Why September historically spells trouble for stocks, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (8.30.2024)

Welcome, Sandbox friends.

Markets whooshed higher in afternoon trading today – which also happens to be Warren Buffett’s 94th birthday – as stocks continue to fade the growth scare from early August, now siting right around all-time highs. The brief whiplash in global markets just a few weeks ago seems like a distant memory.

Next up for investors?

The August jobs report due next week on Friday, September 6. You won’t miss it because it will be the talk of the tape.

Hope everyone has a wonderful Labor Day Weekend.

Catch you on Tuesday when markets reopen for trading.

Today’s Daily discusses:

September seasonality is historically challenged

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.29% | S&P 500 +1.01% | Russell 2000 +0.67% | Dow +0.55%

FIXED INCOME: Barclays Agg Bond -0.24% | High Yield +0.01% | 2yr UST 3.919% | 10yr UST 3.911%

COMMODITIES: Brent Crude -1.43% to $78.82/barrel. Gold -0.98% to $2,535.1/oz.

BITCOIN: -0.83% to $58,929

US DOLLAR INDEX: +0.35% to 101.693

CBOE EQUITY PUT/CALL RATIO: 0.62

VIX: -4.15% to 15.00

Quote of the day

“You must be the change you wish to see in the world.”

- Mahatma Gandhi

September seasonality is historically challenged

As we welcome September in the coming days, investors should understand the traditionally softer market conditions that this month often brings. Nothing this bull can’t survive, but seasonality has brought some indigestion for investors.

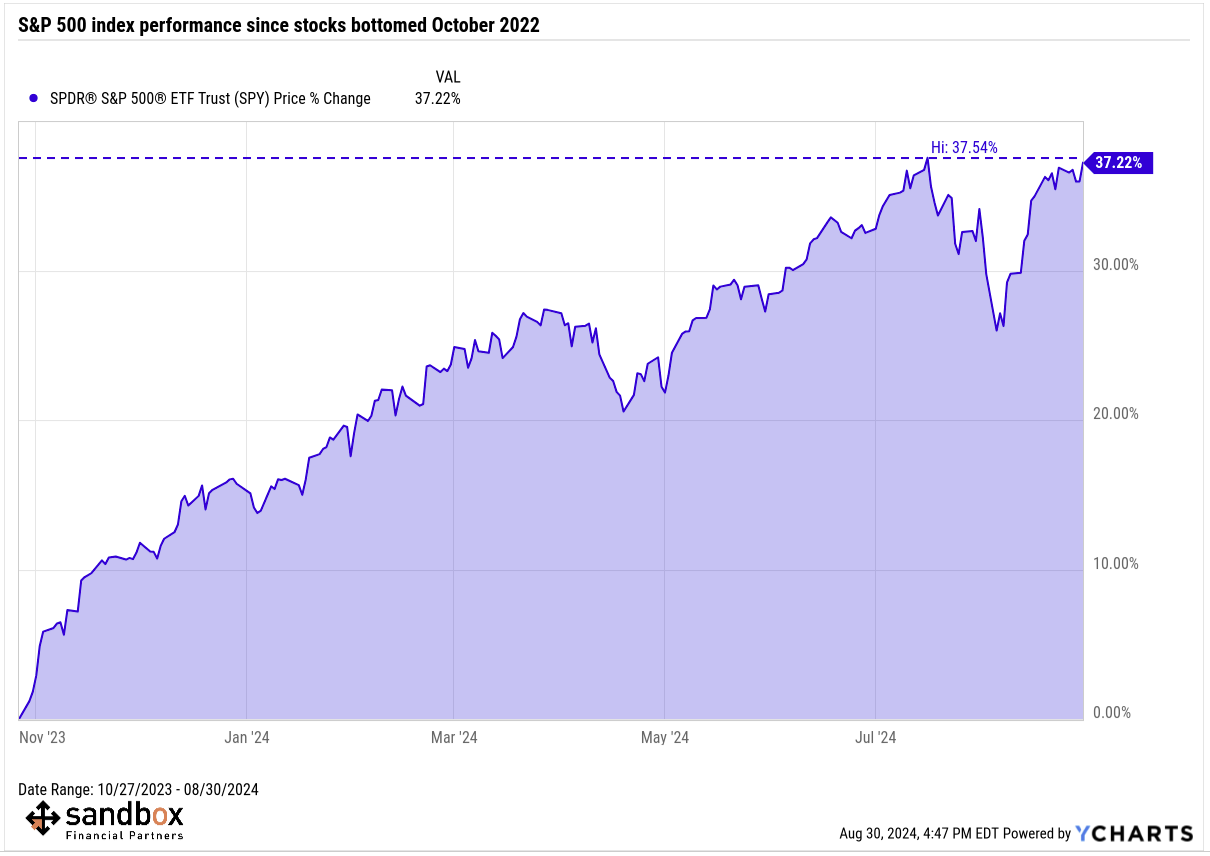

Since bottoming last October, the S&P 500 has ripped higher 8 of the last 9 months for a cumulative gain of 37% as Financials (+45%) have led the way. All that green has sure been a lot of fun!

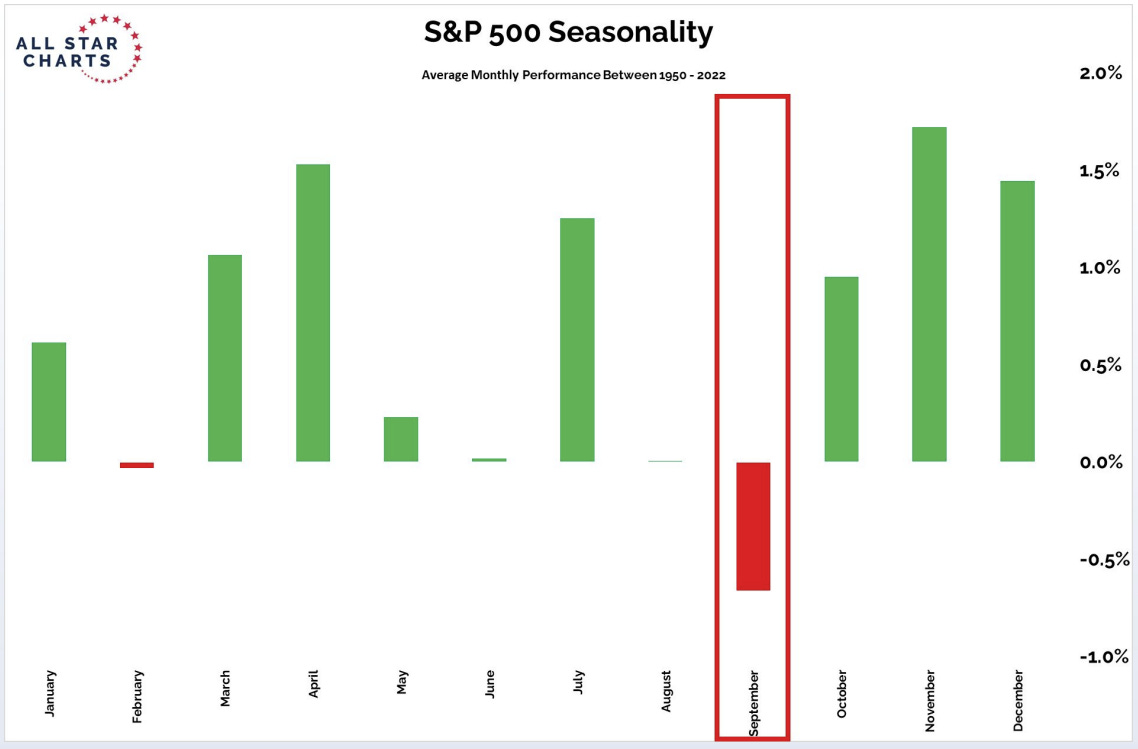

But, looking ahead, historical patterns show that September tends to be a tricky period regardless of timeframe, marked by elevated volatility and bouts of drawdowns.

Since 1950, the S&P 500 has generated an average loss of -0.7% in September and finished higher only 43% of the time, making it the worst month for stocks on an average return and positivity-rate basis.

Good news?

We have several tailwinds at our back that should support stocks heading into year-end even if some short-term turbulence threatens to derail this strong and broadening bull market.

The jobs market remains resilient, earnings are hooking higher, market breadth is robust, and those sweet, sweet Fed rate cuts are waiting just around the corner.

Source: All Star Charts, Ryan Detrick

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Of Dollars and Data – The Sustainable Path is the Only Path (Nick Maggiulli)

Cambria – Should CalPERS Fire Everyone and Just Buy Some ETFs (Meb Faber)

Humble Dollar – One is Not Enough (Adam Grossman)

Pearl’s Prime Cuts – Rediscovering Your Growth Drive (Phil Pearlman)

Hartford Funds – 10 Things You Should Know About Politics and Investing (Hartford)

All Star Charts – We Call that Bull Market Breadth (J.C. Parets)

Podcasts

Facts vs Feelings with Ryan Detrick and Sonu Varghese – Talking the Economy with Dr. David Kelly (Spotify, Apple Podcasts)

At the Money with Barry Ritholtz and Eric Balchunas – Why fees really matter (Spotify, Apple Podcasts)

Up and Vanished – The Disappearance of Tara Grinstead (Podcast Website, Spotify, Apple Podcasts)

Movies

A Walk Among the Tombstones – Liam Neeson, David Harbour (IMDB, YouTube)

The Intern – Robert De Niro, Anne Hathaway, Rene Russo, Adam DeVine, Anders Holm (IMDB, YouTube)

Music

Zach Bryan – Something in the Orange (Spotify, Apple Music)

Books

Scott Galloway – The Algebra of Wealth (Amazon)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.