U.S. trade deficit narrows sharply (and the important lesson for investors)

The Sandbox Daily (6.5.2025)

Welcome, Sandbox friends.

We are off tomorrow for a summer lacrosse tournament in Ocean City and the dreaded mid-Atlantic humidity, so The Sandbox Daily will return to your inbox on Monday, June 9th with our regularly scheduled programming.

Today’s Daily discusses:

U.S. trade deficit narrows sharply

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 -0.05% | Dow -0.25% | S&P 500 -0.53% | Nasdaq 100 -0.80%

FIXED INCOME: Barclays Agg Bond -0.26% | High Yield -0.21% | 2yr UST 3.922% | 10yr UST 4.395%

COMMODITIES: Brent Crude +0.53% to $65.23/barrel. Gold -0.61% to $3,378.5/oz.

BITCOIN: -3.63% to $101,060

US DOLLAR INDEX: -0.05% to 98.741

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +4.94% to 18.48

Quote of the day

“The greatest danger for most of us is not that our aim is too high and we miss it, but that it is too low and we reach it.”

- Michelangelo

U.S. trade deficit narrows sharply

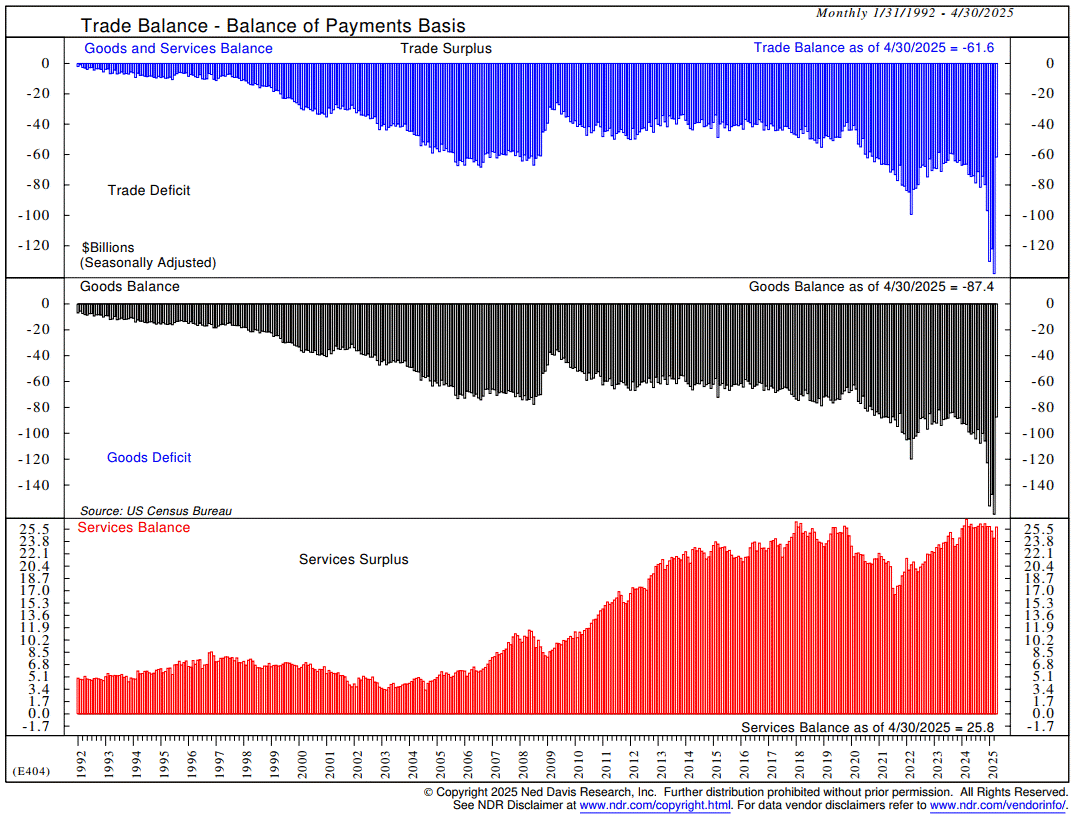

The U.S. trade deficit shrank by the most on record in April on the heels of the largest-ever plunge in imports.

The trade gap in goods and services fell 55% from March to $61.6B, indicating a sudden and total collapse to the front-loading of imports ahead of tariffs in the first few months of this year.

Imports plunged 16.3%, a record drop, while exports picked up 3.0%.

Net Exports (how much the U.S. sends out minus how much the U.S. brings in) was the biggest drag on GDP growth in Q1, the primary contributor to a negative print last quarter.

The narrowing of the trade deficit should flip that drag into a major positive contribution to GDP growth in Q2.

And yet, the biggest takeaway from this Commerce Department report had nothing to do with the data itself.

Therein lies the important lesson for investors at home.

Market data is often highly volatile and subject to short-term noise – seasonal quirks, one-off events, or data revisions – that can muddle the underlying trend where the true information resides.

The same is true with stock prices.

That’s why the best investors focus on trends, more specifically changes in the trend, and implement moving averages to paint clearer pictures.

These simple tools help smooth out any aberration that isn’t statistically significant, providing more reliable and effective signals to take action.

Reacting to a single data point without that context risks mistaking temporary fluctuations for meaningful shifts.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)