The market doesn’t care about your government shutdown headlines

The Sandbox Daily (9.3.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the market’s resilience to Washington gridlock

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.79% | S&P 500 +0.51% | Dow -0.05% | Russell 2000 -0.09%

FIXED INCOME: Barclays Agg Bond +0.36% | High Yield +0.27% | 2yr UST 3.619% | 10yr UST 4.223%

COMMODITIES: Brent Crude -2.31% to $67.55/barrel. Gold +0.74% to $3,618.8/oz.

BITCOIN: +1.22% to $112,159

US DOLLAR INDEX: -0.21% to 98.186

CBOE TOTAL PUT/CALL RATIO: 0.93

VIX: -4.78% to 16.35

Quote of the day

“The trouble is, you think you have time.”

- Jack Kornfield

Shutdown risks are more noise than signal

With less than two months until the end of the United States government fiscal year, concerns about a government shutdown this fall could add to market noise and volatility.

Historically, the economic impact of a shutdown has been marginal and temporary. Even if headlines grow louder, investors should remember the stock market has generally proven resilient through these short-lived funding gaps.

Odds of a shutdown are low but lurk nonetheless

Government funding expires on September 30, and Congress has yet to resolve the issue. Lawmakers returning from the August recess have just four weeks to finalize spending legislation or extend the deadline.

Political tensions remain high, not just between Republicans and Democrats but also within the parties themselves.

Democrats, frustrated by the passage of the One Big Beautiful Bill Act (OBBBA), may resist cutting a deal and push for a shutdown this fall, while Republican divisions have slowed the legislative process and stalled new bills.

Given how the year has unfolded, it’s unclear if a compromise will emerge in time.

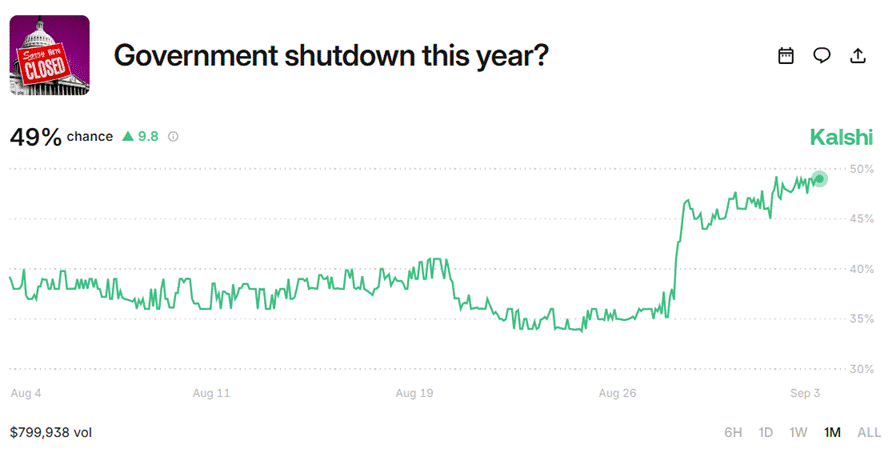

Per the betting market Kalshi, the current odds of a shutdown are roughly 50-50, although the probability has increased recently as the deadline comes to the forefront.

Economic impacts are marginal, temporary

Shutdowns tend to generate a lot of headlines, but their economic impact is small.

About three-quarters of federal spending is mandatory and continues uninterrupted. Key entitlement programs – which include Social Security, Medicare, and Medicaid – don’t require annual appropriations, so spending remains steady.

Meanwhile, the labor impact is also narrower than headlines suggest.

Federal workers comprise less than 2% of the U.S. workforce. During a government shutdown, some are furloughed while others deemed “essential” keep working – but both groups typically receive back pay when the government reopens.

That helps limit household strain and keeps the economic hit brief.

The Congressional Budget Office (CBO), which tends to overestimate in their public reporting, projected the 2018-19 shutdown reduced real GDP by only $3 billion in 4Q18 and $8 billion in 1Q19, essentially rounding errors.

Markets have been largely unfazed

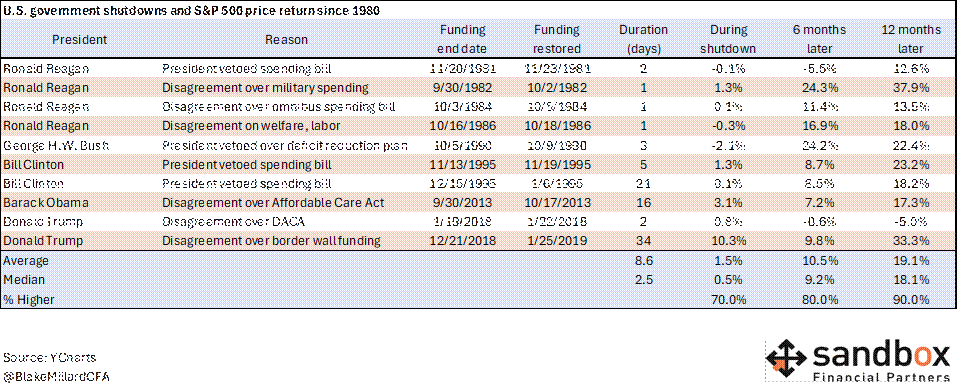

Stocks have historically shrugged off shutdowns, particularly when debt-ceiling risks weren’t involved.

Across the ten government shutdowns since 1980, the S&P 500 has shown little reaction during the events themselves.

Returns were generally strong in the 6- and 12-month periods afterward, with the lone exception being 2018 – when that year’s market decline was driven by slowing growth and earnings concerns, not the shutdown event itself.

Bottom line?

Congress may stall, but the economy and markets will not. As usual, investors should stay on target.

Sources: YCharts, Kalshi

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)