The great (summer) rotation, plus $35 trillion in debt and market breadth improvement

The Sandbox Daily (7.29.2024)

Welcome, Sandbox friends.

Apple released the 1st software preview of its long-awaited Apple Intelligence, the Dow Jones Industrial Average crossed the unchanged line 193 times in today’s session (traders uncertain about FOMC meeting Wednesday and July employment report due Friday), and results from Microsoft (Tue), Meta Platforms (Wed), Apple (Thu), and Amazon (Thu) will be crucial after an underwhelming start of the mega-cap reporting season.

Today’s Daily discusses:

the summer rotation

$35 trillion and counting !

breadth improvement

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.19% | S&P 500 +0.08% | Dow -0.12% | Russell 2000 -1.09%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield -0.09% | 2yr UST 4.398% | 10yr UST 4.171%

COMMODITIES: Brent Crude -1.61% to $79.82/barrel. Gold +0.02% to $2,428.1/oz.

BITCOIN: -2.04% to $66,819

US DOLLAR INDEX: +0.25% to 104.577

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: +1.28% to 16.60

Quote of the day

“It may take some hard work. But the more you say no to the things that don’t matter, the more you can say yes to the things that do.”

- Ryan Holiday, The Daily Stoic

The summer rotation

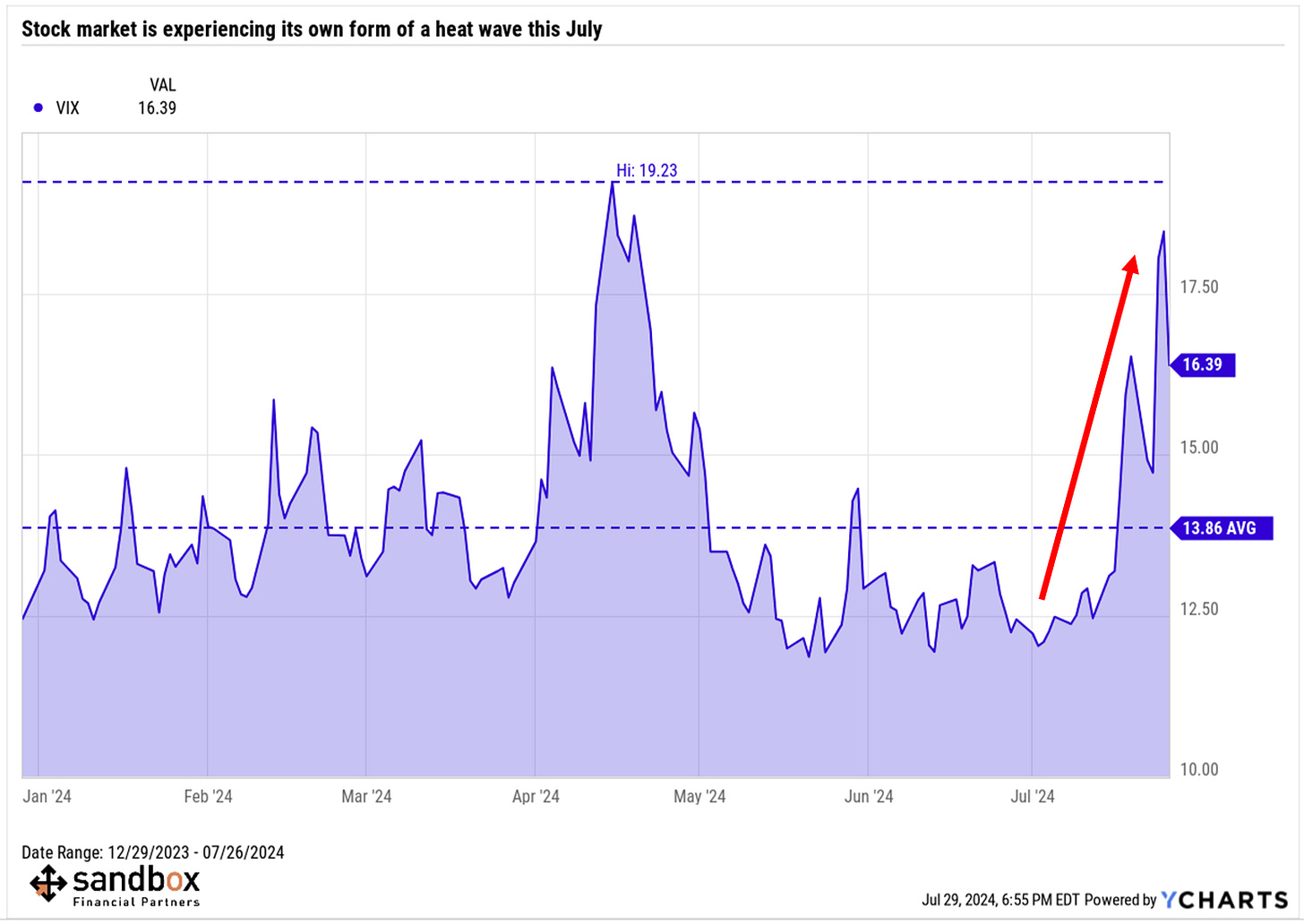

As the summer heats up, the stock market is experiencing its own heat wave in the form of rising volatility.

Market uncertainty has climbed as investors rotate out of mega-cap technology stocks and into a broader array of sectors, sizes and styles, including small-caps.

Since their respective peaks in mid-July, the Nasdaq Composite Index has declined 6% and the S&P 500 is down about 3.5%. The Magnificent 7 shed ~$1.5 trillion in mid-July. Meanwhile, the Russell 2000 index of small-cap stocks has jumped 11% over the same time period.

Stock market swings are never pleasant, and it’s difficult to know whether they are the result of short-term shifts or long-term trends.

The U.S. presidential election is fast approaching and investors have many questions about what this might mean for economic policy and their portfolios. Geopolitical tensions are flaring as well, especially in the Middle East.

At the same time, corporate earnings are healthy, consumer spending is resilient, and GDP growth remains robust.

Through all this, the Fed is expected to begin cutting interest rates as soon as September, as the market is finally getting the rate cuts it so badly desired back in early January.

While it’s important to not overreact to market movements over a few days or weeks, it’s clear that investors are beginning to look for other opportunities beyond the artificial intelligence stocks. The Magnificent 7 stocks, for instance, have experienced a historic bull run of nearly 170% since the beginning of 2023, far outpacing broader market indices. By definition, market runs can’t last forever, so it was inevitable that a pullback would eventually occur – the hard part is knowing exactly when.

There are also growing questions around the billions of dollars large companies are investing in AI and whether there will be a sufficient return on these investments. This speaks to the fact that not all good ideas make for good investments, since the latter depend on paying a reasonable price.

Additionally, small-caps have performed well because they tend to be more sensitive to interest rates and economic growth. This is because smaller companies tend to have less flexible financing options than large- or mega-cap ones, and thus benefit more when rates decline. They also tend to be less globally diversified, and thus more sensitive to domestic growth trends which recent data confirm are still quite healthy.

This has resulted in a rotation rather than a broad rally. Still, there are reasons to be optimistic for the overall market.

In the long run, bull markets are driven by earnings growth, and corporate earnings among large companies have been quite strong. According to FactSet, with 41% of companies having reported results this earnings season, 78% have exceeded expectations, resulting in a projected S&P 500 earnings growth rate of 9.8%. Not only is this historically strong and in-line with the 20-year recent average, but it also represents a continuation of the earnings recovery that began one year ago.

Rotation is the lifeblood of a bull market and this time is no different.

Rather than overreacting to these recent market gyrations, investors should instead maintain a long-term perspective and focus on their strategic asset allocations.

Source: Clearnomics, FactSet, Bloomberg, Barron’s, Goldman Sachs

$35 trillion and counting !

The U.S. national debt is climbing at a rapid pace and has shown no signs of slowing down, despite the growing public criticism of massive levels of deficit spending.

The national debt – which measures what the U.S. government owes its creditors – rose above $35,000,000,000,000 as of Monday afternoon, according to the latest numbers published by the Treasury Department.

Since the pandemic, the United States has added ~$11T in federal debt.

The outlook for the federal debt level is bleak, with economists increasingly sounding the alarm over the torrid pace of spending by Congress and the White House.

Interest payments on the debt for the government's fiscal year, which begins in October, now exceed the costs of Medicare and the defense budget.

Source: Charlie Bilello

Breadth improvement

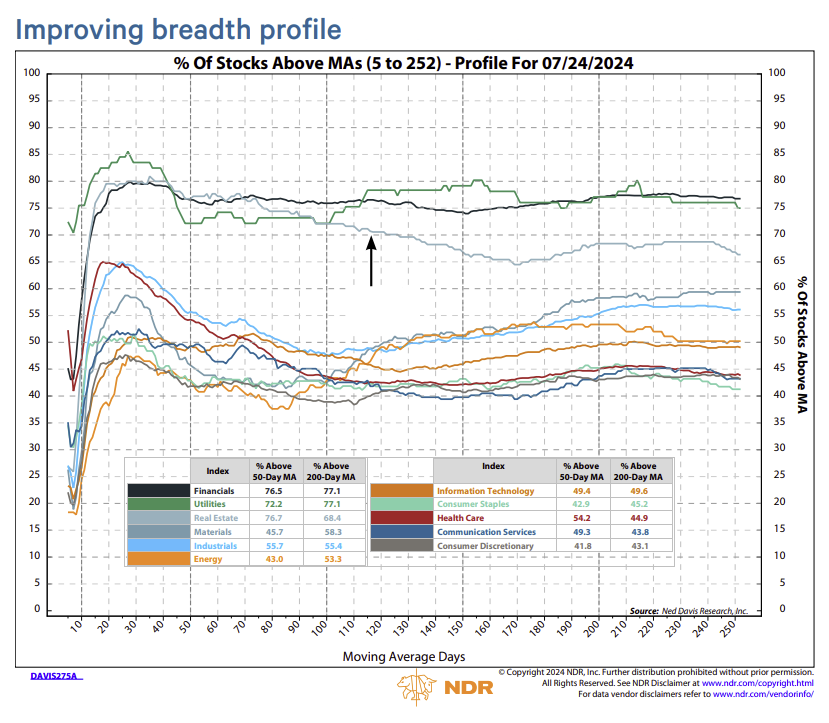

Back at the halfway point of 2024 – just 4 short weeks ago – we noted how few stocks were beating the market.

At the time, just 25% of index constituents were beating the S&P 500 itself.

Today? We’re up to 36%.

The much-needed breadth improvement has seen new sector leadership in the form of Financials, Utilities, and Real Estate in July.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

This was great today, Blake. Thank you

Great write up! Everyone is talking about the Great Rotation into small caps. I think it was a good move for small caps and forward returns will be good. I still think it's going to be a short lived outperformance though, and it will remain difficult to beat large caps over the longer term.