Year 4 of the bull market

The Sandbox Daily (11.12.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

year four of the bull market

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.68% | S&P 500 +0.06% | Nasdaq 100 -0.06% | Russell 2000 -0.30%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield -0.20% | 2yr UST 3.568% | 10yr UST 4.067%

COMMODITIES: Brent Crude -3.84% to $62.66/barrel. Gold +2.03% to $4,199.7/oz.

BITCOIN: -0.95% to $101,793

US DOLLAR INDEX: +0.07% to 99.516

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +1.33% to 17.51

Quote of the day

“Sam Harris once said, ‘No matter how many times you do something, there will come a day when you do it for the last time.’ There will be a last time your kids want you to read them a bedtime story. A last time you’ll go for a long walk with your sibling. A last time you hug your parents at a family gathering. A last time your friend will call you for support. How many moments do you really have remaining with your loved ones? It’s probably not as many as you’d like to believe. All the tiny moments, people, and experiences that we take for granted will eventually be ones we wish we had more of.”

- Sahil Bloom, The 5 Types of Wealth

Year 4 of a bull market

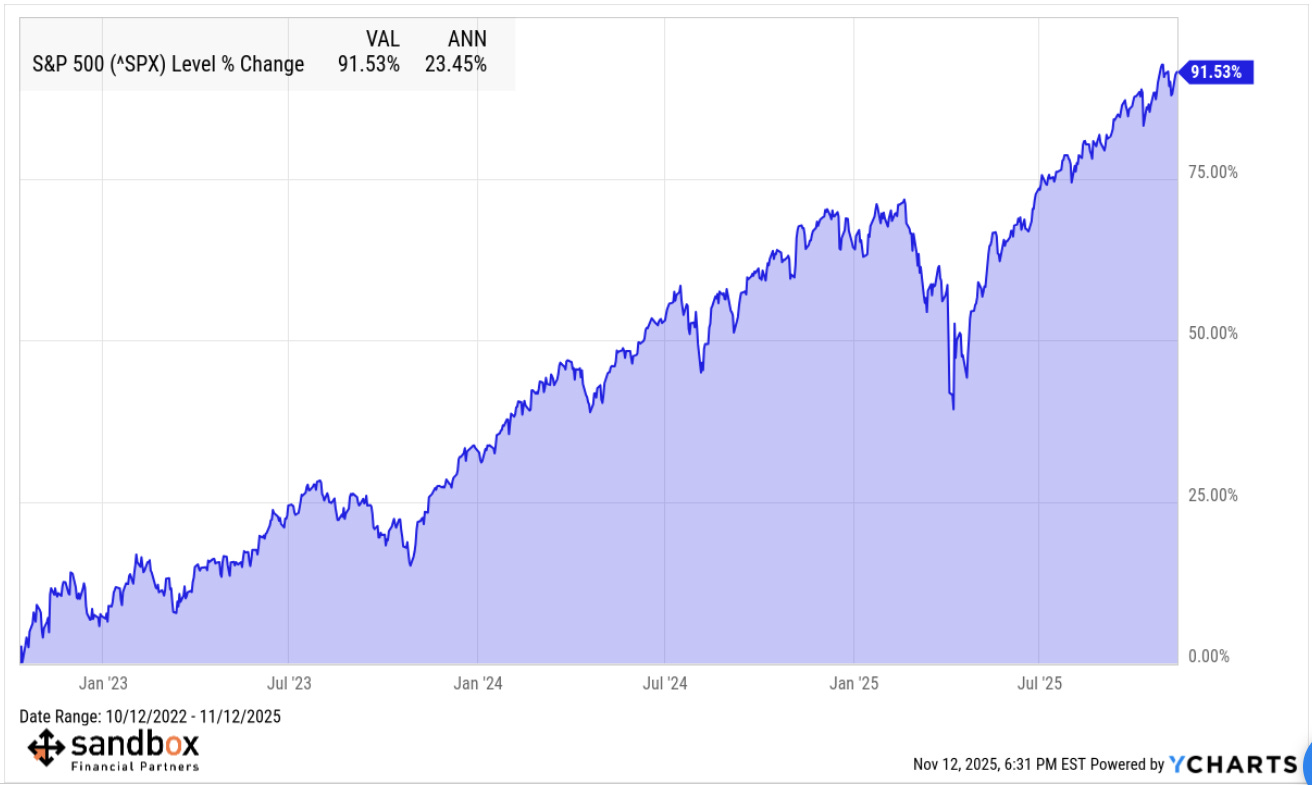

As of last month, we officially entered year four of the bull market that began October 2022.

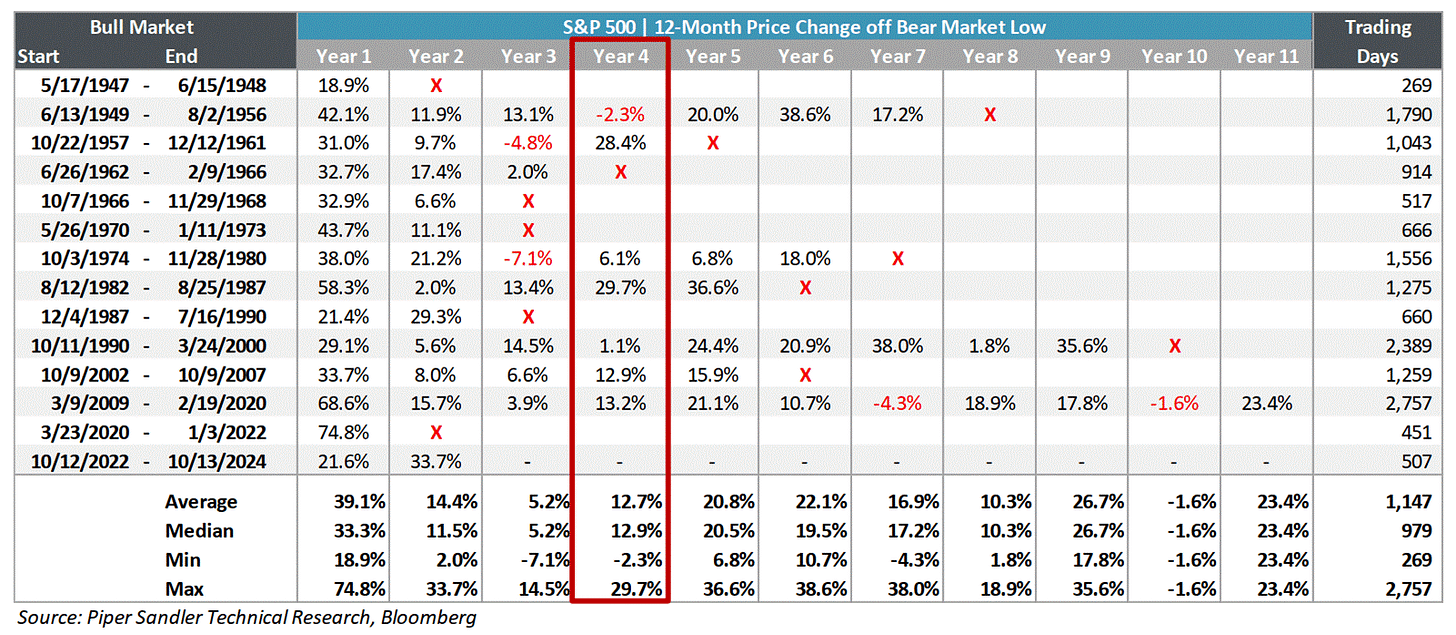

Since World War II, six of the last seven bull markets that reached their fourth year were higher a year later – for an average return of +12.7% and a median return of +12.9%.

The table below highlights the percentage change for each year of a bull market’s advance since World War II. Historically, the strongest years of any bull market have been the first and last years, if it lasts longer than three years.

The median number of trading days in a bull market is 979. The current bull market off the October 12, 2022 low is 775 days old, suggesting more room to run.

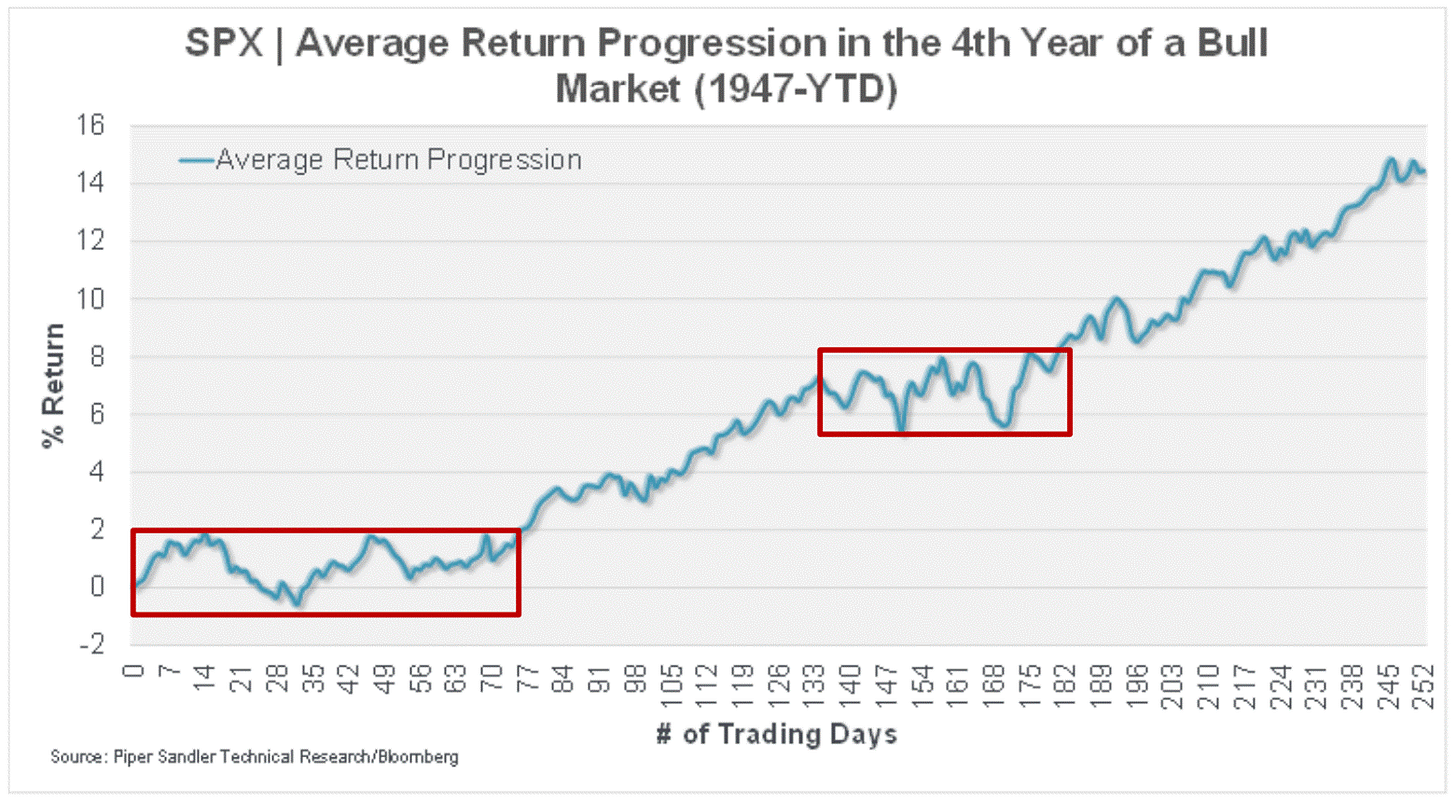

When reviewing the average progression of the fourth year of bull markets, they often undergo a consolidation phase during their first ~75 days before pushing higher.

I share this data not to claim its predictive power for the next year, but instead to show that history remains in our favor.

As of today, this bull market for the S&P 500 has delivered a cumulative return of +92% since those October 2022 lows.

Sources: Piper Sandler, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)