Lump-sum vs. DCA, plus upcoming wealth transfer, volatility, and hidden cost of mutual funds

The Sandbox Daily (5.7.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

lump sum or dollar-cost average

upcoming wealth transfer

interest rate volatility is low right now, which is good for equity markets

the hidden cost that favors ETFs over mutual funds

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.19% | S&P 500 +0.13% | Dow +0.08% | Nasdaq 100 -0.01%

FIXED INCOME: Barclays Agg Bond +0.21% | High Yield +0.01% | 2yr UST 4.828% | 10yr UST 4.459%

COMMODITIES: Brent Crude -0.06% to $83.28/barrel. Gold -0.39% to $2,322.2/oz.

BITCOIN: -0.42% to $63,089

US DOLLAR INDEX: +0.30% to 105.371

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: -1.93% to 13.23

Quote of the day

“Identifying the direction of primary trends is helpful because without understanding the environment we’re in, how could we possibly pick and choose which tools and strategies to incorporate?”

- J.C. Parets, Founder of All Star Charts in Know What Game to Play

Jumping into the market vs. slowly wading in

One of the classic questions that confronts every investor at some point along their financial journey is deciding when to invest a sum of money.

More specifically, when provided a larger-than-routine deposit into your investment account, should you invest that money up front all-at-once or gradually deploy dry powder according to a schedule?

Lump-sum or DCA?

Given investors’ often visceral aversion to losses, it’s easy to become paralyzed by decisions over exactly how and when to invest. That may be especially true in today’s uncertain market environment. Keep in mind, we are humans – not robots – and we are all subject to behavioral and cognitive biases.

This chart from Nick Maggiulli illustrates the benefit of investing a sum of money all-at-once, rather than incrementally via a dollar-cost averaging (DCA) strategy.

As you can see, over the 25-year period covered by this analysis, an investor would have been better off most of the time by investing a lump sum all-at-once. According to these numbers, the DCA is a losing strategy.

Vanguard ran the math, as well, arriving at a similar answer – with lump-sum investing outperforming DCA purchases 68% of the time.

Back to Nick Maggiulli for a minute, who expanded this exercise beyond U.S. equities to other asset classes.

Result?

Same thing – even on a risk-adjusted basis.

The question becomes more nuanced when you consider path-dependency, timing, and the variability of returns (greater with lump-sum investing).

Bottom line, investors must always balance what the calculator says and how they feel about it. The charts above provide the “calculator answer.” But a calculator doesn’t experience human emotions. And when it comes to the question of whether to invest a lump sum all-at-once, a key emotion hangs in the balance: the potential for regret.

Imagine if you had just sold a business or received your annual bonus. If you invested it all at once and saw it drop over the next 3-6 months by 10/15/20%, these charts and data points might be cold comfort. Perhaps investing incrementally via a DCA – even if it is sub-optimal – may be suitable for some but not others.

Source: Nick Maggiulli, Vanguard

Upcoming wealth transfer

As the Baby Boomers approach their twilight years – whose average age is 67.1 with birth years ranging from 1946 to 1964 – many are curious to watch the largest transfer of wealth in modern times.

Beneficiaries, namely Millennials, are set to inherit $68T over the next 20 years.

Some hope the so-called Great Generational Wealth Transfer will be a panacea for Millennials and the economy more broadly.

The reality is that inheritances are very highly concentrated, and for most people (especially the lower households), skyrocketing educating and healthcare costs will eat into their net worth.

The top 1% holds nearly as much wealth as the lower 90%, so naturally that’s where the big inheritance transfers will originate. With wealth largely going from one high income group to another, incremental spending will be modest. The transfer will likely exacerbate existing inequalities.

Source: FS Insight, Piper Sandler, Coldwell Banker

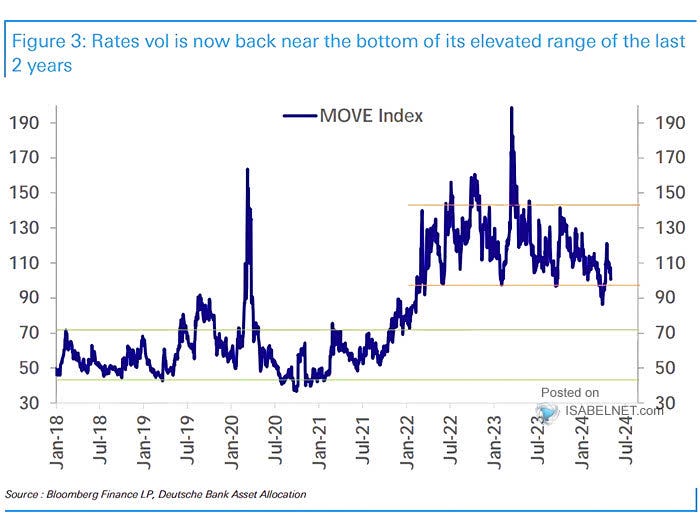

Interest rate volatility is low right now, which is good for equity markets

We highlighted in April that higher volatility was applying pressure on financial markets in a way we didn’t see much in Q1. Implied volatilities across assets are still higher than the ultra-low levels of the 1st quarter, so optionality is no longer as cheap as it was. But volatilities have come down from their recent peaks across different markets and now sit at the lower ends of their historical ranges.

One asset class in particular, though, stands out – with volatility still at the higher end of normal. See the “US 10y yield” below, where implied volatility for 10-year U.S. Treasuries is at the 67th percentile of its recent 15-year range.

The last two years have repeatedly shown that it is the volatility of interest rates – and not just their level – that has mattered most for equities.

The ICE BofAML MOVE Index – which reflects the level of volatility in U.S. Treasury futures – has moved steadily lower over the past three weeks, allowing stocks to inflect higher after weeks of corrective price action. The MOVE Index now sits at the lower end of its 2-year range and back to the high end of normal.

Low volatility of interest rates can be beneficial for the stock market for several reasons:

Cost of borrowing: Low volatility in interest rates means that the cost of borrowing for businesses remains stable. This stability makes it easier for companies to plan their investments and expansion strategies without the uncertainty of fluctuating borrowing costs, which can positively impact their stock prices.

Discount rates: Interest rates play a crucial role in determining the present value of future cash flows. When interest rates are stable, the discount rates applied to future earnings streams remain predictable and consistent. This can lead to higher valuations for stocks.

Investor confidence: Steady rate environments often signal a stable, if not growing, economy which can boost investor confidence in the stock market. Investors are more likely to invest in stocks when they have confidence in the overall economic outlook, leading to increased demand for equities and potentially higher stock prices.

Consumer spending: A stable interest rate regime encourages consumer borrowing and spending. When consumers have greater visibility and confidence in the cost of capital, they are more likely to make big purchases like homes and cars, which can stimulate economic growth and benefit companies in those sectors. This increased consumer spending can translate into higher revenues and profits for companies, boosting their stock prices.

Source: Goldman Sachs Global Investment Management, Isabelnet

The hidden cost that favors ETFs over mutual funds

Investors have increasingly moved away from mutual funds towards ETFs in recent years. Of course, mutual fund AUM still claims trillions of invested assets, but has ceded its majority share to ETFs.

One key reason?

Costs.

In addition to oft-cited higher average expense ratios, mutual funds struggle with how many taxable events they encounter as opposed to ETFs. In general, the more distributions a fund makes means more money is forfeited to taxes – resulting in a higher tax-cost ratio. That hidden cost of mutual funds sees 62.6% of all U.S. equity mutual funds distributing capital gains, compared to just 2.5% of ETFs per American Century Investments.

The tax-cost ratio is the percentage loss on a fund’s annual return due to the taxes investors may pay on their funds’ distributions. It measures the potential tax “drag” on a taxable investment’s return.

As you see in Figure 2 below, the average tax-cost ratio is materially higher for mutual funds than ETFs.

Source: J.P. Morgan Markets, American Century

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

DCA every time, way better emotional experience