – 7 Areas Where Probabilities of Errors are Rising (Barry Ritholtz)

The Joint Account – Six Financial Red Flags You Can’t Afford to Ignore (Heather Boneparth)

Richard Bernstein Advisors – Historically Confident Investors Meet Historically Uncertain World (RBA)

A Wealth of Common Sense – Market Timing a Recession (Ben Carlson)

Podcasts

Tucker Carlson with Ray Dalio – America’s Hidden Civil War and the Race to Beat China in Tech, Economics, and Academia (YouTube, Spotify, Apple Podcasts)

The Compound and Friends with Cerity Partners’ Jim Lebenthal – Staying Bullish on Stocks Through Economic Pain (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Carry-On – Taron Egerton, Jason Bateman (Netflix, IMDB, YouTube)

Music

20:02 – Faded Flowers (Spotify, Apple Music, YouTube)

Books

Vishal Khandelwal – Boundless (Safal Niveshak)

Tweet

Donald Trump doing The Black Parade

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: