Fed cuts interest rates for the 1st time in 2025, citing "risk management"

The Sandbox Daily (9.17.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

“risk management” cut

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.57% | Russell 2000 +0.18% | S&P 500 -0.10% | Nasdaq 100 -0.21%

FIXED INCOME: Barclays Agg Bond -0.18% | High Yield -0.10% | 2yr UST 3.553% | 10yr UST 4.083%

COMMODITIES: Brent Crude -0.73% to $67.97/barrel. Gold -0.85% to $3,693.3/oz.

BITCOIN: -0.83% to $115,948

US DOLLAR INDEX: +0.44% to 97.071

CBOE TOTAL PUT/CALL RATIO: 0.78

VIX: -3.91% to 15.72

Quote of the day

“You will remain the same until the pain of remaining the same is greater than the pain of change.”

- Tony Robbins

“Risk management” cut

The famous investing principle "don't fight the Fed" was coined by Marty Zweig in 1970, and yet it, it’s only grown in significance.

The idea is simple: the Federal Reserve's monetary policy decisions can have outsized effects on the economy and markets, so investors should consider them carefully.

This is relevant today as the Fed continues its rate-cutting cycle amid a complex economic environment.

Fed meeting recap: the decision

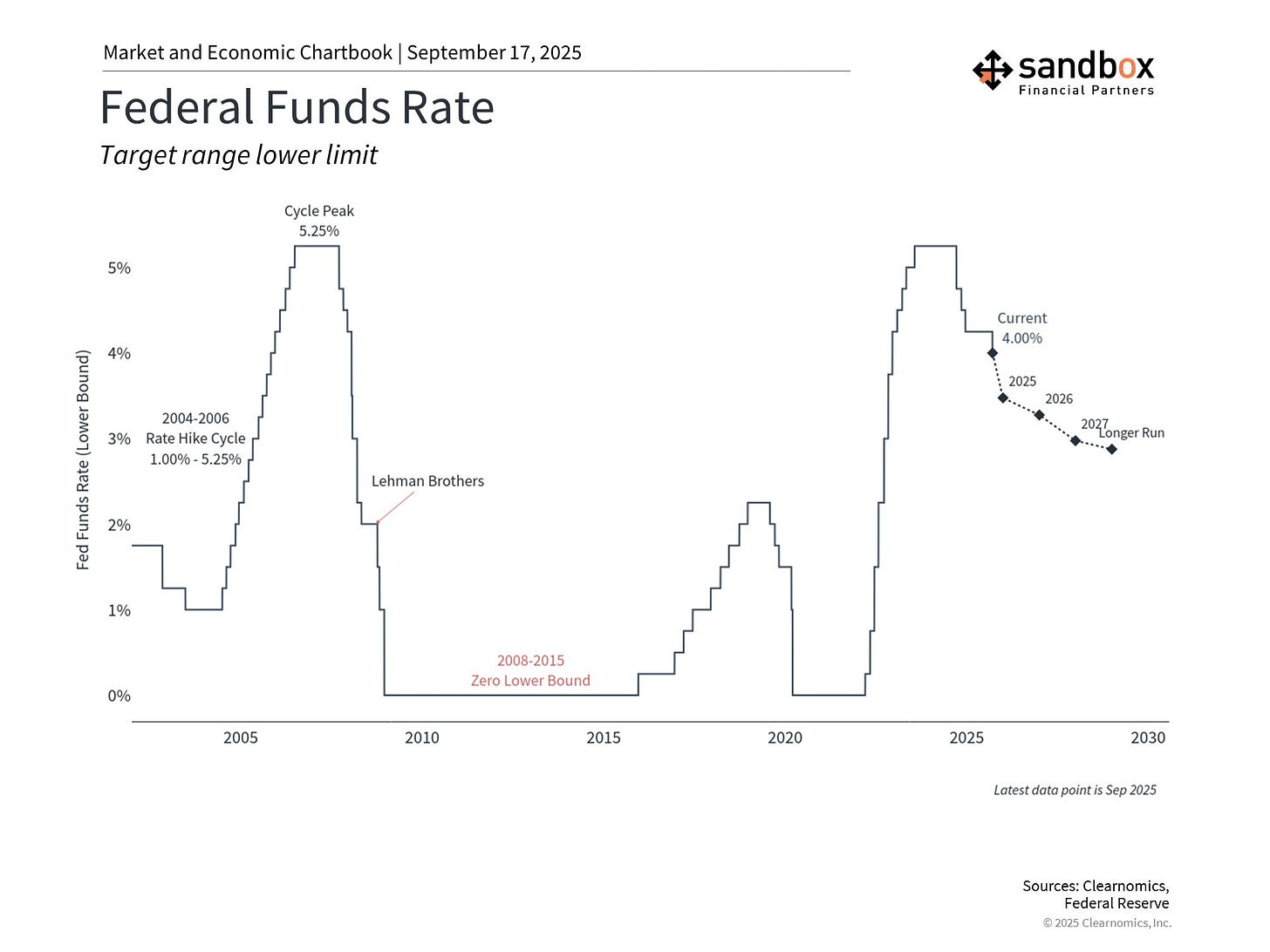

Today, the Fed cut its benchmark overnight lending rate by a quarter percentage point (0.25%), bringing its target range to 4.00% to 4.25% for the Fed Funds Rate. This is the first rate cut of 2025 after pausing in December 2024.

Of the 12 voting members of the Fed’s policymaking arm, there was just one dissenting vote: newly appointed Fed Governor Stephen Miran, who also serves as chair of the Council of Economic Advisers in the White House and remains a close ally to President Trump, favored a half-percentage point reduction (0.50%).

While the Fed’s move was widely expected, investors have been eager to get the official decision and then hear from Fed Chair Jerome Powell and see the dot plot.

The meeting comes at a time when the central bank is stuck between a rock and a hard place, given the recent uptick in inflation (not desirable) that’s coincided with a slowing job market (also not desirable).

In the statement alongside the announcement, the Fed said: “The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.”

In plain English, the balance of risks has shifted and rate cuts are needed to support the jobs market.

Speaking at his post-meeting news conference, Powell characterized today’s policy decision as a “risk management cut.”

THE dot plot

With this meeting, we received an update to the Fed’s quarterly Summary of Economic Projections (SEP) statement, which contains its much-maligned “dot plot” of interest rate projections, as well as forecasts for economic growth, inflation, unemployment.

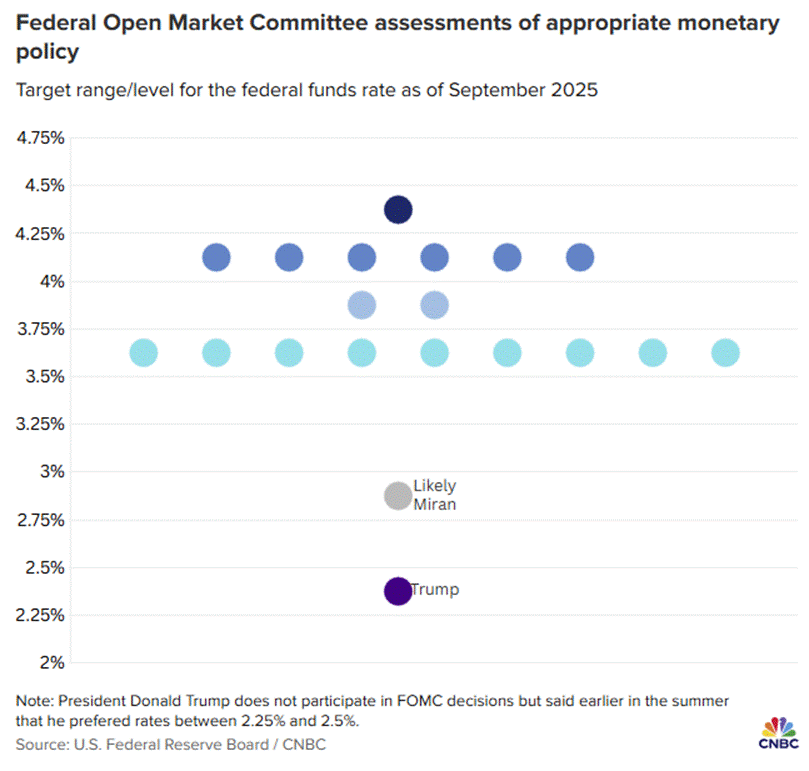

One thing is clear: there is notable disagreement across the committee about the future path of interest rates.

1 Fed member sees five more 25 basis point cuts by year-end, 9 Fed members believe two more cuts are likely warranted, and 6 Fed members expect zero more cuts.

Those are very divided opinions about what should happen for the balance of the year.

While these votes are tallied anonymously, the one outlier of the group – calling on five 25 bps cuts – is believed to be Stephen Miran, the same Fed official with a direct connection to the president that many believe this week’s appointment is degrading the central bank’s independence from short-term political pressures. Miran is pressing the Fed to go bigger and faster on its rate cutting cycle.

All that being said, it’s important to remember we shouldn’t read too much into the dot plot, given the Fed has repeatedly said it is going to be data-dependent and not on a preset course.

That’s even more important to be mindful of, given how uncertain the dynamics remain around a precarious inflation backdrop and notable labor market weakness that wasn’t previously known until recent revisions.

Bottom line quote

“From a policy standpoint, a standpoint of what we’re trying to accomplish, there are no risk-free paths now. It’s not incredibly obvious what to do.”

Well, that doesn’t necessarily instill confidence.

Sources: Federal Reserve, Clearnomics, Renaissance Macro Research, Yahoo Finance, CNBC

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)