Year-end rally post-election, plus the labor market and tax policy

The Sandbox Daily (10.24.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

but what about markets after the election ?!?

continuing claims for unemployment insurance are rising

tax policy on the campaign trail

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.83% | Russell 2000 +0.23% | S&P 500 +0.21% | Dow -0.33%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.29% | 2yr UST 4.083% | 10yr UST 4.214%

COMMODITIES: Brent Crude -0.51% to $74.58/barrel. Gold +0.71% to $2,748.8/oz.

BITCOIN: +3.22% to $68,625

US DOLLAR INDEX: -0.38% to 104.031

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: -0.83% to 19.08

Quote of the day

“Love the life you live. Live the life you love.”

- Bob Marley

But what about markets after the election ?!?

Looking at the average S&P 500 progression during the fourth year of the Presidential Cycle, equities historically climb after election day as the event risk clears – with the S&P 500 gaining average and median returns of +1.64% and +1.78% into year-end during the post-World War II ear.

When a Republican won the presidency, the median return into year-end was +3.75% with a hit ratio of 67%.

When a Democrat won the presidency, the median return into year-end was +0.57% with a hit ratio of just 54%.

The largest increase from the election into year-end was +11.48%, occurring in 2016 with Donald Trump.

Meanwhile, the largest decline from the election into year-end was –10.19%, occurring in 2008 with Barack Obama; however, the it is surely unfair to pin the Global Financial Crisis and residential mortgage meltdown on the President-elect.

Dismiss market history and seasonality trends at your own peril.

Source: Piper Sandler

Continuing claims for unemployment insurance are rising

The most closely followed measures of employment tend to be lagging indicators. However, there is one indicator that assesses the labor market in near real-time. Initial and Continuing Jobless Claims, published weekly, provide real-time information on the number of employees recently fired and their ability to find new jobs. While understanding how many people are being let go is important (“initial”), the health of the labor market is best gauged by how quickly those recently unemployed find new work (“continuing”). Therefore, continuing jobless claims provide valuable and current insight into the labor market's health.

After a few weeks of elevated filings, initial claims for unemployment insurance fell 15,000 last week to a lower-than-expected 227,000 and reversed lower into a more “normal” range (blue line below). The four-week moving average dropped to 238,500 (red line); because this data series is noisy week-to-week, we smooth the inputs so trend-like patterns can bring us better information.

Despite the impact of recent hurricanes and weather-related disruptions in the South, initial claims remain range-bound and close to pre-pandemic levels. That’s the good news.

But, continuing jobless claims (which lag initial filings) jumped to 1.897 million (yellow line below), a three-year high dating back to mid-November 2021. And the insured jobless rate, which has been stuck at 1.2% since early 2023, edged up to 1.3%. That’s the not-so-good news.

This suggests two things:

Even though layoffs remain subdued, it has become harder for displaced workers to find employment. This is consistent with continued easing in labor market conditions, but not a recession at this time.

As Neil Dutta wrote in a note to clients today: “I think the bigger story is that the slow-leaking march higher in continuing claims hasn’t stopped. That will mean the level of unemployment keeps rising over time.” The soft/no landing scenario is beholden to the unemployment rate bucking the historical record and tapering off at current levels without meaningfully rising and inducing economic recession.

Source: St. Louis Fed, Advisor Perspectives, Yahoo Finance

Tax policy on the campaign trail

The two presidential candidates Trump and Harris have glaring differences about tax policy. At stake are various proposals which impact businesses and individuals alike.

Vice President Harris has proposed taxing unrealized capital gains, raising the stock buyback tax rate from 1% to 4%, increasing capital gains tax rates from 20% to 28%, and reversing half of the rate cut from the 2017 Tax Cuts and Jobs Acts.

Former President Trump’s tax policies call for a reduction in the corporate tax rate to 20%, while lowering the rate to 15% for corporations that produce their products domestically.

Even eliminating taxes on tips has been hotly campaigned and widely debated.

Of course, most of these campaign ideas are political footballs used to energize their constituencies for votes and rarely become Congressional policy. People often forget this.

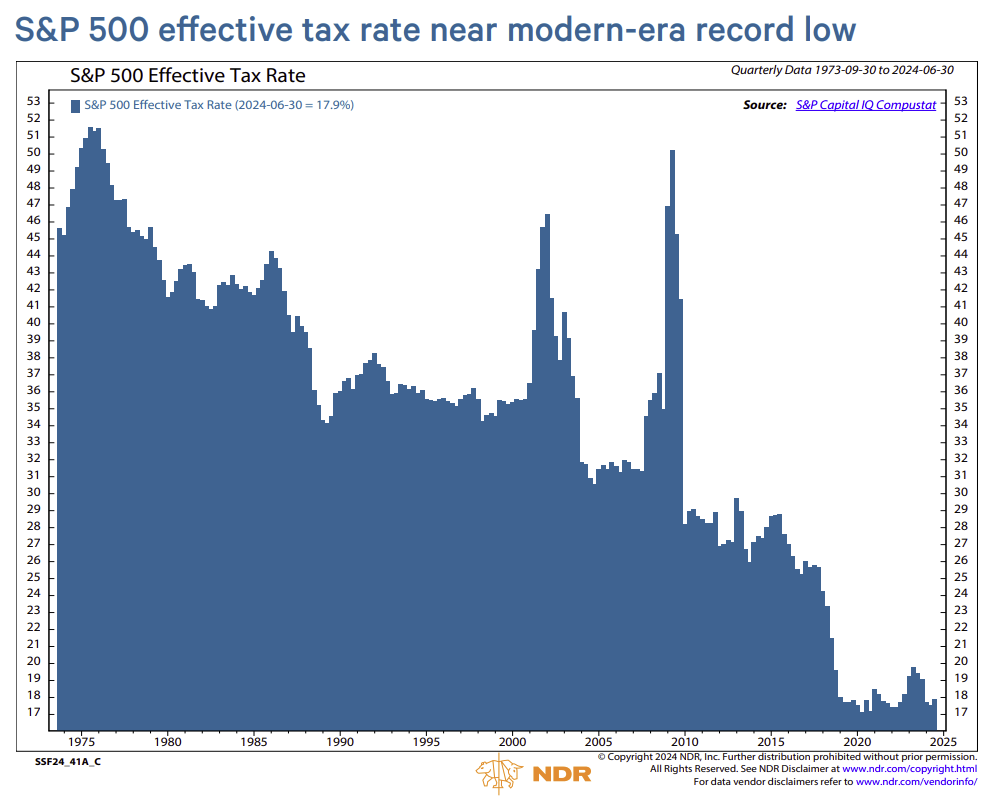

The most realistic battleground in tax policy will evolve around corporate tax rates. The 2017 Tax Cuts and Jobs Act lowered the federal corporate tax rate from 35% to 21%. The result was the effective tax rate for the S&P 500 fell from 24.2% in 2017 to its current level at 17.9%. In simple parlance, corporate tax rates are historically at low levels, which is great news for the stock market.

While hard to quantify, an upward adjustment to the corporate tax code will impact EPS model estimates, change capital allocation plans, disrupt international trade policy, and cause disparity among sectors (example: a corporate tax hike could disproportionately hurt the capital-intensive sectors like Utilities).

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: