Investors, bond market weigh the state of the U.S. economy

The Sandbox Daily (8.6.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

investors, bond market signal cuts are needed

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.29% | S&P 500 +0.73% | Dow +0.18% | Russell 2000 -0.20%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield +0.10% | 2yr UST 3.710% | 10yr UST 4.228%

COMMODITIES: Brent Crude -1.42% to $66.68/barrel. Gold -0.07% to $3,432.1/oz.

BITCOIN: +0.97% to $115,157

US DOLLAR INDEX: -0.55% to 98.234

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: -6.05% to 16.77

Quote of the day

“Be yourself; everyone else is already taken.”

- Oscar Wilde

Investors, bond market signal cuts are needed

A weak labor market report last Friday has raised concerns over the U.S. economic outlook, driving a significant front-end rally in U.S. rates.

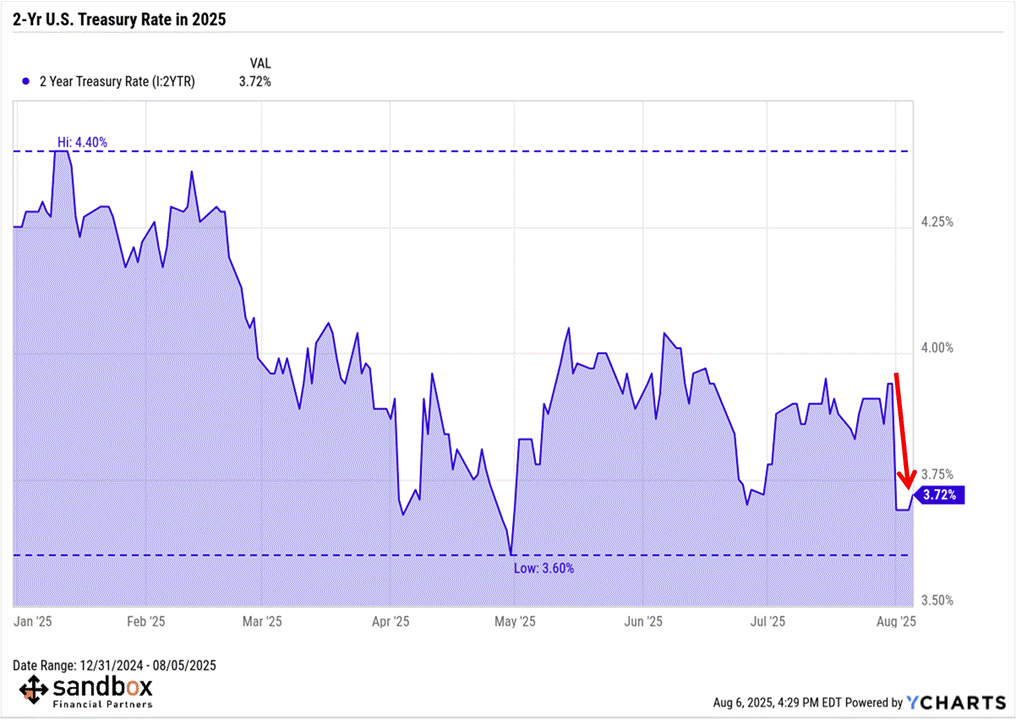

Pricing in the 2-yr U.S. Treasury rate has shifted sharply from the hawkish to the dovish end of the recent range with the market-implied rate trading near the post-Liberation Day lows. For a generally sleepy market, the move on the short-end of the Treasury curve is an abrupt reassessment of the economic outlook.

In response, it seems investors are no longer questioning whether the Fed will cut rates in September.

Now the conversation is evolving around how much policy easing is needed.

Allianz’s Chief Economic Advisor Mohamed El-Erian believes the Fed “would have cut” rates last week if it had the July jobs report (and those nasty revisions) in hand. He went on to tell Yahoo Finance that while a 25 basis point cut is a lock, a jumbo cut of 50 basis points is a real possibility.

Neil Dutta of Renaissance Macro Research wrote in a client note titled Labor Data Signal Conditions Heading South that “the market is right to price in additional cuts to the near-term outlook.”

Jan Hatzius of Goldman Sachs echoed these comments, stating that “U.S. growth is near stall speed” and a “50bp cut in September is also possible.”

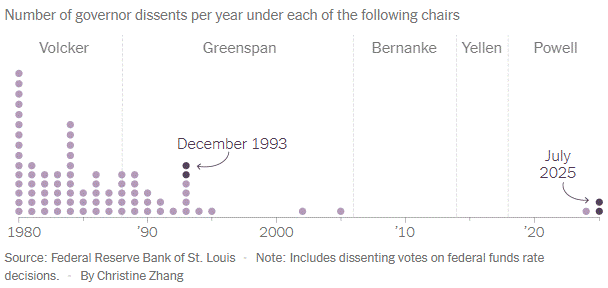

Even dissention among the Fed’s own committee is growing. For the first time since 1993, two governors (Christopher Waller and Michelle Bowman) broke ranks by casting votes against the decision to hold the central bank’s benchmark key rate unchanged, instead preferring to reduce it by a quarter percentage point.

Most important, the bond market agrees. And the Fed has a habit of following the bond’s markets lead.

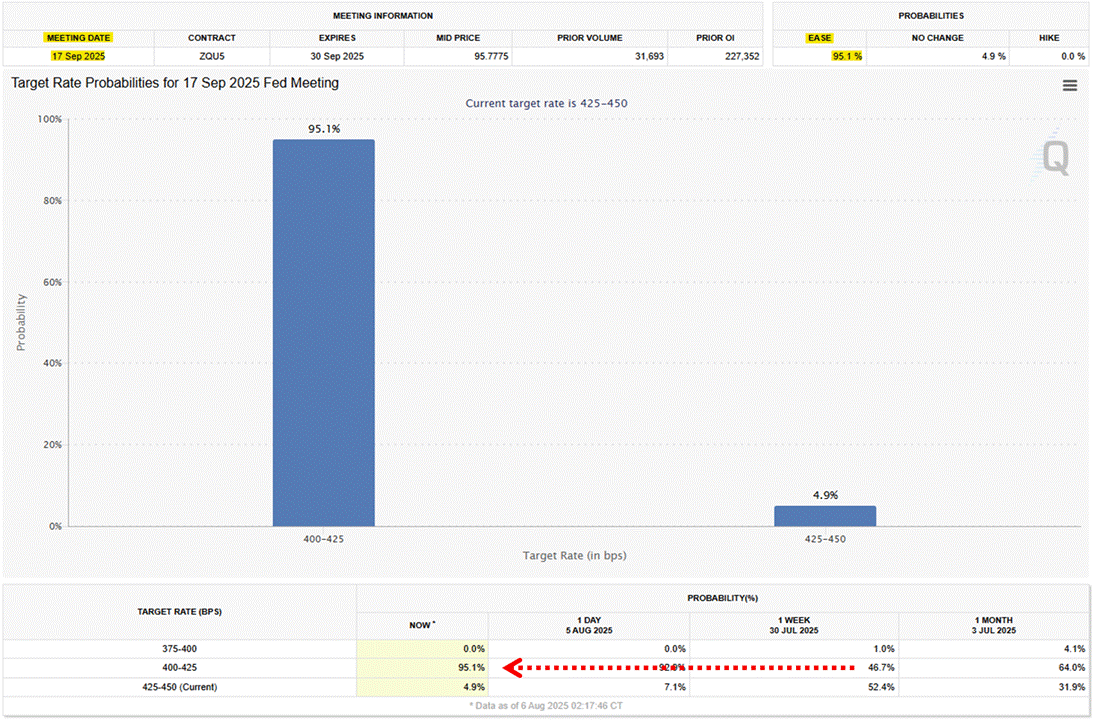

Options data using the CME's FedWatch Tool shows the probability of a September cut surged from a 50-50 proposition (46.7%) to a near certainty (95.1%), while a total of three 25 bp cuts are priced by years-end.

We are six weeks away from the next Fed meeting.

In last week’s FOMC meeting, Federal Reserve Chair Jerome Powell mentioned downside labor market risks roughly ten times.

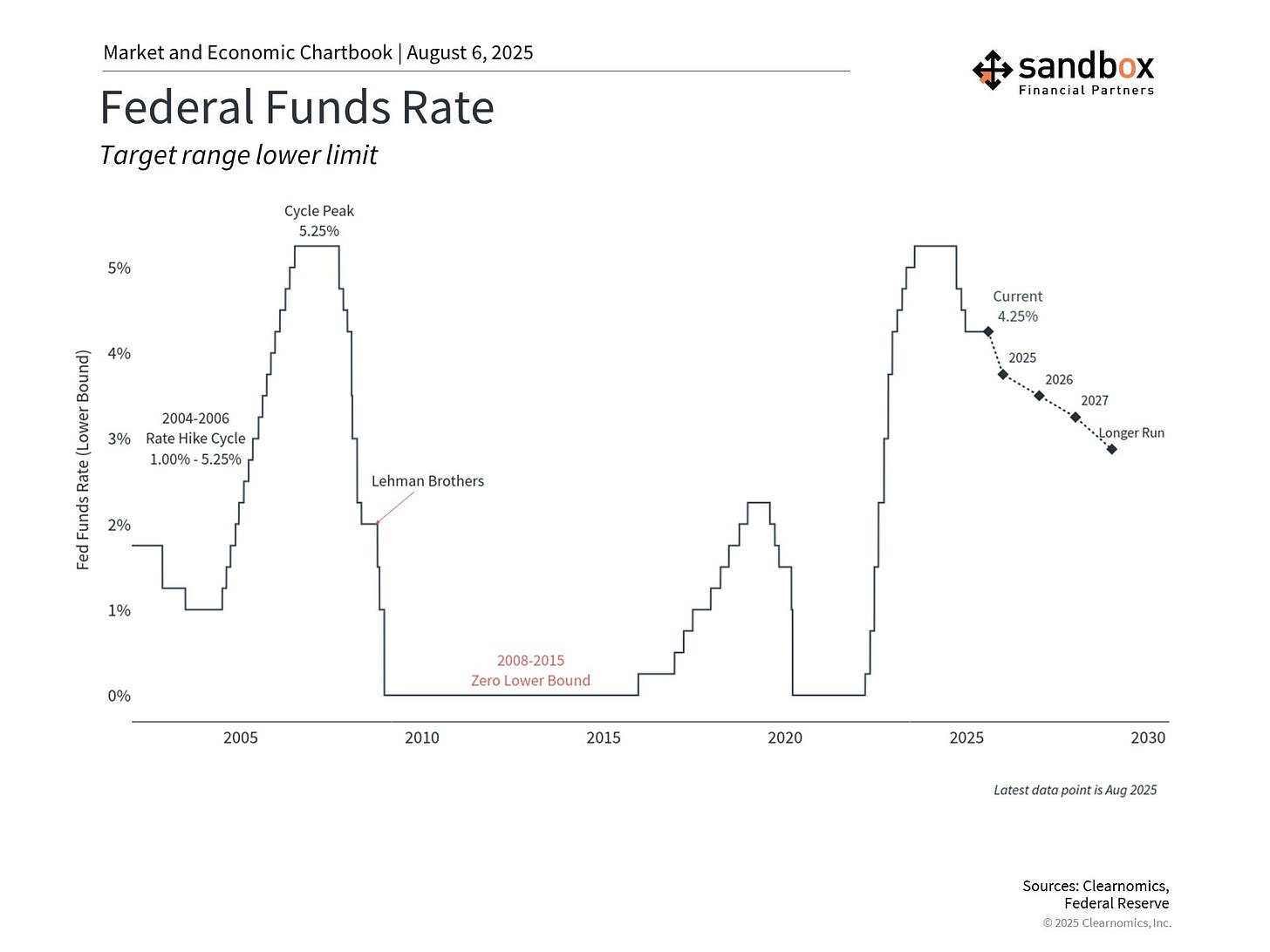

Now that these downside risks seem to be materializing, the table is set for the Fed to re-engage their easing cycle that has been on pause for the last five meetings since the last rate cut on December 18th, 2024.

By waiting until September 17, the nine-month pause would be the fourth longest historically. Talk about data dependent and Fed “efficiency.”

Bottom line, a September cut is now the base case, following Powell’s Jackson Hole Symposium speech in late August, one additional nonfarm payrolls report, and two monthly CPI releases.

Sources: YCharts, Yahoo Finance, RenMac, Goldman Sachs, Reuters, CME FedWatch, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)