Bitcoin hits major $100K milestone

The Sandbox Daily (12.5.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Bitcoin hits major $100K milestone

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -0.19% | Nasdaq 100 -0.31% | Dow -0.55% | Russell 2000 -1.25%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield -0.09% | 2yr UST 4.142% | 10yr UST 4.178%

COMMODITIES: Brent Crude -0.06% to $72.25/barrel. Gold -0.82% to $2,654.3/oz.

BITCOIN: -1.65% to $97,176

US DOLLAR INDEX: -0.57% to 105.716

CBOE TOTAL PUT/CALL RATIO: 0.80

VIX: +0.67% to 13.54

Quote of the day

“Dream big and dare to fail.”

- Norman Vaughan, American Dogsled Driver and Explorer

Bitcoin hits major $100K milestone

Bitcoin traded above $100,000 for the first time – a nice round, but mostly arbitrary, number – that had acted as resistance over the past few weeks, as the bumper rally continues in the aftermath of the U.S. election.

The ride has sure been a wild one for Bitcoin and the crypto/digital asset ecosystem, which dates back to October 2008 when Satoshi Nakamoto released the Bitcoin: A Peer-to-Peer Electronic Cash System whitepaper.

$100,000 feels like a phoenix rising from the ashes when you consider the fraud, scams, and bad actors that poisoned the well for so many, especially over recent years – distracting builders and capital allocators from development and progress.

The most recent catalyst stems from President-elect Donald Trump's nomination of Paul Atkins, a crypto-friendly former regulator, to take over the helm at the U.S. Securities and Exchange Commission (SEC).

Investors are thinking if Donald Trump's plan to create a Bitcoin Strategic Reserve (à la the U.S. Strategic Petroleum Reserve) is implemented and other countries quickly follow suit, it would significantly increase overall demand for Bitcoin.

This could also introduce the potential for widespread corporate balance sheet adoption as a reserve asset. MicroStrategy's (MSTR) success here provides a tantalizing blueprint for other companies to replicate its strategy.

The downstream network effects continue to build on itself, something referred to as Metcalfe’s Law, a “phenomenon that makes some products and services more valuable with each additional person who uses them.”

Of course, Bitcoin's meteoric rise will always be met by naysayers who argue the mostly-speculative asset is driven by sentiment, FOMO, and momentum rather than fundamentals.

Now, many are wondering if they “missed” the rally.

My strong hunch is no. I believe this party is just getting started, but it all depends on your time horizon.

Remember when Donald Trump was first elected President and Bitcoin rallied from $700 to $19,000 during the November 2016-to-December 2017 face-ripper?

In fact, there are many historical analogs that show the digital asset ecosystem can move quickly.

Very quickly.

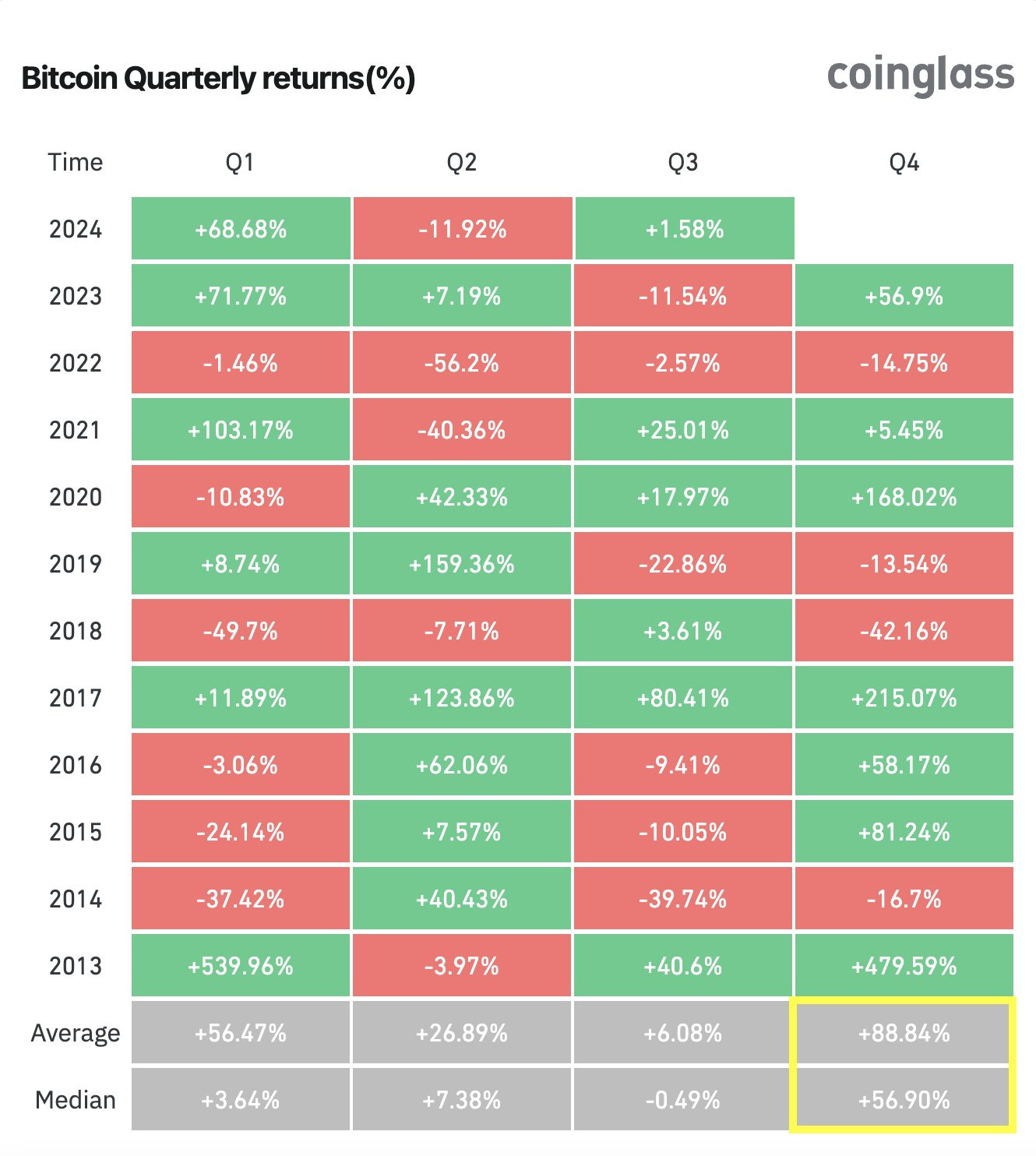

Just look at these quarterly returns and the outsized moves (in both directions).

I like using Fibonacci extensions to establish price targets and define logical support and resistance levels for risk management.

Having achieved the 161.8% Fibonacci extension of the 2022 bear market at $102k, the next logical upside price target is $155k.

Important reminder: this ride is a wild ride.

The volatility and drawdowns are not for the faint of heart.

Size positions appropriately, and, of course, manage your risks.

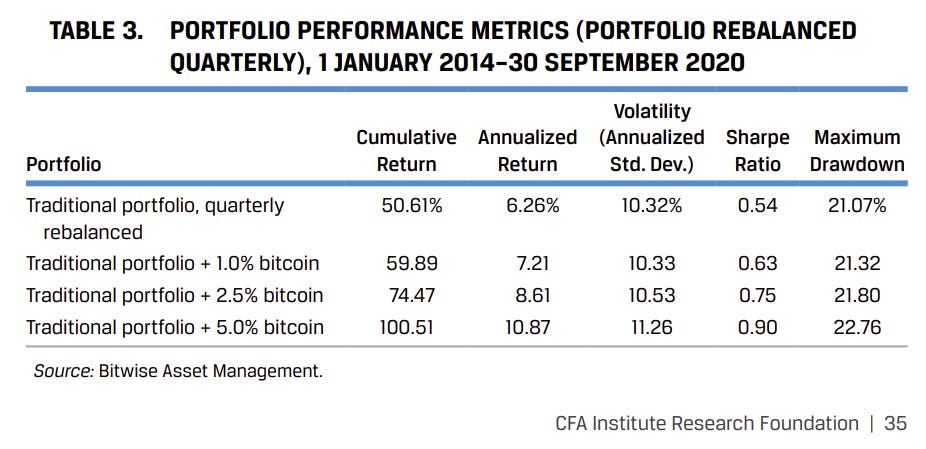

Adding a bitcoin allocation to a traditionally diversified portfolio has a meaningful impact on both risk and reward.

To the moon, they say !

Source: U.S. Congress, Reliants Project, All Star Charts, Bitwise

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: