The bifurcated consumer, plus expensive valuations, S&P 500's changing composition, and startup shutdowns

The Sandbox Daily (3.25.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

low-end consumers getting squeezed

expensive valuations

the ever-changing makeup of the S&P 500 index

startup shutdowns

We appreciate your patience during our publishing hiatus last week. My father passed away suddenly in Bangkok, Thailand while on a photography excursion with friends. The past week has been an emotional rollercoaster full of overwhelming grief and disorienting pain and sadness. In his absence, only silence resonates – a poignant testament to one life's journey ended, leaving hearts heavy with loss and souls adrift. This heart-breaking experience for our family is a chilling reminder of how fragile life really is – hold your loved ones close and don’t wait until tomorrow.

And now, on to today’s Daily…

Markets in review

EQUITIES: Russell 2000 +0.10% | S&P 500 -0.31% | Nasdaq 100 -0.34% | Dow -0.41%

FIXED INCOME: Barclays Agg Bond -0.18% | High Yield -0.15% | 2yr UST 4.631% | 10yr UST 4.249%

COMMODITIES: Brent Crude +1.46% to $86.68/barrel. Gold +0.60% to $2,194.7/oz.

BITCOIN: +4.84% to $70,104

US DOLLAR INDEX: -0.24% to 104.227

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: +1.00% to 13.19

Quote of the day

Low-end consumers getting squeezed

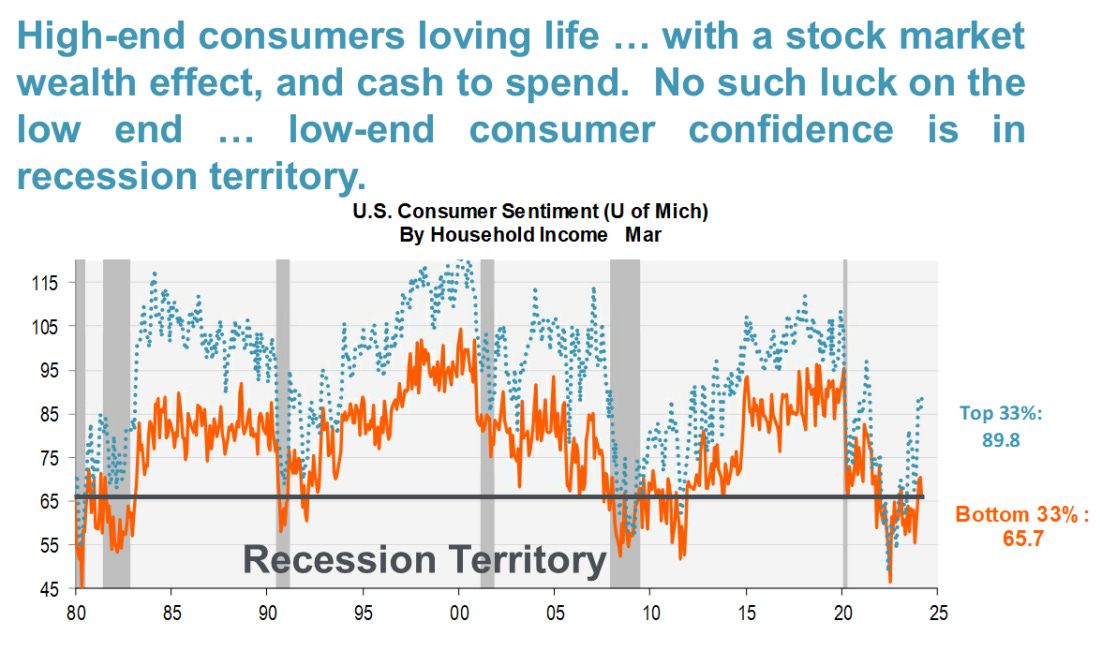

It’s not just the stock market that’s bifurcated – it’s the consumer, too.

The University of Michigan consumer confidence survey for early March had quite the dichotomy. The low-end consumer confidence measure moved deeper in recession territory, while high-end confidence hit a cycle high.

Why the divergence?

For the top tier, Fed rate cut talk is powering stocks higher, and in turn, high-end consumer confidence and spending. In addition, high-end consumers still have excess savings, supporting consumer spending. House prices are still near record highs, another wealth effect multiplier that supports spending.

And yet, low-end consumers confront a different reality, explaining their recession-like sentiment.

Facing tight budgets, low-end real purchasing power is being smothered by cumulative inflation stacking from the last three years.

Low-end consumers are facing sticky and high prices which has exhausted savings.

The widening spending power disparity highlights an increasingly fragmented economic backdrop.

Source: Piper Sandler

Expensive valuations

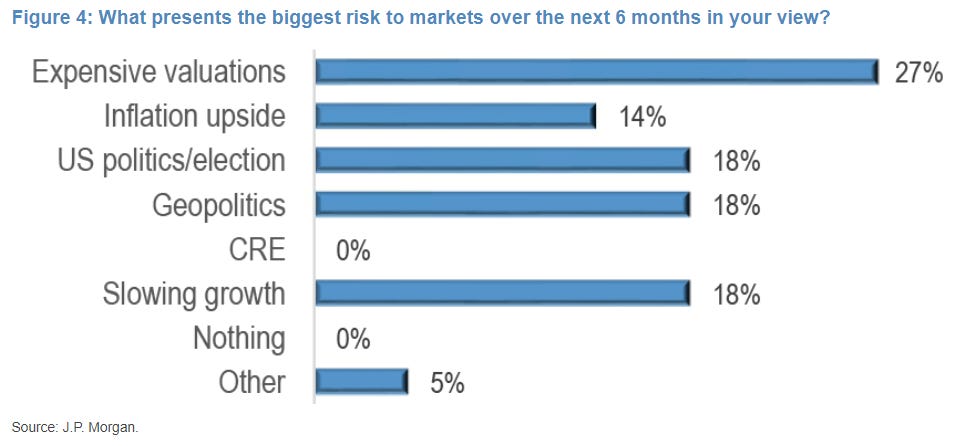

Last week, J.P. Morgan’s poll of its institutional clients showed that elevated valuations are the biggest perceived risk to markets over the next 6 months.

The bulk of the equity performance so far this year, and the past 18 months, has been driven by multiple expansion.

Globally, 12-month forward earnings are up only 7% from the lows, in contrast to a 28% P/E upmove.

The current U.S. forward P/E multiple of 21.4x is up 6% year-to-date, up 20% since October 2023, and up 30% from the October 2022 lows.

Source: J.P. Morgan Markets

The ever-changing makeup of the S&P 500 index

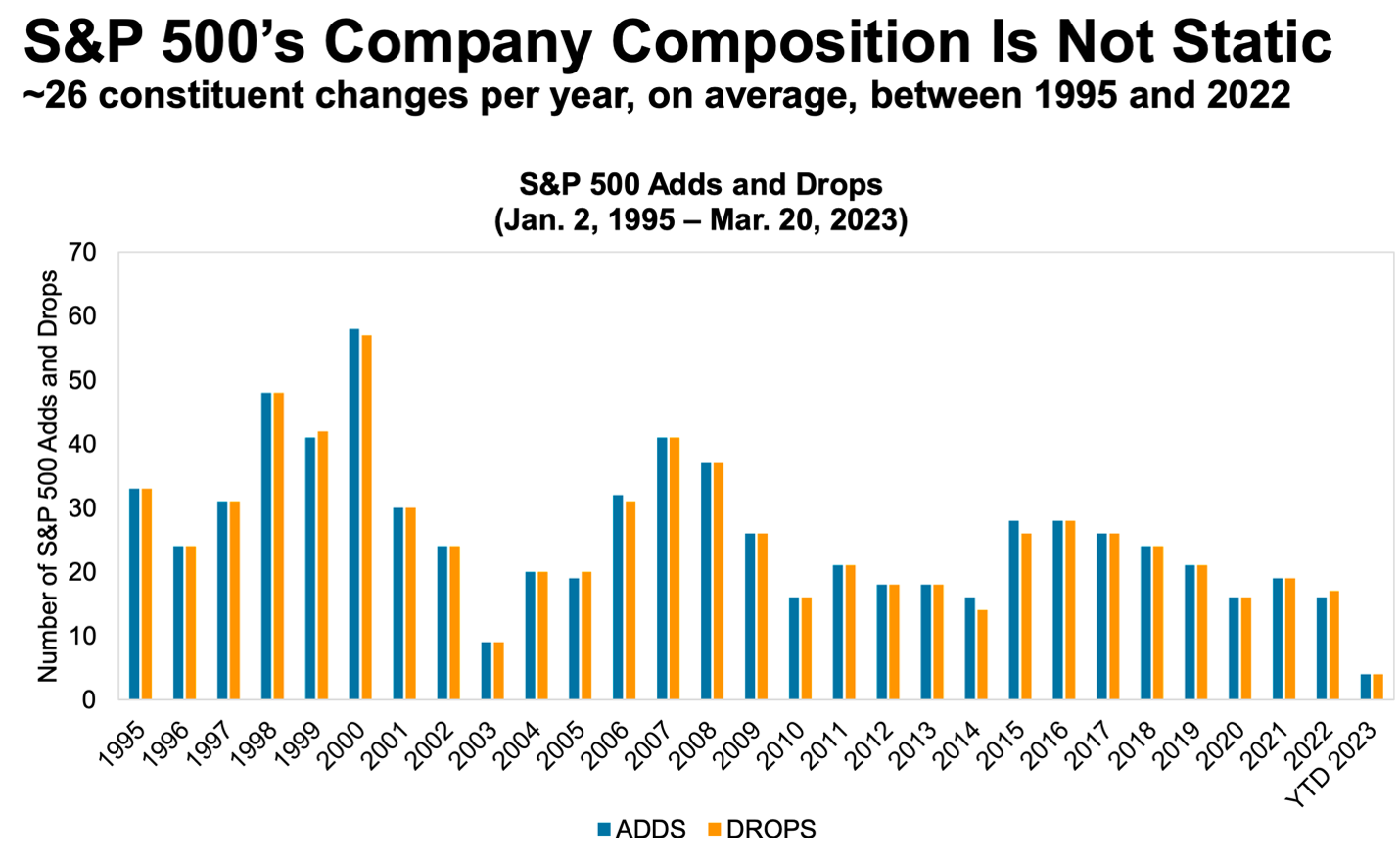

Many investors are often advised to allocated capital towards an S&P 500 index fund due to its historical performance, low cost, and ease of implementation. As we recently noted, active management is difficult and most professional money managers fail to beat their benchmarks.

This passive investing approach generally means buying and holding securities for the long-term, with only minor adjustments along the way.

And yet, buying the S&P 500 index does not mean we are purchasing a static basket of 500 stocks. In fact, it’s quite the contrary. See below.

The S&P 500 index may be the greatest momentum strategy available to us because the index offers exposure to the select few names driving the bulk of performance, while slowly replacing the weakest names with new up-and-coming rising stars over the years.

Source: Fundstrat

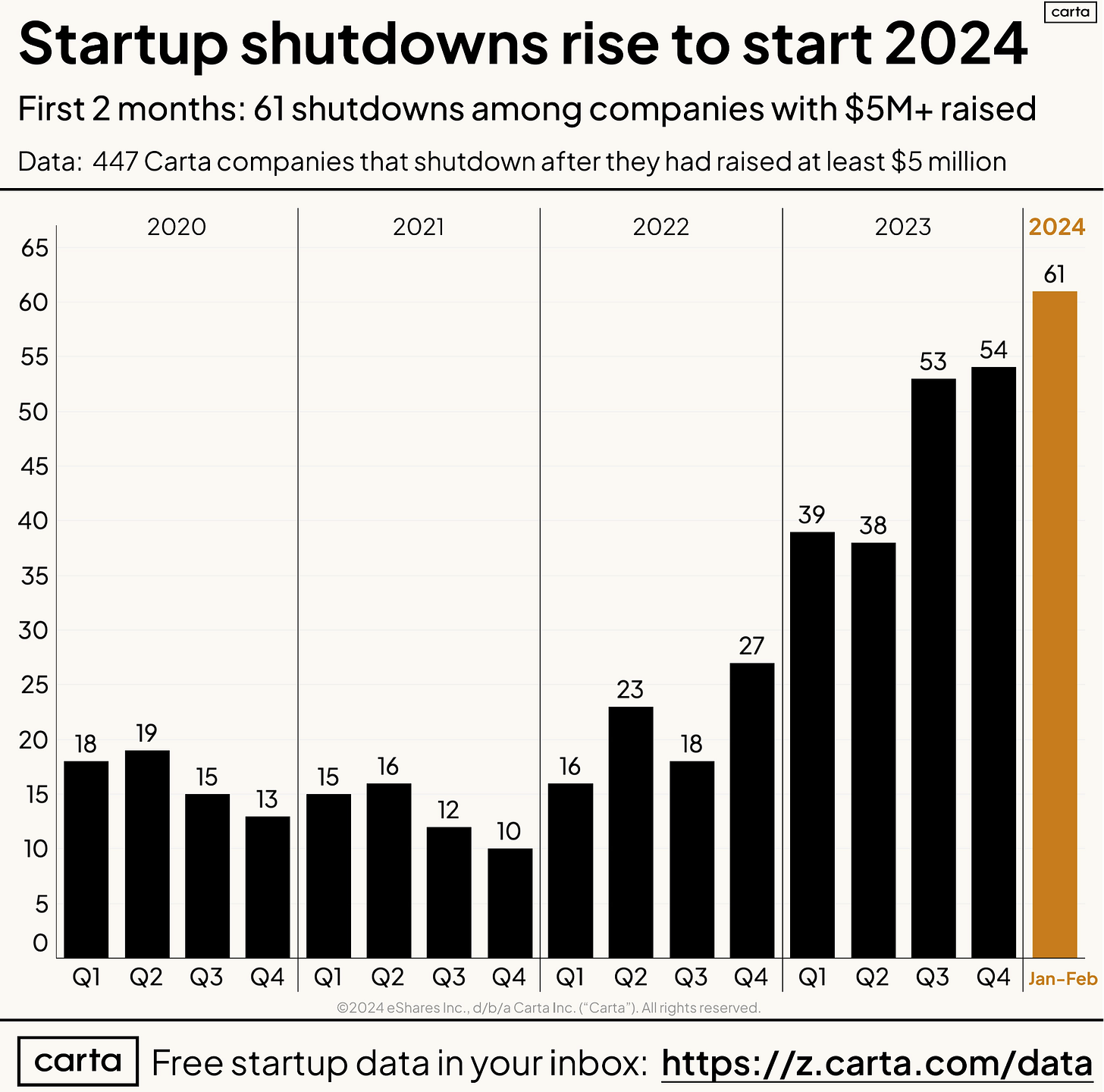

Startup shutdowns

The brutal reality facing many early-stage startups often means shutting down.

We’ve seen the IPO and M&A markets freeze over, with just a handful of exits preventing venture capitalists from redeploying capital into new projects. We’ve watching the decline in growth stage rounds as tourist money from hedge funds has disappeared. We’ve witnessed lower graduation rates from seed to series A and/or series B.

Fears of recession and higher costs of capital shift the attention of the C-Suite pendulum from silly workplace perks to a heightened focus on metrics, capital efficiency, and layoffs. And, at its worst, shutting the business down.

Source: Carta, crunchbase

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

So sorry for your loss Blake.

Dear Blake,

my heartfelt condolences.

I am terribly sad to hear about your loss and I truly wish you and your family all the best!

Thank you for everything you do and may you be blessed with all the warmth and light in this world!