Recent underperformance from Technology stocks cause for concern?

The Sandbox Daily (2.18.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

tech’s recent underperformance

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.45% | S&P 500 +0.24% | Nasdaq 100 +0.23% | Dow +0.02%

FIXED INCOME: Barclays Agg Bond -0.40% | High Yield -0.09% | 2yr UST 4.308% | 10yr UST 4.558%

COMMODITIES: Brent Crude +0.76% to $75.79/barrel. Gold +1.79% to $2,952.6/oz.

BITCOIN: -1.28% to $95,024

US DOLLAR INDEX: +0.44% to 107.048

CBOE TOTAL PUT/CALL RATIO: 0.70

VIX: -0.13% to 15.35

Quote of the day

“You can't go back and change the beginning, but you can start where you are and change the ending.”

- C.S. Lewis

Recent underperformance from Technology stocks cause for concern?

Investor concerns over the choppiness and underperformance of many technology stocks since mid-December have raised questions about the broader stock market, even as the major U.S. averages touch all-time highs.

While strong returns from artificial intelligence breakthroughs and enthusiasm have buoyed portfolios over the past few years, they have also raised a number of questions about the sustainability of the market rally.

Concerns for tech stocks primarily include concentration risk, frothy valuations, and comparisons to prior bubbles.

So, how should investors interpret these potential headwinds?

When it comes to tech stocks, it’s important to separate their performance from their impact on the broader market. While these companies have shown ridiculously strong growth, this has also led to higher valuations, creating both opportunities and challenges for investors.

History shows that leadership among both stocks and sectors tends to rotate over time as investor expectations shift, suggesting that maintaining exposure across different parts of the market is the best way to maintain portfolio balance.

The Information Technology and Consumer Discretionary sectors have lagged the broader market in the early parts of 2025. This is a reversal of the trend since late 2022 when these sectors, which include some of the largest technology companies, led the market alongside Communication Services. Instead, other sectors have contributed positively, including Financials, Materials, and Consumer Staples.

This rotation has been driven by concerns over frothy valuations, higher-than-expected interest rates, and uncertainty around AI investments by large tech companies.

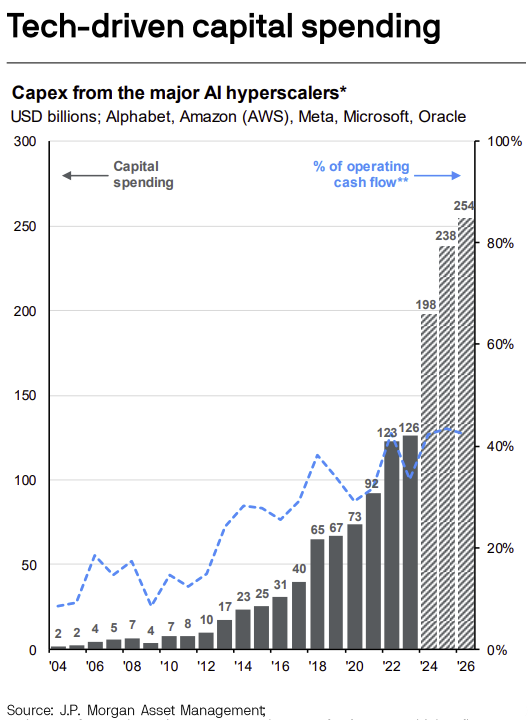

The price-to-earnings ratio for the S&P 500 is now 22x, approaching dot-com bubble peaks, and 27.7x for the Information Technology sector. Importantly, spending on AI infrastructure continues to increase at a rapid rate, just as global competition is rising.

The fact that other sectors and stocks from the S&P 493 have rallied is a positive sign for many investors who have hoped for a broadening of the market.

While it’s still early in the year, this wider market participation suggests a healthier environment where growth is not concentrated in just a few areas and susceptible to growth scares.

It also highlights the search by investors for more attractive valuations across different parts of the market, after two and a half years of strong returns.

Tech stocks will always be attractive investments, but are naturally volatile and sensitive to the economic environment.

In 2022, the Nasdaq and S&P 500 Information Technology sector each fell about 35% before rebounding quickly. Similar pullbacks occurred in 2018 and 2020 as well.

This is a recurring phenomenon, with the most famous being the dotcom bust that began in 2000. However, many other periods experienced similar trends. For instance, the 1960s technology boom centered around a group of popular technology and electronics stocks. These companies traded at high valuations before experiencing significant declines in the 1970s market downturn.

In the long run, technological breakthroughs – whether it’s semiconductors, cloud computing, or large language models – benefit many types of companies and sectors. The digital revolution that accelerated in the 1990s is still evolving today.

For most long-term and/or passive investors, it's important to maintain a balanced approach that takes advantage of these broader trends, rather than attempting to time each market rotation.

Stock market sectors are also important in how they affect the broader market. The composition of major market indices has shifted over the past decade with the largest stocks in the S&P 500 now dominated by technology-related companies.

The fact that a small group of stocks has an outsized impact on the overall stock market may feel unsustainable to many investors. This is a form of "concentration risk," or the potential vulnerability from too much exposure to a single sector, asset class, or small group of investments.

Many investors may unintentionally find themselves with increased exposure to certain sectors as dominant stocks in major indices grow larger.

Perhaps the simplest way to visualize this is to compare the standard S&P 500 index, which places a weight on each stock based on size, to one which gives an equal weight to each stock. The former provides a more accurate sense of the composition of the stock market, i.e., where the dollars are. On the contrary, using equal weightings helps investors to benefit from a broader base of companies and their performance, regardless of their size.

Concentration can amplify both gains and losses. In this environment, after years of significant Tech outperformance, regular monitoring and rebalancing of portfolios may be needed to maintain your preferred risk level. This makes it crucial for investors to regularly review their portfolio.

While a concentrated set of tech stocks has driven markets since the Global Financial Crisis, it's important to know that this has not always been the case. History shows that over longer periods, many stocks have contributed to the success of the S&P 500, as shown in the chart below.

In fact, it's also not the case that large companies always dominate stock market returns. For much of the history of the stock market, the largest companies, known as "blue chips," were viewed as the most conservative, often serving as a source of stable dividends.

So, while there continues to be investor enthusiasm for artificial intelligence stocks and for good reason, investors should maintain a broader view on market opportunities. If AI trends are as impactful as many hope, the economic effects could be more extensive and longer lasting than previous technological revolutions, a fact that benefits balanced investors.

Bottom line – despite concerns about the recent weakness in large tech stocks, long-term investors should remain disciplined to take advantage of all parts of the market.

Source: Clearnomics. J.P Morgan Guide to the Markets, Ned Davis Research, Goldman Sachs

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: