Will U.S. home bias lead to missed opportunities abroad in 2025?

The Sandbox Daily (12.18.2024)

Welcome, Sandbox friends.

Fed Chair Jerome Powell poured cold water on the year-end rally despite cutting its key benchmark rate, the Dow sank deeper into the history books with its 10th straight losing session (worst since 1974), and the Magnificent 7 couldn’t save the day as stocks everywhere got clobbered – 483 stocks within the S&P 500 index fell today.

Today’s Daily discusses:

U.S. home bias

Let’s dig in.

Markets in review

EQUITIES: Dow -2.58% | S&P 500 -2.95% | Nasdaq 100 -3.60% | Russell 2000 -4.39%

FIXED INCOME: Barclays Agg Bond -0.76% | High Yield -1.03% | 2yr UST 4.357% | 10yr UST 4.512%

COMMODITIES: Brent Crude -0.40% to $72.90/barrel. Gold -2.08% to $2,606.4/oz.

BITCOIN: -5.21% to $101,082

US DOLLAR INDEX: +1.01% to 108.038

CBOE TOTAL PUT/CALL RATIO: 0.81

VIX: +74.04% to 27.62

Quote of the day

“The cave you fear to enter holds the treasure you seek.”

- Joseph Campbell

Will home bias lead to missed opportunities abroad in 2025?

Home bias is the tendency to favor domestic stocks over international ones because of a feeling of familiarity or comfort.

In the extreme, investors may focus only on the companies they or their friends and family work for, those in their hometowns, ones they see and interact with each day, etc.

While this makes intuitive sense because these are the companies and stocks they know well, it limits portfolio growth and diversification. Investments in other countries, which are less correlated to U.S. markets, can act as a hedge or secondary growth engine – helping reduce risk in an investor’s portfolio and make the long-term journey more palatable.

For U.S. investors, home bias has paid off in spades since the Global Financial Crisis. It’s been the easiest trade in town.

Notice how many times the red box (S&P 500) in the quilt chart below is at/near the top than the bottom?

U.S. stocks have outperformed international markets over the past decade and have consistently delivered superior returns over that time, driven by a dynamic and innovative economy, robust corporate governance, and deep, liquid capital markets.

In fact, returns haven’t even been close. The performance differential over five or even ten years – ten years!!!!! – is quite stark. See below.

Concerns about currency fluctuations, international regulations, and perceived higher risks in foreign markets can also reinforce home bias.

Add a hyper business-focused, pro-America Trump administration to this cocktail and the U.S. investor has every reason to continue this domestic allocation overweight into 2025 and beyond.

One issue many investors must overcome is holding their nose to buy U.S. stocks right now.

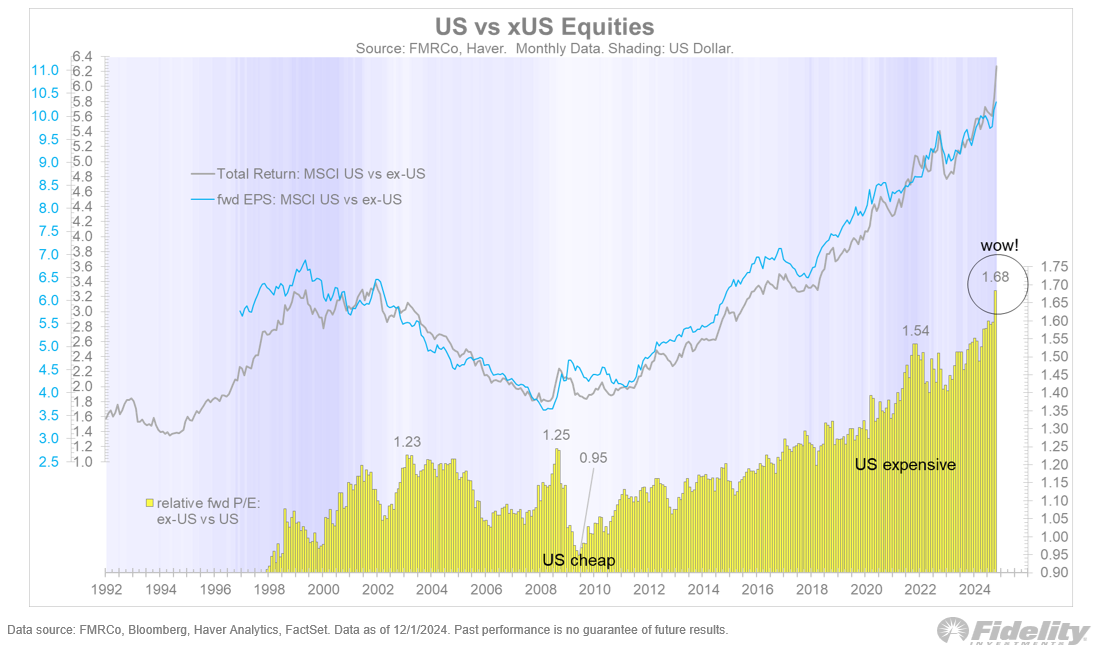

U.S. markets are expensive, while most around the world are not.

No matter what valuation measure you plug into your model, the U.S. is expensive: one, or even two, standard deviations so.

Valuations matter, but they are unlikely to be a catalyst in the absence of a change in fundamentals.

Many expect the mean reversion game to play out in global equity markets – even has the P/E premium between the U.S. and ex-U.S. jumped to a post-2000 all-time high – but as you can see, these can stay stretched for years or even decades.

Despite all this, international markets continue to offer unique opportunities and potential diversification benefits for global investors, along with lower valuations of course.

Yet, lumping all corners of the globe into one blanket theme is not fair, either. Regional differences and opportunities abound should an investor spend the time to run the scans and parse the data.

Even though the perceived equity risk premium is higher in other parts of the world, especially in emerging markets, investors are often rewarded for these risks over long periods of time.

International markets remain far more attractive than U.S. markets, but – and a big BUT – a catalyst is needed to swing the pendulum in the other direction.

The big questions for investors are what and when.

Sources: YCharts, Clearnomics, DataTrek Research, J.P. Morgan Guide to the Markets, Jurrien Timmer

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: