Why the S&P 500 will return just 3% annually over the next decade (read: it won't), plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (10.25.2024)

Welcome, Sandbox friends.

Happy Friday to you all !!

Today’s Daily discusses:

why S&P 500 returns may be muted in the long-term

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.59% | S&P 500 -0.03% | Russell 2000 -0.49% | Dow -0.61%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield -0.10% | 2yr UST 4.109% | 10yr UST 4.244%

COMMODITIES: Brent Crude +2.03% to $75.89/barrel. Gold +0.31% to $2,757.4/oz.

BITCOIN: -2.39% to $66,548

US DOLLAR INDEX: +0.25% to 104.323

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: +6.55% to 20.33

Quote of the day

“The only limit to our realization of tomorrow will be our doubts of today.”

- Franklin D. Roosevelt

Why S&P 500 returns may be muted in the long term

Goldman Sachs made headlines all week after its Equity research team released an update to their long-term return forecasts.

TLDR: Goldman is not a fan of S&P 500 index outperformance over the next ten years. Instead, they would prefer that you consider broader market exposure, or even other asset classes.

Goldman expects the S&P 500’s return over the next decade will average just 3% per year – far lower than the 13% returned over the past decade and the 9-10% long-term average.

The forecast, which includes a range of outcomes from -1% to 7%, is notably lower than the estimates from other major institutional outlooks: buy- and sell-side projections of long-term returns for U.S. equities average roughly 5-7%.

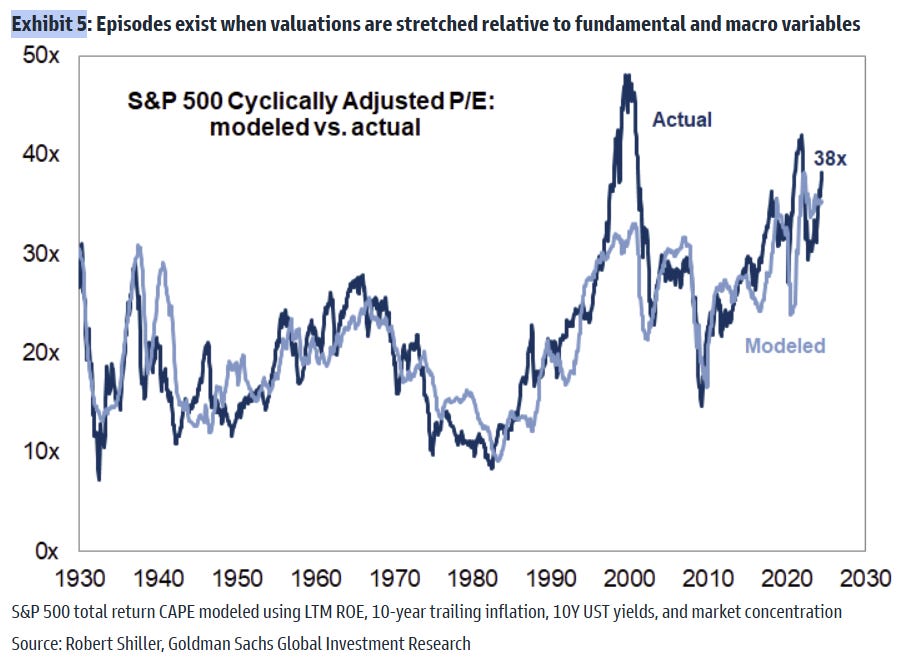

The most important variable in this forecast is starting valuation.

“In theory, a high starting price, all else equal, implies a lower forward return. The current high level of equity valuations is a key reason our 10-year forward return forecast sits at the lower end of the historical distribution. The CAPE ratio currently equals 38x, ranking at the 97th percentile since 1930.” writes David Kostin, Chief U.S. Equity Strategist at Goldman Sachs Research.

Another important consideration for Goldman: market concentration.

At present, the 10 largest stocks in the S&P 500 account for more than a third of the total market cap. The current level of market concentration – at a multi-decade high – represents another drag on their forecast. Without this variable, the baseline return forecast would be roughly 4 percentage points higher (7% rather than 3%) and the range would be 3% to 11%, rather than -1% to 7%.

Goldman then argues that U.S. stocks will face stiff competition from other assets at such low levels of return. Their forecast suggests the S&P 500 has roughly a 72% probability of underperforming bonds and a 33% likelihood of lagging inflation through 2034.

Bottom line, Goldman has a sour outlook on U.S. equity outperformance continuing.

My Take

Keep in mind institutional money managers publish updates to their long-term capital market assumptions frequently. Markets are living, breathing organisms. Economic conditions evolve, key fundamental inputs like interest rates and inflation change, political and monetary cycles emerge, and structural technology regimes shift over time. Models must adjust accordingly.

Having said that, we know that most economists and market strategists can’t predict market returns over the next 6- or 12-months with any degree of precision or regularity. We know this to be true from the vast historical record. That’s not a knock on their market sensibilities or integrity, but rather an admission of how challenging it is to read the tea leaves of the market.

So, when I hear about 10-year horizon forecasts, words like absurdity and arrogance come to mind. There are too many variables and uncertainties to predict 10-year returns with any level of confidence.

Also something to keep in mind – if stocks return 8% per year on average over long periods of time (say 20-30 years) and we just experienced an average of 13% over the last decade, perhaps expecting a 3% (mean-reverting) return over the next decade is not entirely unreasonable because that would produce a long-term average of… 8%.

10-year market calls are largely irrelevant to 99% of all investors. Instead, focus your wealth building journey on things you can control – like your savings rate, your spending habits, and your long-term asset allocation.

Source: Goldman Sachs Global Investment Research, J.P. Morgan Guide to the Markets

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

OptimistiCallie – This Time is Different (Callie Cox)

Investment Talk – Why Are We Drawn to Low Probability? (Conor Mac)

Oaktree – Ruminating on Asset Allocation (Howard Marks)

A Wealth of Common Sense – The New Normal of Negativiy (Ben Carlson)

The Atlantic – Inside the Carjacking Crisis (Jamie Thompson)

Podcasts

Masters in Business with Barry Ritholtz and special guest Toto Wolff – Fueling Success for Mercedes F1 (Spotify, Apple Podcasts)

The Meb Faber Show with special guest Dr. Bryan Taylor – Surprising Lessons from 100 Years of Financial History (Spotify, Apple Podcasts)

Facts vs. Feelings with Ryan Detrick, Sonu Varghese, and special guest Josh Brown – Talking About Anything and Everything (Spotify, Apple Podcasts)

Movies/TV Shows

Bodyguard – Richard Madden, Keeley Hawes (IMDB, YouTube)

Music

Bon Iver – S P E Y S I D E (Spotify, Apple Music, YouTube)

Cold War Kids – Meditations (Spotify, Apple Music, YouTube)

Books

Anthony Pompliano – How To Live an Extraordinary Life (Amazon)

Pop Culture

ESPN – 30 for 30: The Two Escobars (IMDB, YouTube, Netflix)

BBC Radio 1 – Zane Low meets Rick Rubin (YouTube)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: