🍾🎉 This bull market turns two ! 🎉🍾, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (10.11.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

🍾🎉 Bull market turns two ! 🎉🍾

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +2.10% | Dow +0.97% | S&P 500 +0.61% | Nasdaq 100 +0.15%

FIXED INCOME: Barclays Agg Bond +0.03% | High Yield +0.26% | 2yr UST 3.953% | 10yr UST 4.096%

COMMODITIES: Brent Crude -0.79% to $78.79/barrel. Gold +1.32% to $2,674.2/oz.

BITCOIN: +3.15% to $62,516

US DOLLAR INDEX: -0.07% to 102.915

CBOE EQUITY PUT/CALL RATIO: 0.44

VIX: -2.25% to 20.46

Quote of the day

“There is nothing permanent except change.”

- Heraclitus

🍾🎉 Bull market turns two ! 🎉🍾

“These results are consistent with a soft landing,” voiced Chief Financial Officer (CFO) Jeremy Barnum on J.P. Morgan’s conference call Friday morning following the venerable bank’s earnings release.

Wow! Those comments are a far cry from the bank’s position back in June 2022 when Chief Executive Officer (CEO) Jamie Dimon told everyone to “brace yourself” for an economic “hurricane.”

The Dow Jones Industrial Average and S&P 500 indexes both notched new all-time highs on Friday – with the former approaching 43,000 and the latter closing above 5,800 for the first time – as the large U.S. banks kicked off earnings season.

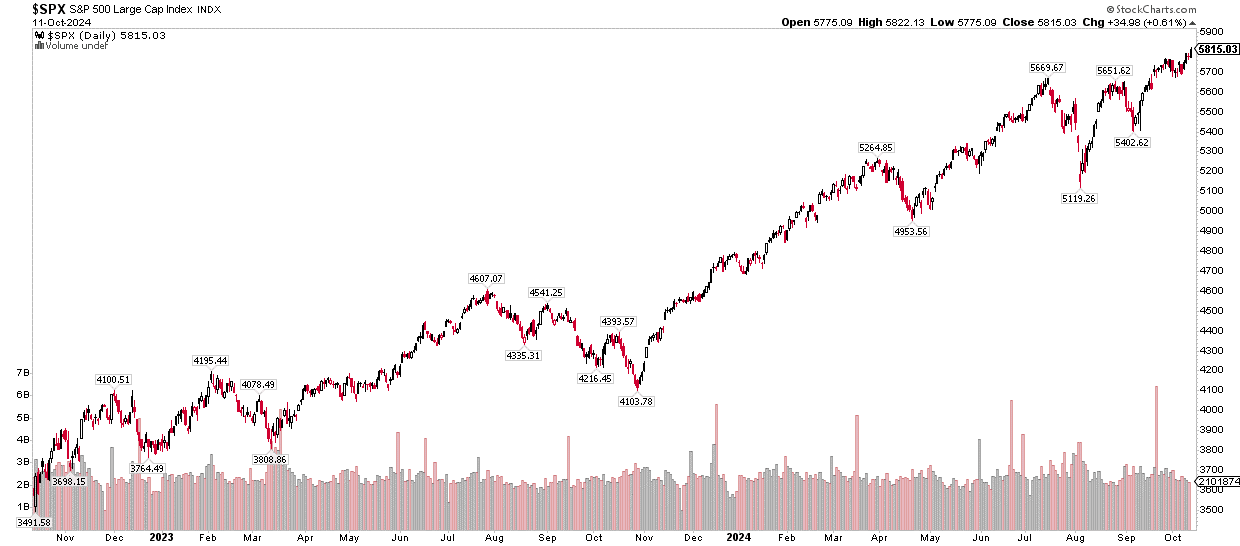

On October 12, 2022, the S&P 500 bottomed at 3577 on a closing basis; technically, the actual bottom arrived the next day on October 13 when we received the September inflation read which sent the S&P 500 reeling to its ultimate cycle low of 3491.

Fast forward two years, the S&P 500 sits at 5815 – good for 2324 points of gains, or a cumulative price return of 66.5% !!!

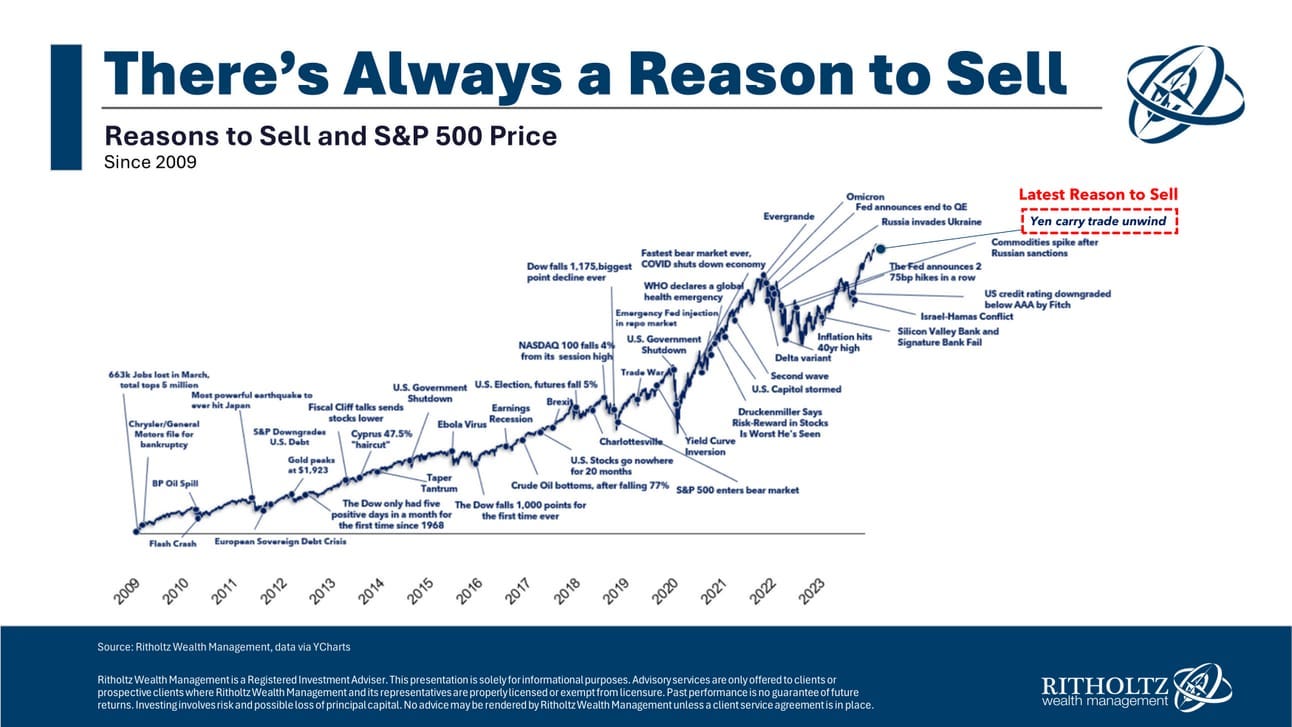

Over the last two years, countless economists, investment strategists, and tv pundits have told us every reason why we should sell:

inflation

economic recession

M2 money supply

the Conference Board’s Leading Economic Indicators (LEI)

the oil shock

inverted yield curves

regional bank contagion

Japanese yen carry trade

geopolitical tensions

the Middle East

rising fiscal deficits

AI and the robots coming for our jobs

etc etc

The meteoric rise in interest rates was enough on its own, right?

Sure, in the moment, each of those risks may have been a valid reason to pause, or worse, sell to cash.

In fact, there is always a reason to sell. We can draw up a new list each year.

And yet, the market climbed the wall of worry – just like it always has.

One thing investors often forget is the stock market is a discounting mechanism – a purveyor of what’s to come – pricing in these events so you don’t have to.

It serves an important reminder of why focusing on your goals, your portfolio, your specific risk capacity and tolerance, and your time horizon is much more meaningful than any of these standalone events and risks.

And you want some more good news?

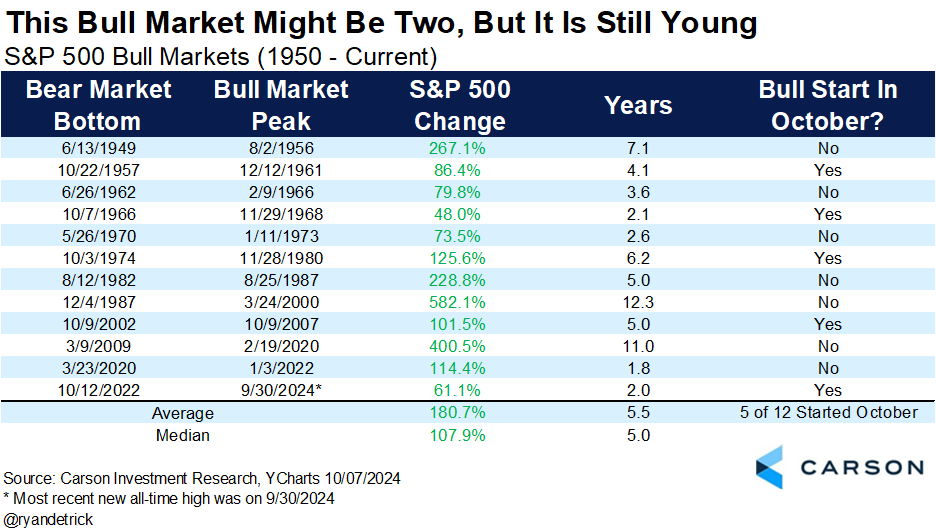

This bull market is young.

As Ryan Detrick shows below, “a two-year bull market historically has plenty of life left, with the average bull market since 1950 lasting more than five years and gaining more than 180%.

How we react to stock market pullbacks and omnipresent risks is perhaps more important than the market moves themselves.

The uncertainty experienced by investors over the post-pandemic cycle is a reminder to always stay focused on the long run and working toward our financial goals.

Source: Wall Street Journal, CNBC, Mike Zaccardi, Opening Bell Daily, Michael Batnick, Ryan Detrick

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Connecting Spirit, Mind, Body, and Money – Shedding Leaves (Justin Castelli)

All Star Charts – I Love It When They're Uninvestable (Steve Strazza)

The Pomp Letter – Tesla (Anthony Pompliano)

OptimistiCallie – Running the Numbers (Callie Cox)

Net Interest – The Changing Face of Finance (Marc Rubinstein)

Advisor Perspectives – The 50 Percent Rule (Allan Roth)

Podcasts

The Meb Faber Show – Brad Gerstner on AI Supercycle, Invest America, and Stock Compensation (Spotify, Apple Podcasts, YouTube)

Up and Vanished – The Disappearance of Tara Grinstead (Podcast Website, Spotify, Apple Podcasts)

Movies/Series

Monsters: The Lyle and Erik Menendez Story – Javier Bardem, Chloë Sevigny, Cooper Koch, Nicholas Alexander Chavez (Netflix, IMDB, YouTube)

Music

Diplo & HUGEL – Forever (Spotify, Apple Music)

Lupe Fiasco feat. John Legend – Never Forget You (Spotify, Apple Music)

Books

Anthony Pompliano – How To Live an Extraordinary Life (Amazon)

Pop Culture

SatPost – How does Michelin Guide’s business work? (Trung Phan)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: