Powell’s last stand: Jackson Hole, rate cuts, and the Fed’s balancing act

The Sandbox Daily (8.21.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Jackson Hole 2025 Economic Symposium

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.21% | Dow -0.34% | S&P 500 -0.40% | Nasdaq 100 -0.46%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.19% | 2yr UST 3.792% | 10yr UST 4.328%

COMMODITIES: Brent Crude +1.11% to $67.58/barrel. Gold -0.17% to $3,382.7/oz.

BITCOIN: -1.64% to $112,280

US DOLLAR INDEX: +0.45% to 98.657

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: +5.80% to 16.60

Quote of the day

“Life is 10% what happens to you and 90% how you react to it.”

- Charles Swindoll

Jackson Hole 2025 Economic Symposium

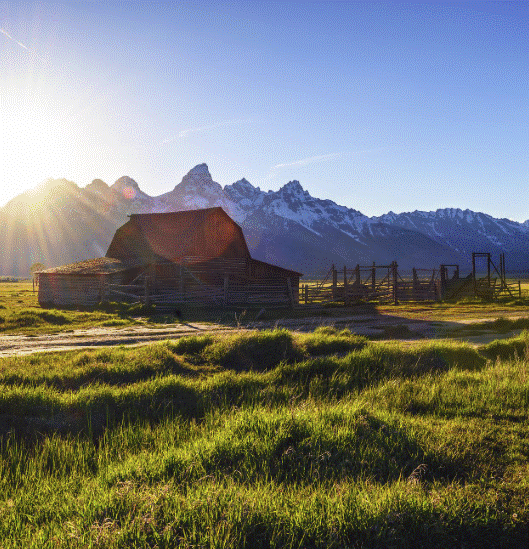

Each August since 1982, the world’s most influential central bankers, economists, policymakers, and journalists descend on the Rockies to Grand Teton National Park for the Jackson Hole Economic Symposium.

The formal theme this year is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.”

But the real conversations – in speeches, panels, and coffee-line debates – center on one question: what comes next for the Federal Reserve at a moment of political pressure, slowing growth, and uncertainty about the institution’s future.

For Jerome Powell, this week’s gathering carries special weight. After nearly eight years as Fed Chair, this should be his last Jackson Hole appearance. His keynote will double as a legacy-defining moment and a signal of how he sees the Fed navigating the difficult months ahead.

A Fed at a Crossroads

Markets are betting heavily that the Fed will cut interest rates in September. Odds run above 80% on most platforms.

The case seems straightforward: labor markets are cooling (3-month nonfarm payrolls are averaging a meager 35,000), while economic growth as measured by GDP cooled to 1.2% in the first half of 2025. While the unemployment rate still sits at a historically low 4.2%, the fragility beneath the surface has investors and policymakers alike on edge.

Inflation, too, looks more benign than feared. Core measures are drifting lower once tariffs are stripped out, with housing inflation easing and other service categories hovering around the Fed’s 2% comfort zone. That combination – weaker labor demand and moderating inflation – is precisely the kind of backdrop in which Powell has previously argued for easing.

And yet, the picture is far from clean. Producer prices jumped 0.9% in July, the sharpest gain since 2022, raising the risk that price pressures re-accelerate. Tariffs remain a wildcard. Services inflation is still hovering around 3%. Elevated asset prices and rampant deficit spending argue for a higher neutral rate.

Powell knows that locking into a September cut could backfire if incoming data flip back toward tightness.

Preserving optionality is, for him, a feature – not a flaw.

The Case for Cutting vs. Pausing

The debate about resuming the easing cycle on hold since last winter is a fierce one.

On one side, officials like Treasury Secretary Scott Bessent and Jeffries’s Economist David Zervos are calling for aggressive easing – 50 basis points in September followed by as much as 100–150 basis points more.

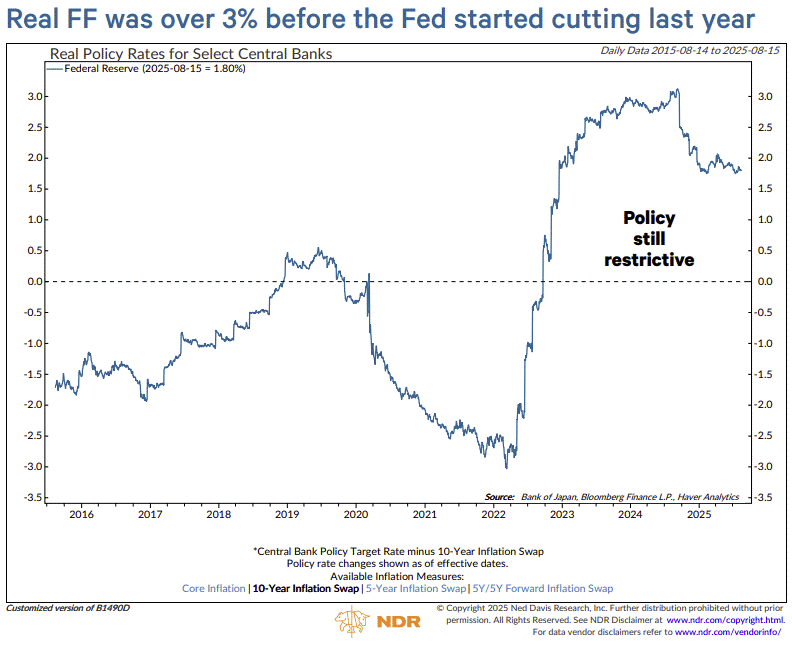

Their reasoning: policy is too restrictive, housing affordability is historically bad, and the risks of waiting are asymmetric. Cut now, they argue, and the Fed can always pause later if inflation ticks up. Wait too long, and the job market may crack in ways that are difficult to repair.

On the other side, skeptics warn that easing too soon could ignite financial excesses and undermine credibility. The neutral rate may be higher than the Fed assumes, equity valuations are stretched, and margin debt has topped $1 trillion.

Cutting prematurely could fuel a dangerous market melt-up. Worse, it could look like Powell is bowing to political pressure from the White House – a replay of the 1970s, when premature easing forced harsher tightening later.

Politics and Independence

Unlike most years, the backdrop to all of this is in part political.

President Trump has made no secret of his desire to exert more control over the Fed. Rate cuts would ease the pressure, but at the potential cost of appearing politically motivated.

Powell, who has carefully defended the central bank’s independence, faces the ultimate credibility test.

Markets want clarity. Politicians want cooperation. History will judge how he chose to balance both.

A Legacy in Review

Layered atop the near-term policy questions is the Fed’s every-five-years review of its monetary framework.

The 2020 version emphasized reacting quickly to employment shortfalls, but offered no symmetric discipline when labor markets overheated. Critics say that asymmetry contributed to the Fed being slow to respond to inflation’s surge in 2021. Powell will need to acknowledge these lessons while knowing that his successor, perhaps Governor Christopher Waller or former Fed Governor Kevin Warsh, will likely chart a new course going forward.

It is a reminder that Powell’s Jackson Hole speech is as much about legacy as it is about the next FOMC meeting.

Eight years of navigating trade wars, a pandemic, the worst inflation spike in five decades, and now political crosscurrents have left him both celebrated and criticized. It’s been a tough stretch, to say the least.

Like Powell stated in 2023: “As is often the case, we are navigating by the stars under cloudy skies.”

The Balancing Act Ahead

For markets, the immediate concern is whether Powell validates expectations for a September cut.

A dovish lean would spark relief rallies in stocks, housing, and rate-sensitive sectors.

A more hawkish tone could add further fuel to this week’s selling pressure, particularly in richly valued tech names.

But beyond the knee-jerk moves lies the deeper question: what role should the Fed play in a society when politics, markets, and economic fundamentals are pulling in different directions?

Powell’s final Jackson Hole keynote won’t settle the debate, but it will frame the terms on which his successor inherits the chair.

Bottom line?

Powell’s last stand at Jackson Hole is about more than one rate decision.

It’s about credibility, independence, and the delicate task of steering the Fed at a moment when both the markets and the White House are pressing hard for answers.

Sources: Kansas City Fed, Axios, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)