Market breadth has significantly improved, plus EM central banks, CEO outlook, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (8.9.2024)

Welcome, Sandbox friends.

Quick (but important) programming note before we get started: The Sandbox Daily is on summer vacation next week 🏖️ ! We will be back with our regularly scheduled programming on Monday, August 19th. Bottoms up 🥃 !

Today’s Daily discusses:

market breadth has improved significantly in 2H24

Emerging Market central banks on the path towards easing

CEOs remain cautiously optimistic about the economy

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.54% | S&P 500 +0.47% | Dow +0.13% | Russell 2000 -0.17%

FIXED INCOME: Barclays Agg Bond +0.35% | High Yield -0.01% | 2yr UST 4.053% | 10yr UST 3.938%

COMMODITIES: Brent Crude +0.63% to $79.66/barrel. Gold +0.23% to $2,468.9/oz.

BITCOIN: +2.19% to $60,923

US DOLLAR INDEX: -0.07% to 103.137

CBOE EQUITY PUT/CALL RATIO: 0.97

VIX: -14.38% to 20.37

Quote of the day

“Prices change when events are different from what the market has expected them to be.”

- Peter Bernstein

Market breadth has improved significantly in 2H24

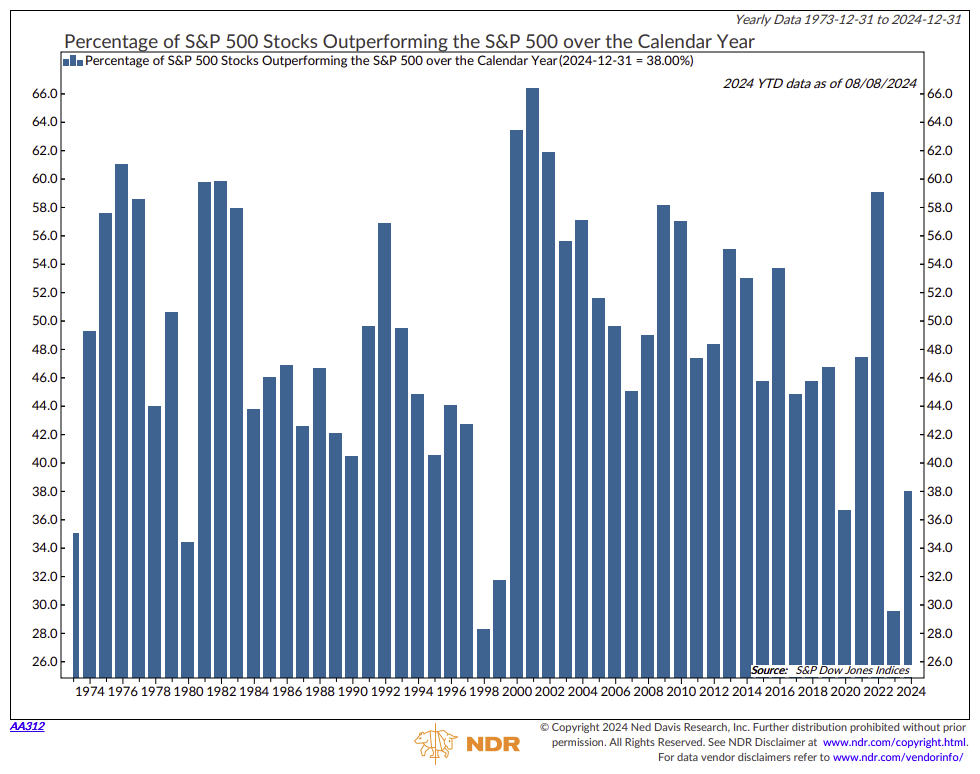

Strategists and investors alike have been clamoring for market breadth to improve for the better part of two years.

At the end of June – marking the completion of the 1st half of 2024 – we previously noted how difficult it was for the majority of stocks to keep up with the benchmark given how concentrated the S&P 500 index has become with the larger stocks continuing to outperform. At the time, just 25.2% of S&P 500 constituents were outperforming the index itself.

6 weeks later and that number has jumped higher by 51%.

Today, 38% of S&P 500 companies are now outpacing the benchmark itself.

The historical average is 48%.

Source: Ned Davis Research

Emerging Market central banks on the path towards easing

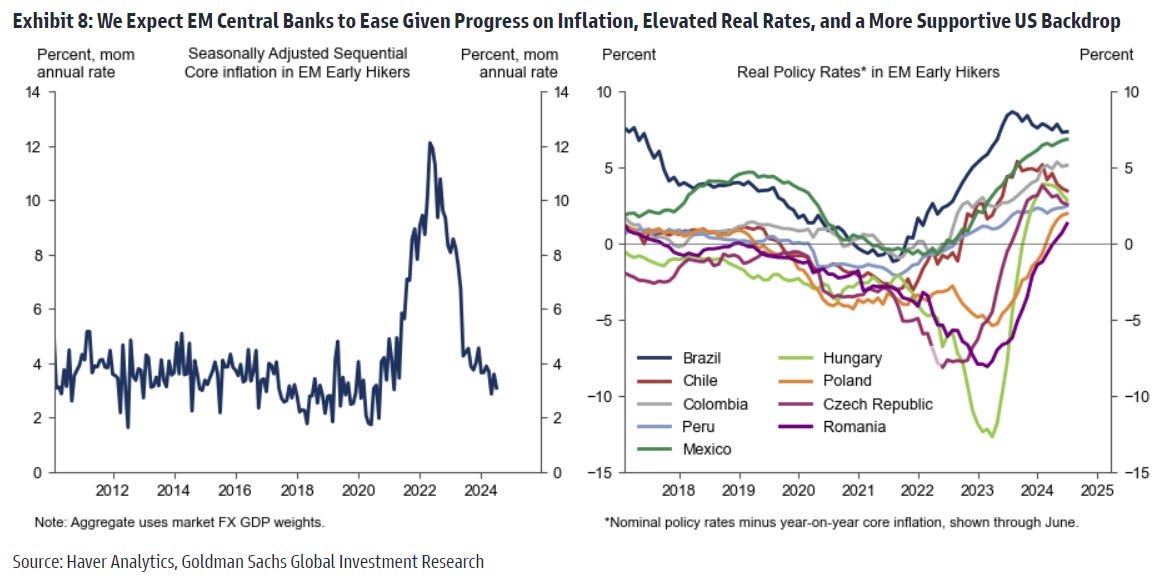

The stars are beginning to align for more decisive rate cuts from Emerging Market economies.

Growth has softened somewhat, inflation is back to pre-pandemic norms, and real policy rates remain very high. Meanwhile, two of the external worries that have kept EM central banks on hold in recent months – a hawkish Fed and a looming Trump presidency with renewed large tariff hikes – have started to look less threatening with the shift in the Fed outlook and the recent swing in the U.S. polls toward Vice President Harris.

Concerns about geopolitics, domestic fiscal policy, and the exchange rate still linger, but expect EM central banks to chart a more dovish course once the recent bout of financial market volatility subsides.

Source: Goldman Sachs Global Investment Research

CEOs remain cautiously optimistic about the economy

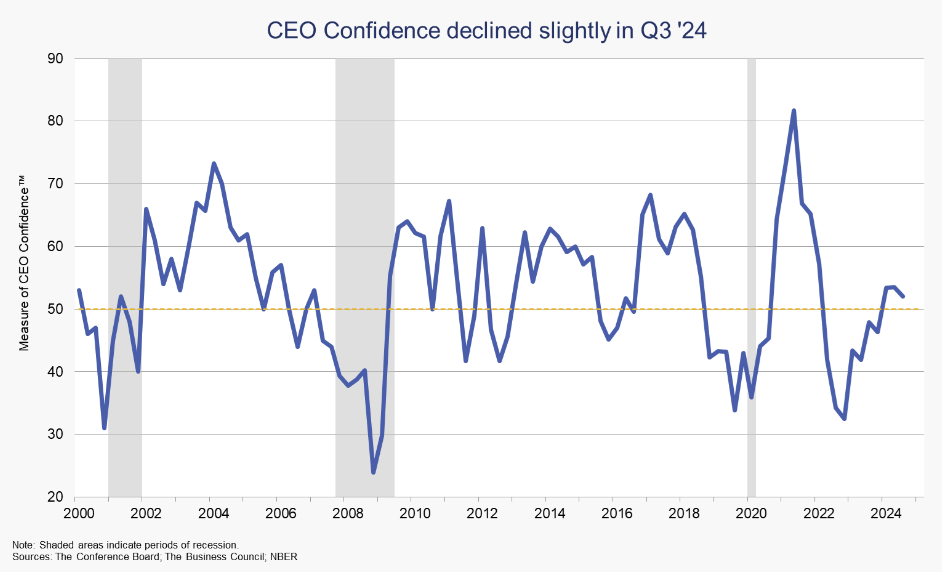

The measure of CEO Confidence from The Conference Board is a barometer of the health of the U.S. economy from the perspective of 130 U.S. chief executives.

After climbing higher most of 2023 and 2024, this week we learned that CEO Confidence Index ticked down two points to 52, reflecting cautious optimism about the economic outlook.

The assessment of current conditions worsened both for the macro economy and CEOs’ own industries. Expectations for the next six months, however, were near steady and modestly positive. The level and trend of CEO confidence are consistent with continued moderate growth in corporate profits and capex.

The share of CEOs expecting a recession in the coming year fell from 35% to 30% from the prior quarter and are down significantly from 84% a year ago.

While the risks of recession have clearly been rising as economic data continues to disappoint to the downside, it's important to remember consensus is not calling for an economic downturn.

Source: The Conference Board, Yahoo! Finance

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs / Newsletters

J.P. Morgan – The Lion in Winter (Michael Cembalest)

Humble Dollar – The Risks We Miss (Jonathan Clements)

A Wealth of Common Sense – The Best Investment I Ever Made (Ben Carlson)

Barron’s – Investing Guru Jeremy Siegel is All-In on Stocks. Why Bonds are a Nonstarter. (Paul La Monica)

Wall Street Journal – How to Stay Sane When Markets Get Wild (Jason Zweig)

Money With Katie – Maybe She’s Born with It, Maybe Her Mom’s the CFO of Kraft Heinz (Katie Tassin)

Podcasts

Excess Returns – Challenging Conventional Investing Beliefs with Meb Faber (Spotify, Apple Podcasts, YouTube)

The Compound – Enough! This is How the Sahm Rule Predicts Recession feat. Claudia Sahm (Spotify, Apple Podcasts, YouTube)

New Hampshire Public Radio – Bear Brook: A True Crime Story (Spotify, Apple Podcasts)

Movies

The Fall Guy – Ryan Gosling, Emily Blunt (IMDB, YouTube)

Triple 9 – Woody Harrelson, Kate Winslet, Chiwetel Ejiofor, Casey Affleck (IMDB, YouTube)

Music

Shoby – Outside (Spotify, Apple Music)

MGK & Jelly Roll – Lonely Road (Spotify, Apple Music)

Calvin Harris & Sam Smith – Promises (Spotify, Apple Music)

Culture

Hard Knocks: Training Camp with the Chicago Bears (YouTube, HBO)

Books

Scott Galloway – The Algebra of Wealth (Amazon)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.