Software stocks show extreme weakness, enter a bear market ($MSFT, $IGV)

The Sandbox Daily (1.29.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

Microsoft drags down Software stocks

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.11% | Russell 2000 +0.05% | S&P 500 -0.13% | Nasdaq 100 -0.53%

FIXED INCOME: Barclays Agg Bond 0.00% | High Yield -0.01% | 2yr UST 3.559% | 10yr UST 4.233%

COMMODITIES: Brent Crude +3.58% to $70.85/barrel. Gold +1.58% to $5,424.6/oz.

BITCOIN: -5.76% to $84,131

US DOLLAR INDEX: -0.26% to 96.194

CBOE TOTAL PUT/CALL RATIO: 0.81

VIX: +3.24% to 16.88

Quote of the day

- Mookie Wilson, New York Mets Left Fielder (h/t Ryan Detrick)

Software stocks show extreme weakness, enter a bear market

Many investors who own Software stocks are aware this sector has been knee-capped very hard over the last three months, in both absolute and relative terms.

Yesterday, it was Microsoft’s turn to further disappoint the Software complex.

Microsoft posted 4th quarter earnings which showed subscriber growth and monetization challenges related to Copilot and its AI business, as well as its Azure cloud revenue stall out further.

The result?

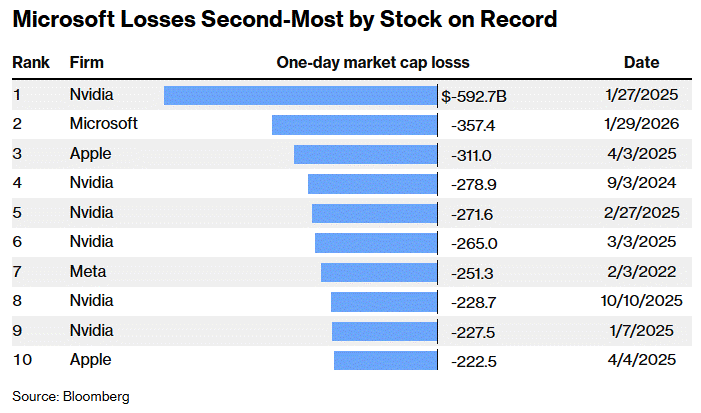

Investors took the name behind the woodshed and sold shares down -9.99% today – erasing $357 billion in market cap, its worst plunge since DeepSeek hit Nvidia in early 2025.

The selloff comes amid heightened skepticism from investors that the hundreds of billions of dollars Big Tech is spending on Artificial Intelligence will eventually pay off.

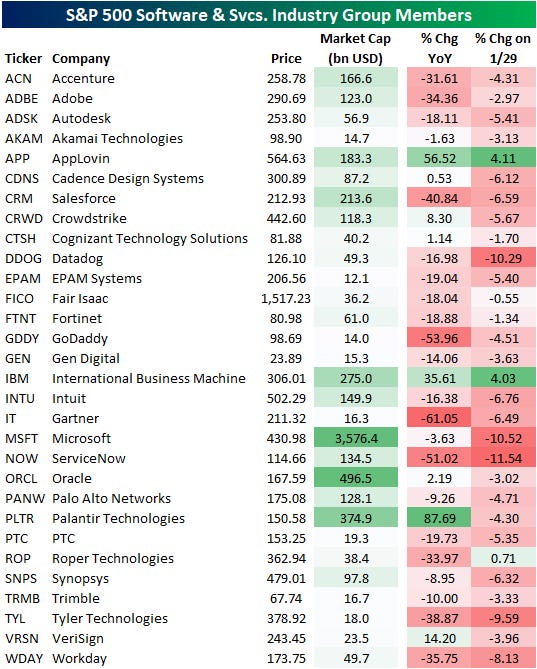

With Microsoft’s tough quarter in tow, alongside ServiceNow having also reported unsatisfactory earnings results, the rest of the Software names were hit brutally hard today.

As a result, the iShares Expanded Tech-Software Sector ETF (IGV) dropped -4.94% in today’s session and now sits in a technical bear market from its late October cycle high.

It was the worst one-day selling pressure for the group since the Liberation Day lows.

Many investors who are expecting the broader U.S. indexes to continue to push higher have a growing problem with regard to Tech: Software remains in a structural downtrend line and continues to underperform in a meaningful way. One of the bull’s most offensive groups is stuck in the mud.

As the Mag 7 has regained its shine over the last two weeks, investors are showing differentiation among Technology sub-groups, with Semis and Hardware eating Software’s lunch.

Sources: Optuma, Bloomberg

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)