Consumers don't have a debt problem. The U.S. government does.

The Sandbox Daily (2.26.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

federal debt overhang

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.22% | Russell 2000 +0.19% | S&P 500 +0.01% | Dow -0.43%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield +0.14% | 2yr UST 4.074% | 10yr UST 4.256%

COMMODITIES: Brent Crude -0.31% to $72.29/barrel. Gold +0.44% to $2,931.7/oz.

BITCOIN: -4.96% to $84,152

US DOLLAR INDEX: +0.16% to 106.483

CBOE TOTAL PUT/CALL RATIO: 0.92

VIX: -1.70% to 19.10

Quote of the day

“Everybody has some information. The function of the markets is to aggregate that information, evaluate it, and get it incorporated into prices.”

- Merton Miller

Federal debt overhang

Going back to at least Alan Greenspan, every Fed chair has warned that the United States is on the current vector of an unsustainable fiscal path.

Quick sentiment check on Twitter and OMG, everyone finds this to be a big problem, too.

And yet, every year, the federal debt-to-GDP ratio seemingly goes up. Economists have warned us trouble usually arises when debt-to-GDP exceeds 90% to 100%.

We’ve crossed that threshold and are currently sitting at 119%. Excluding the Fed’s SOMA holdings, the ratio is a more tolerable 92%. But, give that second ratio a Philly tush-push and we’ll cross an alarmist’s threshold in short order.

The U.S., of course, enjoys an exorbitant privilege and reserve currency status that gives it more leeway than all other economies.

So, what is the problem?

As long as debt grows slower than nominal GDP, maybe there isn’t one. But that hasn’t been the case in recent years.

Many projections, such as the one from the Congressional Budget Office, show large deficits well into the future.

At present, what worries me most is the interest on the federal debt since that obligation must be paid. Default is not an option. Close the markets if/when it does happen.

Net interest is the fastest growing item in the federal budget, up around 25% in 2024. It totaled a record $900 billion and consumed 18.5% of all tax receipts. The eye-catching headline on mainstream media in 2024: “net interest exceeds national defense spending.” That will trigger some folks watching at home.

With rates remaining higher-for-longer, net interest is expected to climb from 3% of GDP to over 4% in the coming years.

Another issue is debt issuance, i.e. the mechanical operations of bringing U.S. Treasuries to market.

Here, newly-appointed Treasury Secretary Bessent – well aware of the growing debt and deficit spending issue – has been saying it would maintain auction sizes “for at least the next several quarters,” while focusing on the shorter tenors to avoid too much issuance at higher rates locked over longer time frames.

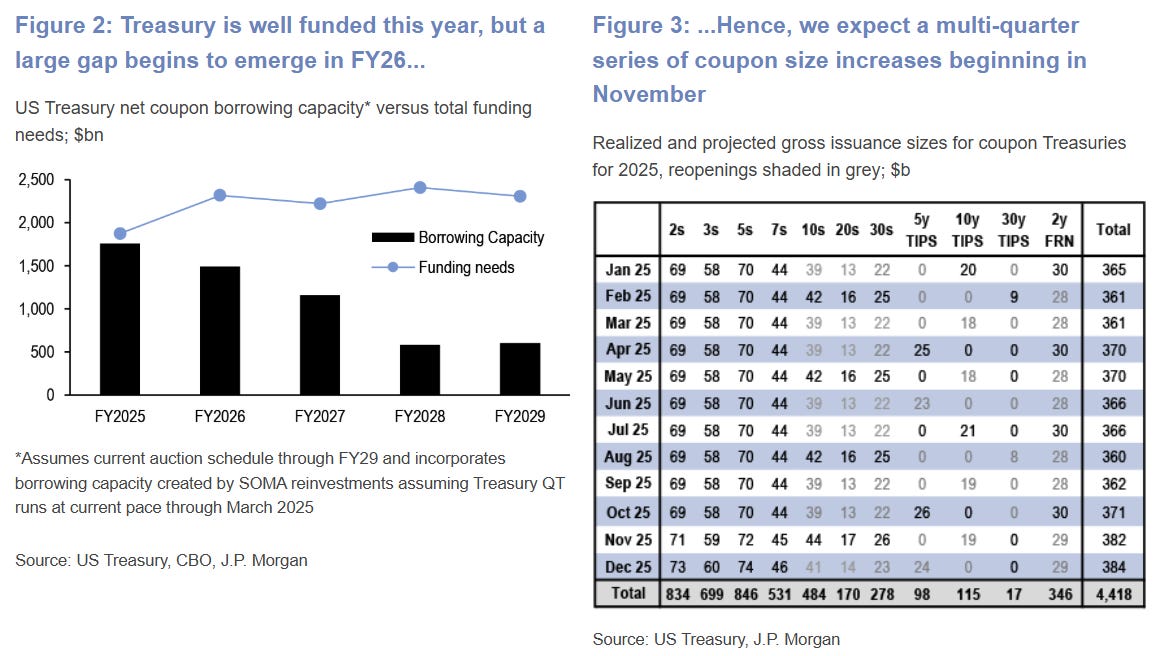

The current auction schedule remains appropriate for 2025; Treasury created substantial borrowing capacity from increasing auction sizes during the latter half of 2023 and first half of 2024 – as was widely reported at the time. It became the biggest talking point on the street.

However, its borrowing capacity declines considerably in fiscal year 2026 and beyond, as large-sized 5-year notes issued during the COVID-19 pandemic begin to mature and need to be refinanced. Given the expectations of wider deficits and large maturities, Treasury will have to address a financing gap of approximately $5T over the second half of this decade.

For now, Bessent has said the Treasury will focus on lowering the 10-year Treasury yield.

One last issue is the markets’ perspective.

Namely, who is going to buy the debt and keep the bids firm?

The Fed is no longer buying and continues to shrink its balance sheet via Quantitative Tightening. Banks are sitting on underwater securities. China and Japan are also reducing their holdings, focusing on gold more recently as a preferred reserve asset.

Interestingly enough, households have stepped up to the plate. Will that hold?

One final wrinkle.

With the Republican party controlling the White House and holding majorities in both houses of Congress, the 2017 TCJA tax cuts will be extended at some point, resulting in even wider deficits.

For now, it’s status quo.

One day the chickens will come home to roost, but that is day is not today.

Sources: Federal Reserve Bank of St. Louis, Congressional Budget Office, Bloomberg, J.P Morgan, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Aren't hedge funds lumped into the household category in lots of official data sources? My suspicion is the data is not what it seems. The HFs are long cash USTs but short futures.