Treasury market volatility forces Trump's hand on tariff reprieve 💪

The Sandbox Daily (4.9.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Treasury markets seize up on volatility, tariffs

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +12.02% | S&P 500 +9.52% | Russell 2000 +8.66% | Dow +7.87%

FIXED INCOME: Barclays Agg Bond +0.23% | High Yield +2.68% | 2yr UST 3.916% | 10yr UST 4.321%

COMMODITIES: Brent Crude +4.74% to $65.80/barrel. Gold +3.76% to $3,102.6/oz.

BITCOIN: +8.87% to $82,814

US DOLLAR INDEX: +0.08% to 103.053

CBOE TOTAL PUT/CALL RATIO: 1.23

VIX: -35.75% to 33.62

Quote of the day

“The greatest trick the devil ever pulled was convincing investors that volatility and risk were the same thing.”

- Unknown

Credit markets seize up on volatility, tariffs

Wall Street’s dramatic turnaround rally on Wednesday’s announcement of a 90-day tariff pause demonstrates why investors must stay the course even when it’s most difficult to do so. Missing days like today – the 10 best days rule – explains the behavior gap, or the difference between stated returns and an individual investor’s return.

In recent days, the market seemed to have lost any glimmer of hope in the face of tremendous losses. The 10% baseline tariff and the country-specific retaliatory tariffs that President Trump announced on Massacre Day Liberation Day has weighed heavily on markets.

Moving headlines over the past 24 hours?

Bond market volatility, specifically small fractures for the traditionally sleepy $30 trillion dollar Treasury market.

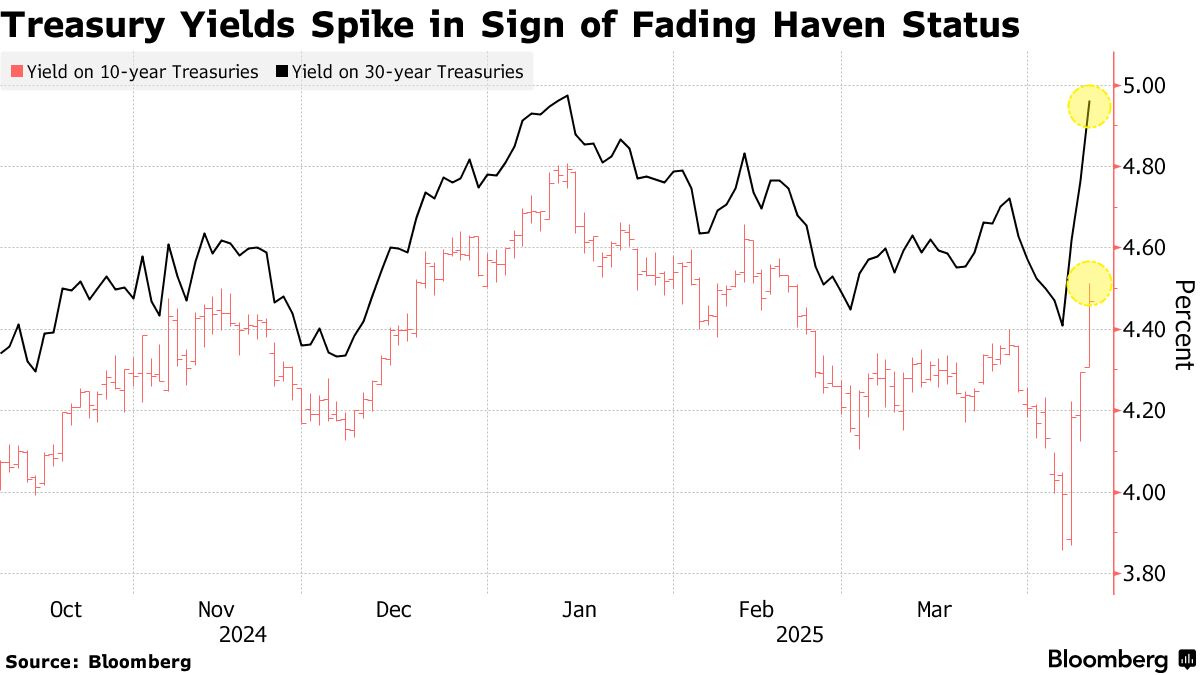

While stocks were suffering a waterfall decline over the past week, 10- and 30-year Treasury yields were not down but up – an unusual outcome because typically we should see a flight to quality from stocks into bonds that drives yields lower.

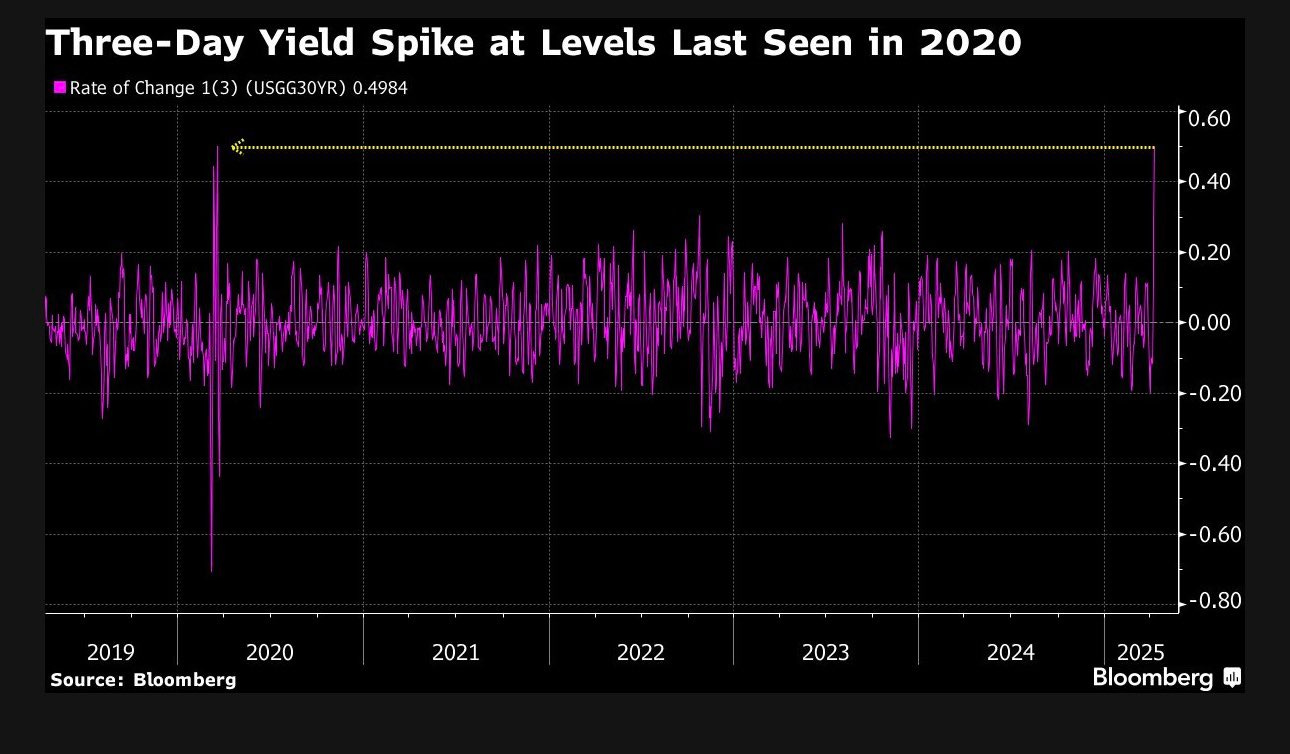

The yield on 30-year Treasuries surged as much as 25 basis points to a level unseen since November 2023, bringing the three-day rise in yields at one point to the largest since 2020.

“This is a fire sale of Treasuries,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors. “I haven’t seen moves or volatility of this size since the chaos of the pandemic in 2020.”

Markets have been reacting to some of the worst case scenarios – namely a protracted trade war with no immediate end date, leading to higher prices and weaker growth.

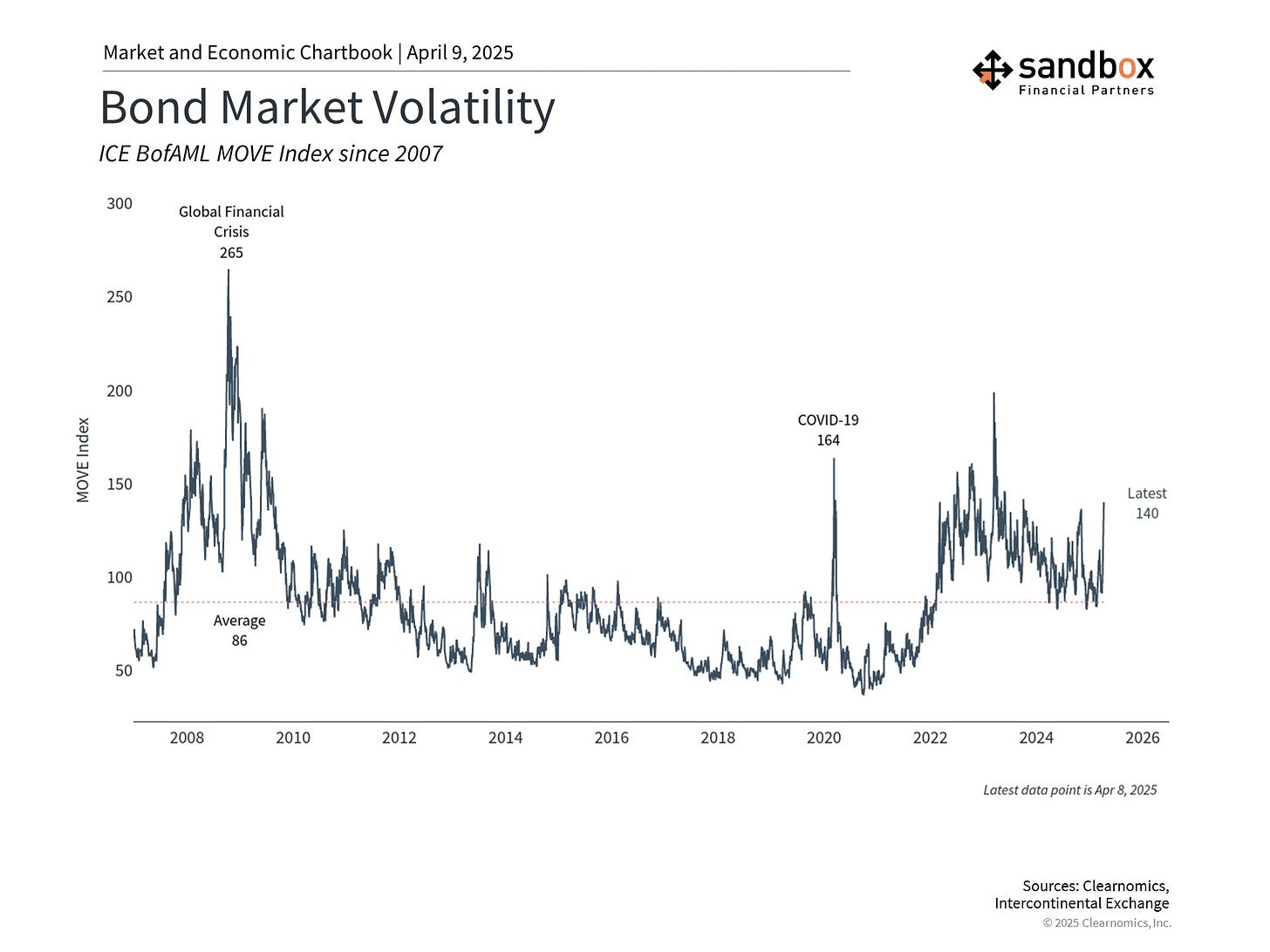

According to recent data, the MOVE Index (a measure of bond market volatility) was moving higher and well above its historical average, indicating uncertainty in bond markets.

This Trump administration, full of former Wall Street veterans, understands protecting the credit markets is paramount in the face of rising systemic risks.

A pressure cocktail on U.S. government bonds from several angles led to early tremors of dislocation in the world’s safest asset, which according to certain narratives forced Trump’s hand toward the 90-day tariff reprieve.

A popular hedge fund trade, the “basis trade” which exploits gaps between cash Treasury prices and futures – was unwinding where leveraged sellers were being forced to liquidate and take any bid available.

Some countries, such as China and Japan, were dumping portions of their Treasury reserves in retaliation of Trump’s reciprocal tariffs as one measure of the broader trade war.

Broader market pressure led to institutional money degrossing their portfolios in a dash-for-cash panic.

Bonds are valuable in any portfolio because historically they’ve 1) provided stability, 2) typically moved in the opposite direction to stocks, and 3) kick off predictable cash flows in the form of income.

Instead, over the past few days, the swing in bond prices reflected the growing uncertainty in financial markets and the potential for a disruption in the most important asset across the globe.

Remember that market volatility is a normal part of investing and has historically stabilized once clarity arises.

While current trade tensions are concerning, history suggests that financial markets are remarkably resilient to geopolitics, and maintaining a diversified, long-term investment approach remains the best strategy for navigating these complex global economic relationships.

Sources: Clearnomics, Bloomberg

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: