Bottom of the 9th for the 2024 election (do NOT be a Karen)

The Sandbox Daily (10.28.2024)

Welcome, Sandbox friends.

This is going to be a very busy week, so buckle up.

Earnings season will shift into top gear, with five of the Magnificent Seven companies reporting their earnings this week: Alphabet, Microsoft, Meta Platforms, Amazon, and Apple.

Meanwhile, this week’s economic calendar is also filled with a number of key releases that will help shape the thinking of investors and Fed policymakers, alike. First up is the Job Openings and Labor Turnover Survey (JOLTS) for a read on the job market. Then we see the advance estimate of U.S. Q3 GDP on Wednesday, followed by a reading on the Federal Reserve's favored inflation gauge – the Personal Consumption Expenditures (PCE) price index – on Thursday. Finally, the October jobs report rounds out the blistering week on Friday.

Those key reports and indicators will come ahead of a pivotal first week of November, which will see the culmination of the 2024 presidential election and the Federal Reserve’s second penultimate monetary policy committee meeting of the year.

Today’s Daily discusses:

bottom of the 9th for the 2024 election (don’t be a Karen)

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.63% | Dow +0.65% | S&P 500 +0.27% | Nasdaq 100 0.00%

FIXED INCOME: Barclays Agg Bond -0.16% | High Yield +0.25% | 2yr UST 4.133% | 10yr UST 4.278%

COMMODITIES: Brent Crude -5.36% to $71.97/barrel. Gold +0.02% to $2,755.3/oz.

BITCOIN: +2.76% to $69,907

US DOLLAR INDEX: +0.03% to 104.284

CBOE EQUITY PUT/CALL RATIO: 0.51

VIX: -2.61% to 19.80

Quote of the day

“Change captures our attention because it’s surprising and exciting. But the behaviors that never change are history’s most powerful lessons, because they preview what to expect in the future. Your future. Everyone’s future. No matter who you are, where you’re from, how old you are, or how much money you make, there are timeless lessons from human behavior that are some of the most important things you can ever learn.”

- Morgan Housel in Same as Ever: A Guide to What Never Changes

Bottom of the 9th

With just a week to go until the presidential election on November 5, national media polls suggest it will be a close race between former President Donald Trump and Vice President Kamala Harris, while betting markets (Polymarket, PredictIt, Kalshi) strongly favor Trump.

Both candidates are campaigning hard in swing states, and investors are worried about how either outcome might affect their portfolios.

Given the intense political divisions in recent years, it’s not surprising that emotions surrounding this election are running hot. Like, red hot.

And that’s not hyperbole; I nearly fell out of my chair while reading America is Having a Panic Attack Over the Election in the Journal this morning:

In this environment, it’s important for investors to prevent politics from derailing their long-term financial plans.

The election matters for many reasons, but its long-term impact on the stock market and economy is often overestimated. The economy has grown under Democrats and Republicans alike, and it’s important for investors to maintain perspective this election season.

The U.S. election is just one of many risks that lie ahead. The path of Fed policy remains uncertain. Geopolitical conflicts are worsening with possible implications for global stability, supply chains, and oil prices. The market multiple is on the higher side of history.

The reality, however, is that facing risks is unavoidable when it comes to investing and planning for the future. How investors choose to react to those risks is ultimately what determines investment and financial success.

Bespoke shared this chart several months ago showing $1,000 invested since 1953 under Republican leadership only, under Democratic leadership only (the blue bar is bigger than the red bar because we’ve had more Democratic presidents), and remaining invested irrespective of which party controls 1600 Pennsylvania Avenue.

Notice how the green bar is like the New York Yankees (27 World Series titles) or even the Los Angeles Dodgers (7 titles), while the blue and red bars resemble the Seattle Mariners. Don’t be the franchise that’s never won or even appeared in a World Series.

As citizens, voters, and taxpayers, the result of this election could have important implications for our everyday lives. However, putting political preferences aside, this is not necessarily true when it comes to your portfolio.

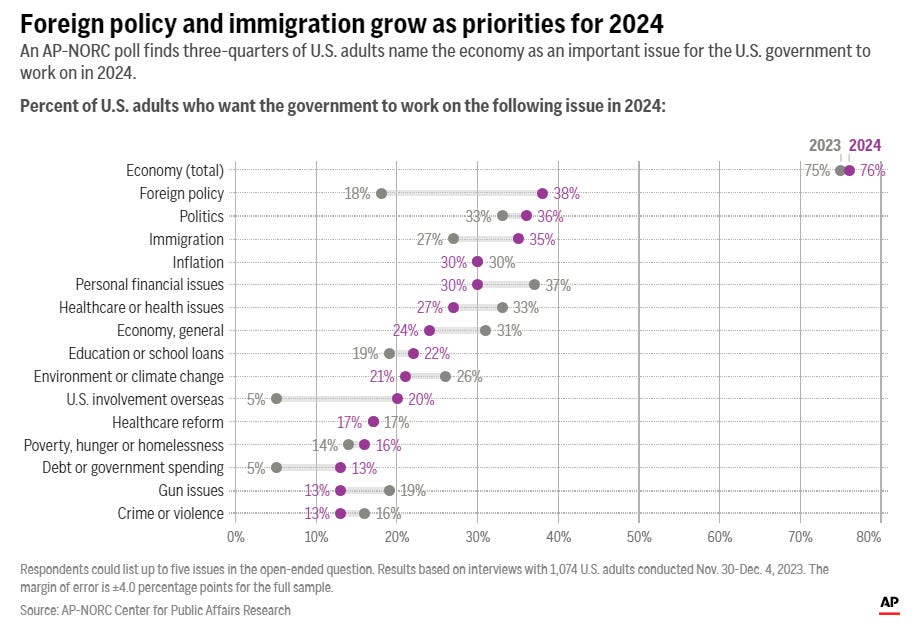

In fact, history shows that the economy and markets tend to impact the result of elections, and not the other way around. The economy is the singular top priority for the voting public in any election-year poll.

It’s important to remember we vote at the ballot box as our civic duty.

Do not conflate voting with investing.

Do not be a Karen.

Source: Wall Street Journal, Clearnomics, Bespoke Investment Group, All Star Charts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: