Year-end outlooks? Forget about it.

The Sandbox Daily (11.20.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Year-end outlooks? Stay on target!!

Let’s dig in.

Markets in review

EQUITIES: Dow +0.32% | Russell 2000 +0.03% | S&P 500 0.00% | Nasdaq 100 -0.08%

FIXED INCOME: Barclays Agg Bond -0.10% | High Yield -0.03% | 2yr UST 4.321% | 10yr UST 4.414%

COMMODITIES: Brent Crude -0.35% to $73.05/barrel. Gold +0.88% to $2,654.1/oz.

BITCOIN: +3.07% to $94,309

US DOLLAR INDEX: +0.42% to 106.651

CBOE EQUITY PUT/CALL RATIO: 0.87

VIX: +4.95% to 17.16

Quote of the day

“We can't run from who we are. Our destiny chooses us.”

- Professor Abe Petrovsky (Martin Landau) in Rounders

Year-end targets? Stay on target!!

Many, many, maannnyyyy years ago, John Pierpont Morgan was asked by an investor what the stock market would do next.

He candidly responded: "It will fluctuate."

And that's the best answer any investor with experience could possibly entertain.

End of year price targets?

A hilarious exercise in futility, and yet here we are. We’ve punched our ticket, eagerly awaiting our turn to find out what’s next.

This is the time of year (again) when Wall Street strategists roll out their projections for the coming year.

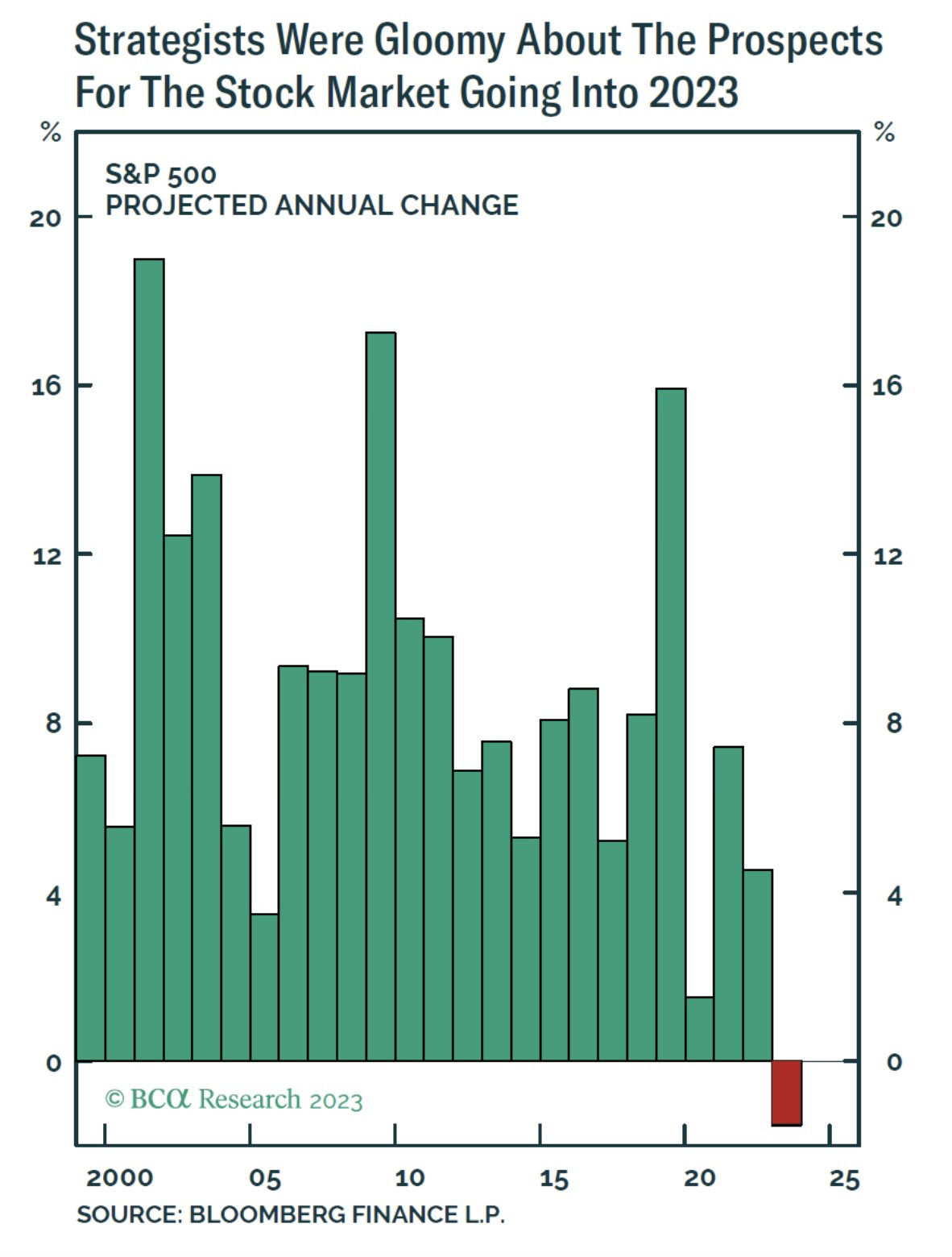

Did you see how Wall Street came into 2023?

The consensus target called for an outright fall in the stock market in 2023, the first time this century they had predicted a loss.

It turned out to be one of the greatest years on record. The S&P 500 returned +26.29% in 2023.

Even at the midpoint of 2023, there was a ~50% difference between the most bullish year-end S&P 500 target (Fundstrat’s Tom Lee saw it rising nearly +10% higher to 4,825) and the most bearish call (Piper Sandler had stocks down some -27% to 3,225).

In hindsight, that was a difficult market to call with any level of conviction.

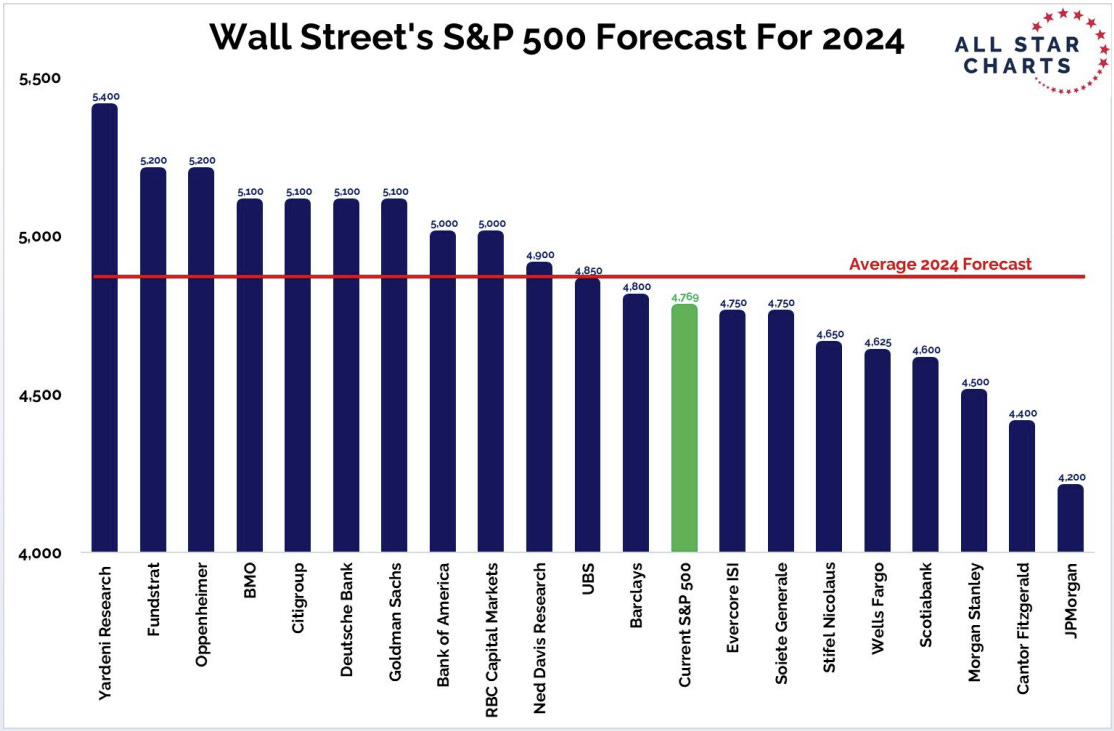

What about 2024? Surely they updated their models.

Wall Street consensus predicted a meager +2% upside move.

Ed Yardeni was at the top end with a 5400 year-end target (+13% upside), while the bears over at J.P. Morgan called for 4200 at the low end of the range (-12% downside).

Today, the S&P 500 closed at 5917 – higher than all of them.

The 2024 economy has proved far more resilient than most expected at the beginning of the year. In fact, stock markets outran the best of them.

The point here isn’t to beat up on the Wall Street strategists.

Quite the contrary, actually.

These men and women are tasked by management and boards to put out forecasts because the bank can then sell it to their institutional clients. These folks produce evidence-based research grounded in historical data and interpreted through robust multi-factor models. Many of these people are off-the-charts intelligent. But, you share a bourbon or three with them, and they’ll share their disdain for these outlooks.

The purpose of this message is to exert caution.

The historical track record of Wall Street strategists correctly forecasting the market 12 months in advance is not great. In fact, they’re more often wrong than right.

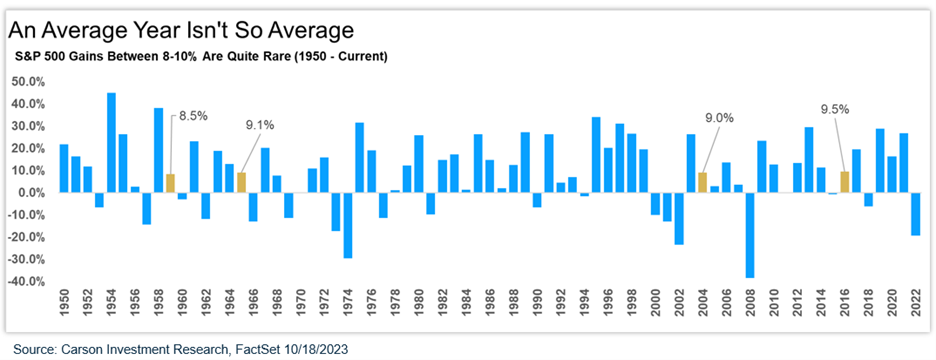

In particular, never trust the outfits who hug the bogey 7-10% average return because we know the market rarely produces the long-term average return in any particular calendar year.

Even Wall Street knows how futile this whole exercise is.

Back in July, the revered Piper Sandler announced it would no longer publish an S&P 500 price target.

"Having target prices on individual stocks makes sense, but makes less sense nowadays for the index," wrote Chief Investment Strategist Michael Kantrowitz. “The market no longer represents the stocks in the market.”

Kantro published an accompanying chart showing almost no correlation between what the S&P 500 is doing and what individual stocks are doing.

And here is the prodigious Sam Ro of TKer who hit it right on the nose:

“I’d caution against putting too much weight into one-year targets. It’s extremely difficult to predict short-term moves in the market with any accuracy. Few on Wall Street have ever been able to do this successfully. I do however think the research, analysis, and commentary behind these forecasts can be informative.”

Investment errors occur by acting on short-term forecasts.

While these forecasts are sure to grab headlines over the coming weeks, remember these are rarely accurate. Price targets are speculative, based on assumptions about economic conditions, earnings growth, and market sentiment that are inherently uncertain. Moreover, they often reflect consensus thinking or incentives to drive interest and trading volume, not actionable insights for individual investors.

Instead, fixate on your North Star – whatever that may be – which could include:

Market Internals

The overall trend of the market – whether it’s bullish, bearish, or sideways – provides more actionable insight than a single price level. Understanding market direction and internals (breadth, momentum, sentiment, positioning, relative trends, inter-market analysis, etc.) helps investors align their strategies with broader movements rather than chasing unrealistic targets.

Economic Fundamentals

Metrics like GDP growth, employment, inflation, interest rates, and central bank policy paint a better picture of where markets may be headed. These indicators affect corporate earnings and investor sentiment more directly than arbitrary price predictions.

Personal Financial Goals

Ultimately, the best investment strategy is one tailored to your own specific financial plan. Regularly revisiting your risk tolerance, time horizon, asset allocation, and long-term goals ensures a focus on what truly matters – achieving financial security rather than reacting to market noise.

Listen, learn, consider alternate views, but as always Stay On Target.

Source: Business Insider, Bloomberg, All Star Charts, Ryan Detrick, Josh Schafer, Sam Ro

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: