Year-end S&P 500 price targets, plus today's rough day for stocks, retail sales, market laggards, and timeless investing principles

The Sandbox Daily (12.15.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the season of year-end price targets from market strategists, the rough day for stocks, retail sales show waning consumer demand, market laggards flirt with former lows, timeless investing principles with John Templeton, and the biggest source of power in every state and province.

Let’s dig in.

Markets in review

EQUITIES: Dow -2.25% | S&P 500 -2.49% | Russell 2000 -2.52% | Nasdaq 100 -3.37%

FIXED INCOME: Barclays Agg Bond +0.15% | High Yield -0.37% | 2yr UST 4.236% | 10yr UST 3.448%

COMMODITIES: Brent Crude -1.62% to $81.36/barrel. Gold -1.76% to $1,786.6/oz.

BITCOIN: -2.11% to $17,416

US DOLLAR INDEX: +0.85% to 104.655

CBOE EQUITY PUT/CALL RATIO: 1.33

VIX: +7.99% to 22.83

The season of year-end price targets is here

The annual season (or exercise) of market strategists releasing their year-end S&P 500 price targets is here.

Foolish or not, the numbers carry significance in how these global banks advise their clients and how the everyday investor creates an expectation on where markets can go over the short-term. The average price target is 4,009, with a range of 3,400 to 4,500. Using today’s closing value of 3,895, the upside for the S&P 500 suggests a whopping +2.9% return in 2023. Hmm. With the 2-year U.S. Treasury note yielding 4.23%, it’s no wonder investors think high quality bonds are back in vogue.

And how accurate were last year’s Wall Street predictions for 2022? Let’s see…

The average was 4,900

The lowest was 4,400 (Morgan Stanley)

The highest was 5,300 (BMO)

The S&P 500 today is 3,895

The S&P 500 would need to rise 25.8% by the end of the year to reach the average of the predictions.

Source: Fundstrat, Jeroen Blokland

Dear Santa: Green is a Christmas color, too

Rough day out there today.

Perhaps a response to the Federal Reserve, Bank of England, and European Central Bank all raising their target interest rates within 20 hours of one another?

Source: Stocktwits

Retail sales show waning consumer demand

Retail sales fell -0.6% in November, marking the biggest decline this year and much worse than the consensus of -0.3%. It followed an outsized +1.3% gain in the prior month which came amid reports of early holiday shopping. On a YoY trend basis, retail sales have eased to +6.5%, the slowest pace since December 2020.

But the near-term trend in goods purchases has weakened notably this year, reflecting not only the post-pandemic normalization in demand toward fewer goods and more services, but also some demand destruction from tighter Fed policy and higher financing costs, particularly for durable goods.

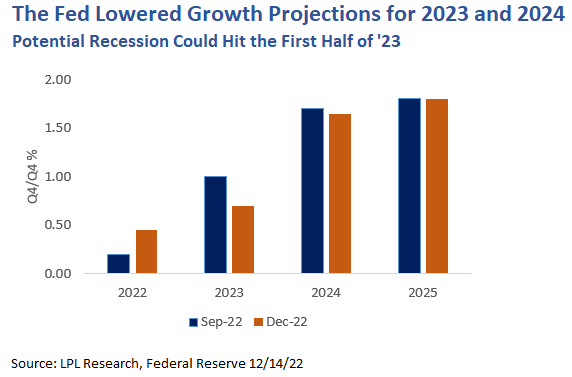

This data helps underpin why the Federal Reserve downwardly revised growth forecasts for both 2023 and 2024 in the release of their updated Summary of Economic Projections (SEP), as high inflation erodes purchasing power and is expected to weigh heavily on consumer spending.

Source: Ned Davis Research, Federal Reserve, LPL Research

Laggards flirt with former lows

As downside volatility picks up steam, it’s worth watching the cycle laggards closely for information on just how bad things could get. When it comes to growth stocks, it can be helpful to use the Ark Innovation ETF (ARKK), as it provides an excellent gauge of how the most speculative growth names are performing.

With the U.S. 10-year Treasury yield falling by more than 75 basis points since early November, ARKK hasn’t budged. It’s still sitting on the lower bounds of its range. If these long-duration equities can’t catch a bid with rates falling, they could experience significant downside if and when rates start rising again.

Investors are watching the current level around $33-35 as ARKK has found support here a number of times over the past several years. Price has been holding above this level again this year, since first testing it back in May. However, with sellers continuing to challenge these former lows, it could only be a matter of time until they absorb the demand at this polarity zone and force a downside resolution.

Source: All Star Charts

Timeless investing principles

15 rules for investment success by famed investor, John Templeton.

Source: Compounding Quality

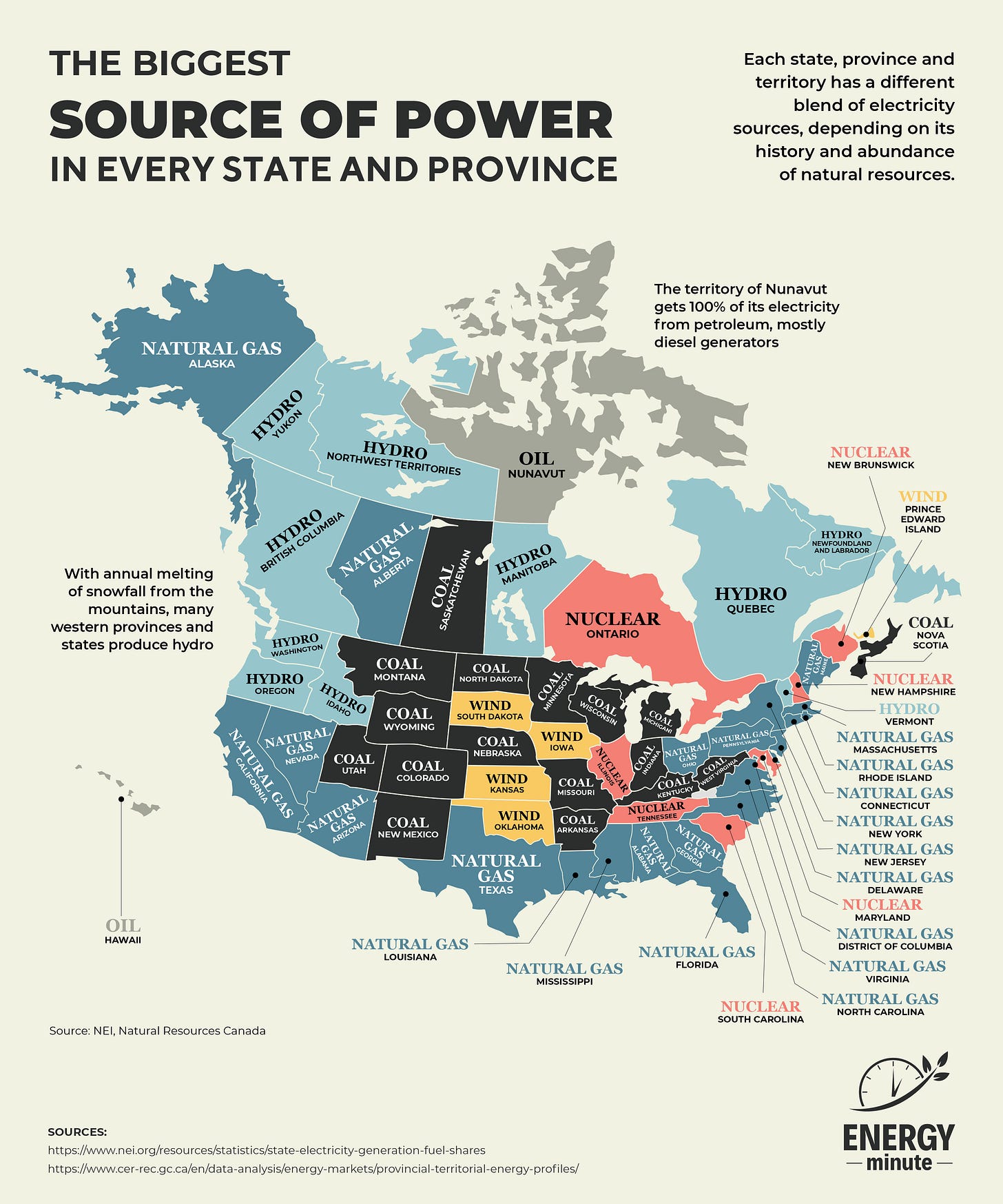

The biggest source of power in every state and province

Each state, province and territory has a different blend of electricity sources, depending on its history and abundance of natural resources.

Source: ENERGY minute

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.