Why the United States, plus 10-yr Treasury to 5.25%, best time to invest, and the streaming business

The Sandbox Daily (10.25.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

why focus on the United States?

eyeing 5.25% for the 10-yr U.S. Treasury

the best time to invest

is the U.S. streaming business maturing?

Let’s dig in.

Markets in review

EQUITIES: Dow -0.32% | S&P 500 -1.43% | Russell 2000 -1.67% | Nasdaq 100 -2.47%

FIXED INCOME: Barclays Agg Bond -0.74% | High Yield -0.54% | 2yr UST 5.127% | 10yr UST 4.966%

COMMODITIES: Brent Crude +2.17% to $89.98/barrel. Gold +0.46% to $1,984.1/oz.

BITCOIN: +3.01% to $34,813

US DOLLAR INDEX: +0.26% to 106.544

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: +6.43% to 20.19

Quote of the day

“Learn to deal with the valleys and the hills will take care of themselves.”

- Count Basie, American Jazz Pianist

Why the United States?

Following last night’s post, a reader asks:

“Why does so much of your stock market analysis focus on the United States? Does global macro weigh in your investment process?”

Great question.

The simple answer to this question is likely home country bias, which is the preference of an investor to look locally for opportunities because of familiarity with monetary and fiscal policy, the companies themselves, consumer trends, supply and demand, news flow, etc.

Another answer could be market structure. While many of the characteristics listed below are true for various countries around the world, the United States demonstrates all of them in their totality, perhaps better than anyone else.

As I grab my CFA textbooks and brush off the dust, market structure includes principles like:

market depth

diversified groups of buyers and sellers

liquidity (the ability to trade without delay and in large quantities)

lower trading costs

tight bid-ask spreads

assurity of trade completion

high transparency (timely and accurate information)

clearinghouses to facilitate and backstop orders

easy access to credit

transparent and widely-followed rules and regulations

Or, perhaps we focus so much on the United States because of market size.

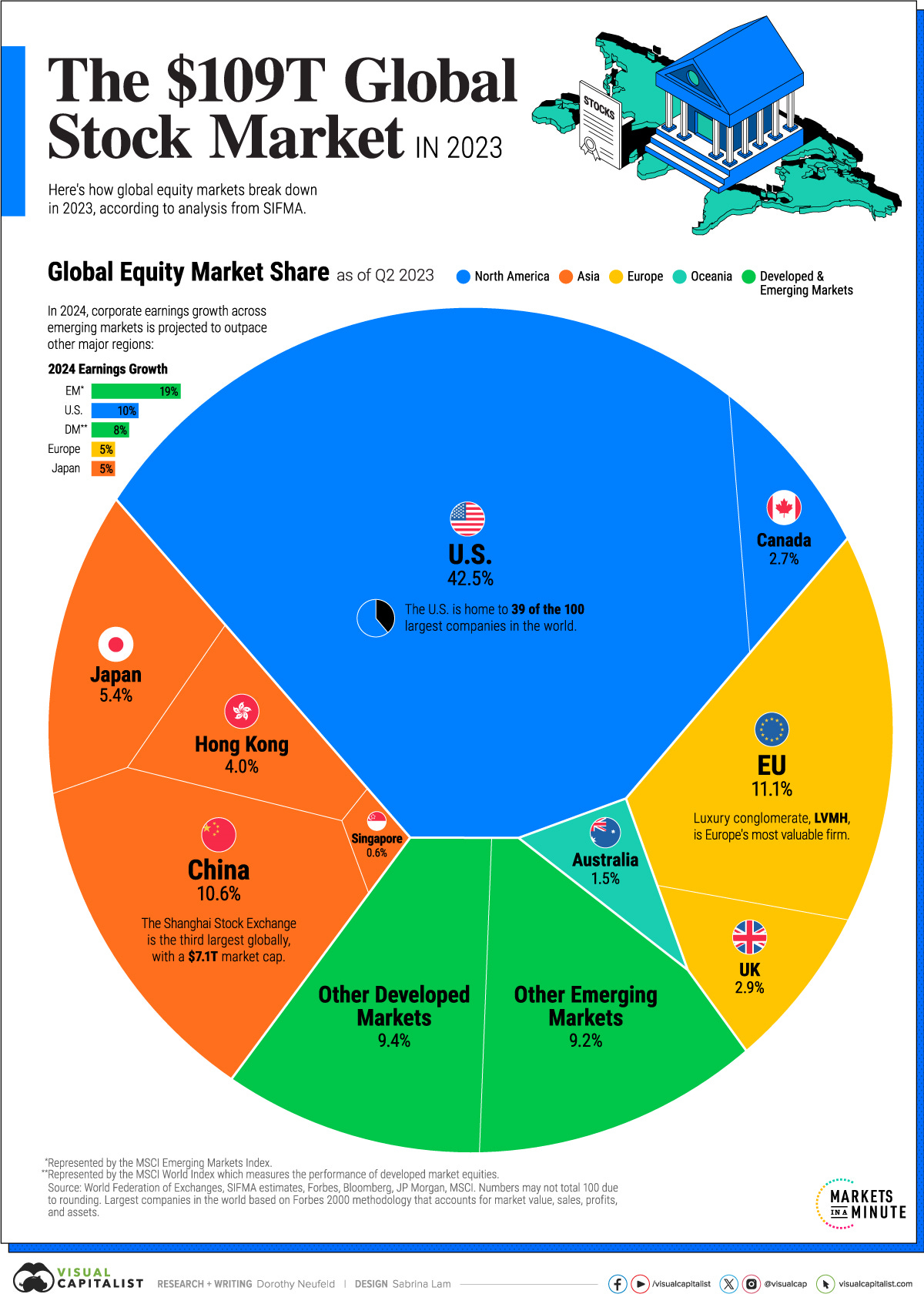

The size of the global stock market is roughly $110 trillion dollars, as of 2Q23 – the United States makes up 42.5% of the global equity market capitalization pie. Rather notable. 2nd closest is the entire European Union at 11.1%, which is like the Utah Jazz to the Chicago Bulls in the 1990s.

And it’s not just the stock market. The bond market illustrates this home bias preference, as well.

The size of the global bond market is roughly $133 trillion dollars; the U.S. makes up 38.3% ($51 trillion) of that pie.

And yes, all investors should focus on market developments around the world and incorporate them into your investment process.

Source: Smart Company, Visual Capitalist, All Star Charts

Eyeing 5.25% for the 10-yr U.S. Treasury

The question on the collecting investing public’s mind: “when will the relentless march higher in rates come to an end?”

The 5.25% yield level was an important double-top back in 2006-07, and represented the point in time of the peak 10-year yield as well as the Fed Funds Rate of that tightening cycle.

A sustained break of this level would not only indicate major technical damage, but may imply significant risk to fair value. This would be a logical level where yields could top out for the cycle.

Currently, the 10-year U.S. Treasury is oscillating in a tight range around 4.9-5.0%.

Source: Ned Davis Research

The best time to invest

Wealth building take time, patience, and a commitment to the plan.

The path forward is not an easy, uninterrupted one. In fact, it is full of fits and starts.

Investing during difficult markets is even harder and can bring about a range of unwelcome emotions, but that is precisely the time to be a buyer – not a seller – when markets go on sale. There is never a moment in time where the stock market referee calls time and runs over to you saying “now is the right time to start.”

As Mark Yusko of Morgan Creek Capital said: “Investing is the only business I know that when things go on sale, people run out of the store.”

Source: Brian Feroldi

Is the U.S. streaming business maturing?

Imagine for one second being a media company executive and trying to forecast, plan, and budget an entire company built on a foundation that is shifting as rapidly as this one.

It’s interesting to note how stable the streaming share of television time in the United States has become. The pandemic pulled forward so many subs that, at this point, who is still left remaining to sign up for one of these platforms?

Much of these companies are looking to international markets for their next lever to pull in terms of material revenue change and generation.

And with all the attention that Netflix garners, it’s actually YouTube (and ultimately parent company Google/Alphabet as the beneficiary) that is the standalone leader in this space.

Anecdotally, my home just converted into YouTube TV subscribers because of personal frustration over the limited access to Michigan football games exclusively licensed through the streaming platform, Peacock+.

When you’re squad is ranked #2 in the country, the game’s going up on the tv – sorry kids!

Source: The Science of Hitting, Peacock TV

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.