A bull market with a deep bench

The Sandbox Daily (1.15.2026)

Welcome, Sandbox friends.

Quick programming note: The Sandbox Daily will be off for the weekend in honor of Martin Luther King. Be back in your inbox on Tuesday.

Today’s Daily discusses:

widespread market participation

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.86% | Dow +0.60% | Nasdaq 100 +0.32% | S&P 500 +0.26%

FIXED INCOME: Barclays Agg Bond -0.13% | High Yield 0.00% | 2yr UST 3.568% | 10yr UST 4.173%

COMMODITIES: Brent Crude -4.09% to $63.80/barrel. Gold -0.37% to $4,618.1/oz.

BITCOIN: -2.60% to $95,534

US DOLLAR INDEX: +0.23% to 99.359

CBOE TOTAL PUT/CALL RATIO: 0.93

VIX: -5.43% to 15.84

Quote of the day

“Avoid having your ego so close to your position that when your position falls, your ego goes with it.”

- Colin Powell

You wanted breadth? Great – now you have it !

Tony Pasquariello, Global Banking & Markets MD at Goldman Sachs, had this to say to clients this week:

“It’s been a highly kinetic start to 2026. The newsfeed has been exceedingly active, and each day has been something of its own ecosystem. Despite all of the noise, the fact is this: global equities have continued to push higher in the new year.”

Major shifts in trade policy, taxes, and immigration have yet to derail this bull market, speaking to its strength. U.S. markets remain largely unaffected by the newswire tape bombs hitting the tape every day.

Two charts this week characterize the resiliency of this market and what should be another good year for equities displaying mid-cycle growth.

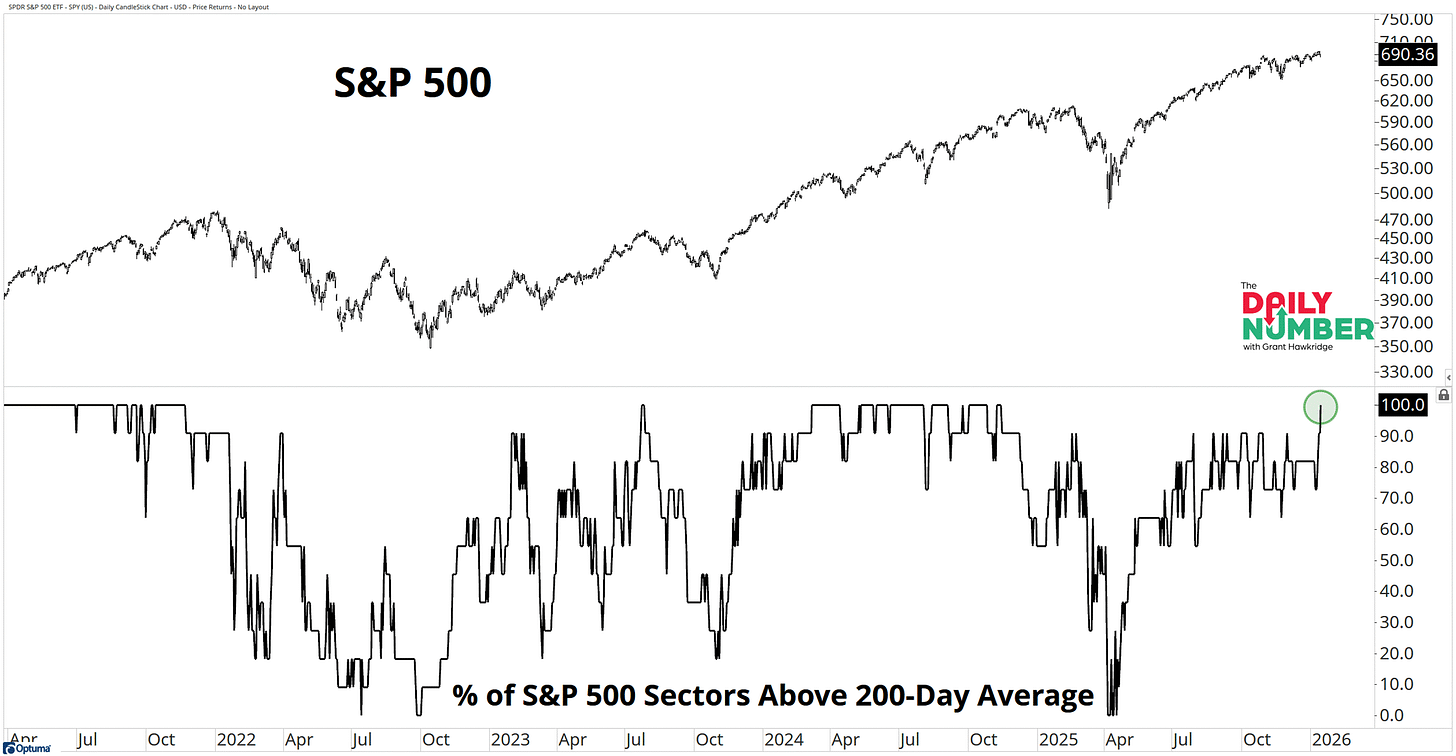

All 11 S&P 500 sectors are currently trading above their 200-day moving average. This means buyers maintain control of this market and trends are aligned across all segments.

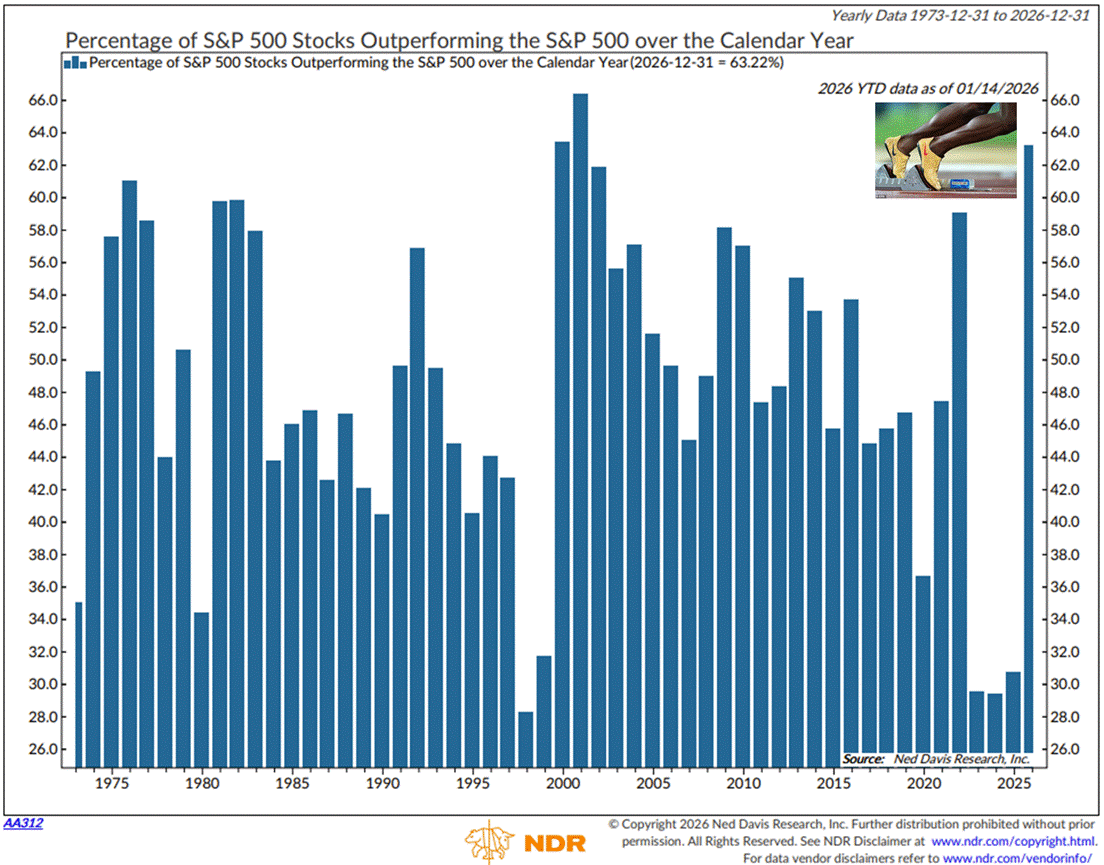

And while the Magnificent 7 suffers an identity crisis stretching on months, cyclical and value oriented segments have run with the baton like Michael Johnson in his gold shoes at the 1996 Atlanta Olympic games.

This has helped market breadth expand in magnitude like we haven’t seen since… 2001. 63% of index constituents are outpacing the benchmark.

Early in the year? Absolutely.

And yet, resilient markets are often characterized by widespread participation and we’re seeing strength expand, not weaken.

Sources: All Star Charts, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)