Female labor force participation ⬆️, plus active management performance ⬇️ and a classic recession indicator ⁉️

The Sandbox Daily (3.13.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

female participation in labor force is soaring

active management is hard, really hard

classic recession indicator remains in place

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.30% | Dow +0.10% | S&P 500 -0.19% | Nasdaq 100 -0.83%

FIXED INCOME: Barclays Agg Bond -0.18% | High Yield +0.04% | 2yr UST 4.637% | 10yr UST 4.192%

COMMODITIES: Brent Crude +2.43% to $83.91/barrel. Gold +0.63% to $2,179.7/oz.

BITCOIN: +3.08% to $73,243

US DOLLAR INDEX: -0.14% to 102.817

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: -0.65% to 13.75

Quote of the day

“Maintain a margin of safety. If your life is designed only to handle the expected challenges, then it will fall apart as soon as something unexpected happens to you. Always be stronger than you need to be. Leave room for the unexpected.”

- James Clear, Atomic Habits

Female participation in labor force is soaring

In honor of International Women’s Day being celebrated last week on Friday, March 8th, highlighting the world’s female population and labor force and its impact on the economy, productivity, and markets seems timely.

2022 was tough year for working women. Female workers, which were disproportionately impacted by the pandemic, had seen participation plunge due to job losses and taking care of dependents. The concern was that this extended period out of the work force would stigmatize women and make it harder for them to return.

Wow, that could not be further from reality – which is fantastic.

The female participation in the labor force has soared all over the world. As shown in the chart below, the participation rate of prime age females (ages 25-54) is higher in almost every major developed economy compared to the pre-COVID 2019 level.

What’s more, the improvement among females has outpaced that of males in every economy but France.

A combination of the types of jobs in demand, higher levels of tertiary education among younger females compared to males, and increased work from home (which allows more flexibility for care of dependents) have all played a role in increasing participation.

In the United States, where employment trends by smaller age cohorts is more readily available, we’ve seen an enormous surge in participation among Millennial women compared to pre-pandemic.

In fact, the labor force participation rate for females ages 25-34 and 35-44 in 2023 was the highest since data began in 1948!

The rise in female participation bodes well for potential real GDP growth, and if sustained, could have positive implications for the economy and equities in the long-term.

Source: Ned Davis Research

Active management is hard, really hard

2023’s installment of the Morningstar Active/Passive Barometer, a semiannual report that measures the performance of U.S. active funds against passive peers in their respective Morningstar Categories, continues to show more of what we already know: outperforming benchmarks is extremely difficult and it’s even more challenging to persistently deliver the goods year in and year out.

Over any 1-year time frame, portfolio managers can outperform for any variety of reasons.

However – over 5-, 10-, and 20-yr time frames – the numbers speak for themselves. The odds of continued outperformance over many years are long.

Source: Morningstar

Classic recession indicator remains in place

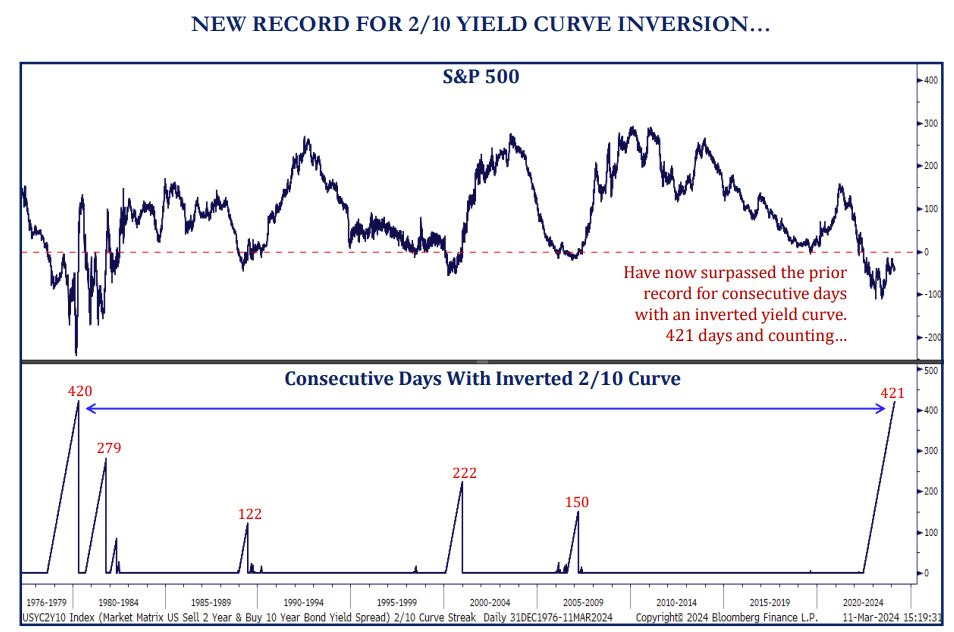

Several indicators get highlighted in financial media for which the market closely watches to gauge the risk of recession. The signal from an inverted yield curve – meaning short-term borrowing rates are above long-term lending rates – is one to which many investors assign great value.

The 2-year/10-year U.S. Treasury yield curve has now been inverted for 423* consecutive trading days, the longest streak ever and ahead of the 1978-1980 inversion.

This false signal from the bond market continues to break people’s brains.

It also cautions us to use history as a guide, or reference point, not as gospel to be followed blindly.

In fact, a recent Reuters poll of bond market experts showed that nearly two-thirds of strategists said the yield curve's predictive power is not what it once was.

For more information as to how/why this is happening, I’d encourage you to review past commentaries we’ve provided here (strong consumer), here (mortgages), here (resilient labor market), and here (outstanding debt composition).

* Chart is dated as of March 11 (421 days), so add 2 more days for March 13 (423 days)

Source: Strategas Research Partners, Reuters

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

👏💗💗💗