Yes, Momentum is Real – No, You Still Shouldn’t Time the Market

The Sandbox Daily (6.18.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

market timing and momentum

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.52% | Nasdaq 100 0.00% | S&P 500 -0.03% | Dow -0.10%

FIXED INCOME: Barclays Agg Bond +0.07% | High Yield +0.15% | 2yr UST 3.943% | 10yr UST 4.395%

COMMODITIES: Brent Crude +0.09% to $76.52/barrel. Gold -0.60% to $3,386.5/oz.

BITCOIN: -0.91% to $103,827

US DOLLAR INDEX: +0.10% to 98.924

CBOE TOTAL PUT/CALL RATIO: 0.94

VIX: -6.76% to 20.14

Quote of the day

“Service to others is the rent you pay for your room here on earth.”

- Muhammad Ali

Yes, momentum is real – no, you still shouldn’t time the market

You've probably seen the research on market timing.

In short, it's not the best idea for investors to try timing the market – that is, trading in and out of positions based on whether you expect the market to be headed higher or lower over short time frames. Over the long run, even for the best investors with unlimited resources, the probability of success is very low. Mistiming moves, such as missing the 10 best days, significantly harm investor returns.

You’ve also likely seen the research on momentum.

Momentum investing is a strategy that involves buying assets that have recently performed well and selling those that haven’t, based on the concept that trends tend to persist in the short- to medium-term. The data does support the idea that today's stock market returns do, on average, predict tomorrow's returns.

And yet, these two findings seem to conflict with one another.

If today's returns can help investor’s predict tomorrow's returns, then isn’t it in the investor’s best interest to use that information to time the market?

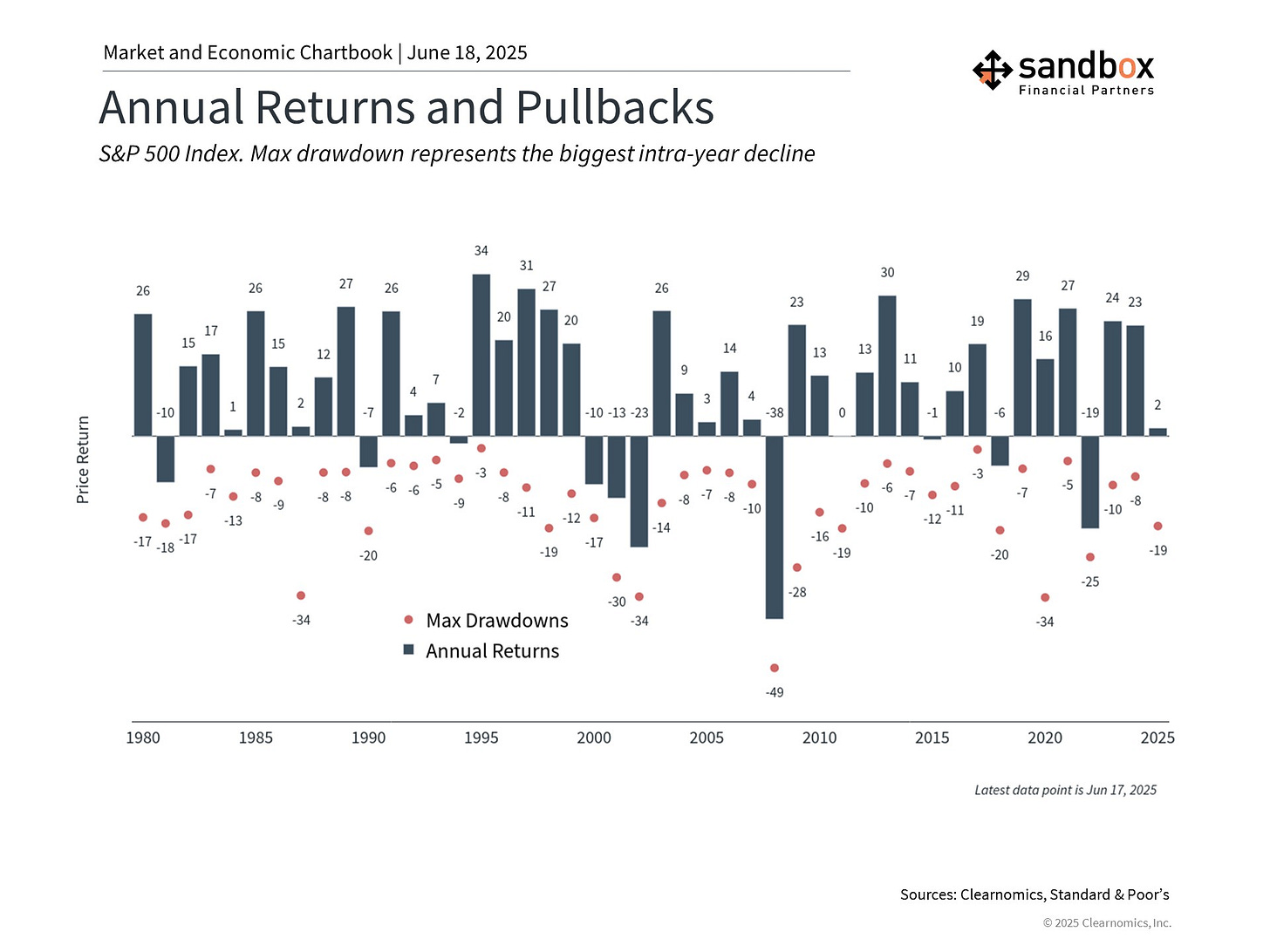

The chart below provides additional context here. As you can see, short-term market returns tell you very little about where the market is headed over the longer term.

Quite frequently the market will dip 10% or more at one point or another during a year but still end the year in positive territory. In fact, despite average intra-year drops of ~14%, annual returns for the S&P 500 were positive in 34 of the past 45 years.

Bottom line?

Yes, the market does exhibit characteristics of momentum.

However, this trading strategy is difficult to profit from repeatedly over short-dated time frames and is best left to professional traders.

On balance, my personal view supports the idea that investors are far better off taking a buy-and-homework approach and not attempting to time markets.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)