Stay the course: revisiting April 7th, 2025

The Sandbox Daily (10.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

stay the course

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.20% | S&P 500 -0.38% | Nasdaq 100 -0.55% | Russell 2000 -1.12%

FIXED INCOME: Barclays Agg Bond +0.17% | High Yield -0.11% | 2yr UST 3.572% | 10yr UST 4.129%

COMMODITIES: Brent Crude +0.43% to $65.75/barrel. Gold +0.69% to $4,003.9/oz.

BITCOIN: -2.76% to $122,133

US DOLLAR INDEX: +0.54% to 98.634

CBOE TOTAL PUT/CALL RATIO: 0.73

VIX: +5.31% to 17.24

Quote of the day

“Whenever you think that some situation or some person is ruining your life, it’s actually you who are ruining your life. It’s such a simple idea.”

- Charlie Munger

Stay the course

On April 7th – just a few days removed from President Trump’s “Liberation Day” tariff announcement on April 2 – I posted a lengthy note to my Instagram account titled “Stay the Course.”

At the time, investors were panicking as market losses mounted and fears intensified.

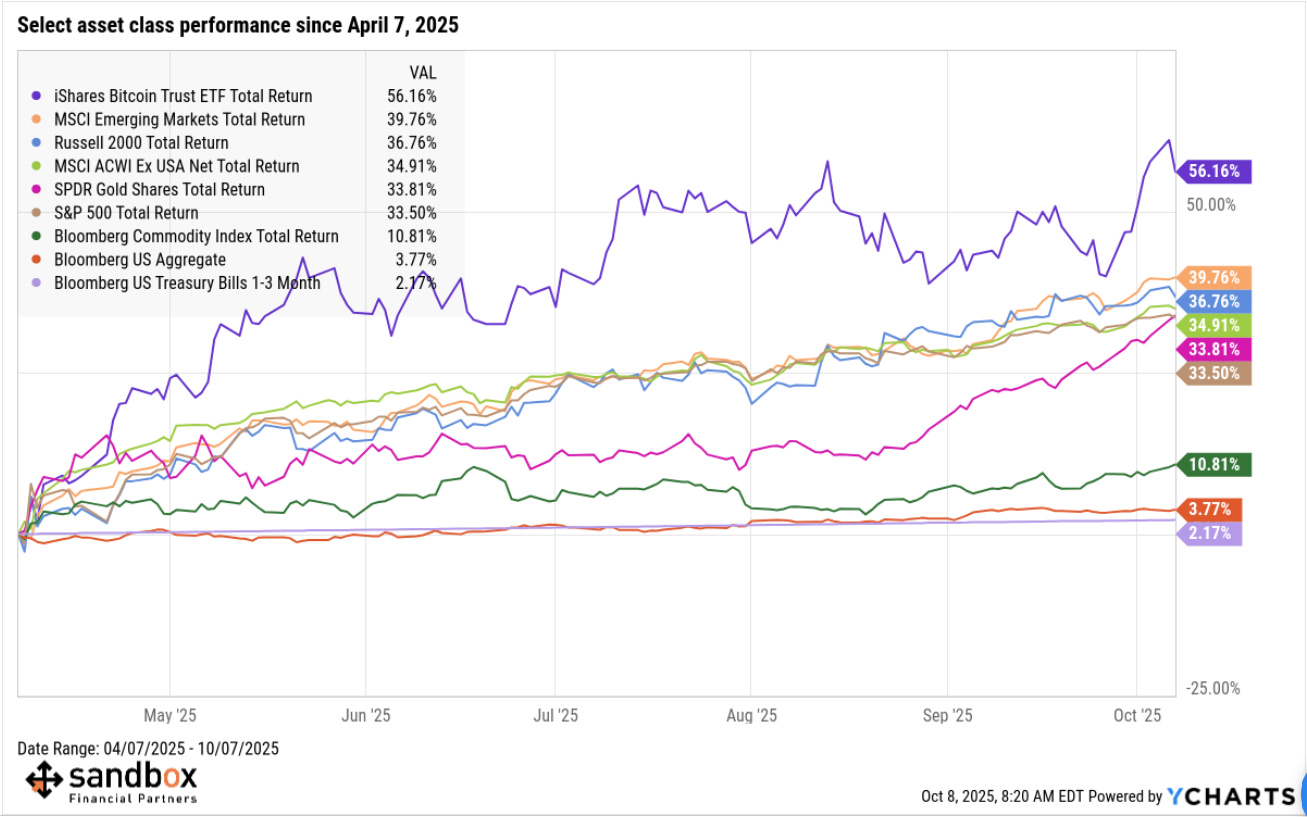

As fate would have it, April 7th would mark the intra-day low for the S&P 500.

Just 48 hours later, the President capitulated and the White House pulled off the biggest about-face in modern history – announcing a 90-day pause on tariffs and explicitly endorsing the U.S. stock market in an unprecedented way that we’ve never witnessed before.

Boy, the President was right.

It sure was a great time to buy.

Six months later, my message on Instagram still rings true.

It’s never easy to stay invested when everything feels broken – fear, after all, is the most primal human response in existence.

But history shows that recoveries rarely send an RSVP. They just arrive, fast and forceful, and when you least expect it, catching most investors on the sidelines.

Missing even a few of those big rebound days – like the +10% surge on April 9 — can quietly rewrite your financial future.

Market timing sounds tempting in theory but feels impossible in practice because sentiment, liquidity, and confidence can all shift in a moment’s notice.

So, if you felt scared back in April, you weren’t alone – I was too. I also shouted more at my television than ever before.

But staying the course through the discomfort is what makes compounding possible; it’s the price of admission, and the ticket is always worth it.

I’ve copied and pasted my “Stay the course” post below.

Save for a rainy day because one day you’ll need it.

Stay the course (dated April 7, 2025)

At multiple points during our investing lives, the market throws tantrums.

This past week is but one of many examples. Portfolios are bleeding, and panic seems to be ratcheting higher.

It’s during these moments, when your stomach turns and your conviction wavers, that you must remind yourself that this is what you signed up for.

We like to think of investing as a rational pursuit. But when prices fall sharply, emotions spill into our hearts and our heads. The mind starts negotiating: “Maybe I should sell now and get back in later… maybe this time really is different.”

But the uncomfortable truth about investing in the stock market is that volatility is not a detour on the investing road. It is THE road. And, if you have to travel long to meet your financial goals, you must travel through it.

When we start investing, we see the charts of the glorious upward slope of compounding over decades. We read stories of patient investors who held through thick and thin and emerged victorious. But, between the starting point and the pot of gold, there’s something most of us gloss over: the cost.

I’m not talking about management or brokerage fees here. Not even taxes. The real cost of investing is emotional discomfort. Outright pain.

You don’t get 8-10% annual returns without signing up for the 30-40% drawdowns. You don’t get the magic of compounding without enduring periods that test your sanity.

As Morgan Housel wrote: “Volatility is the price of admission – the prize inside is superior long-term returns.”

When markets are calm, everyone nods in agreement. But, when the storm arrives, we look for the exit.

I agree that it’s not easy to sit still. After all, human nature is not wired for uncertainty. Our ancestors survived by reacting quickly to threats; this is our “fight or flight” response from the amygdala in our brain. A rustle in the bushes meant danger. In today’s markets, a red tape has the same effect. Selling feels like action, and action feels like control.

And yet, most of the time, doing nothing is the action. It’s the absolute hardest thing to do, but often the most effective.

Every seasoned investor eventually learns that the biggest risk isn’t external. It’s internal. It’s not inflation, recessions, geopolitics, or tariffs that derail wealth creation, but ourselves, acting on emotion instead of reason.

One of the most powerful mental shifts I’ve learned in investing is to reframe volatility not as risk, but as opportunity. Volatility is the stock market throwing a tantrum, and people run for the exits.

When you buy great businesses or ETFs at lower prices, you’re effectively buying future corporate earnings at a discount. But that only works if you’re still in the game, and if you’re not sitting in cash waiting for the “all clear” sign (hint: it never comes).

And let’s be clear: staying the course doesn’t mean being reckless. It means having a plan, which includes asset allocation, diversification, and rebalancing, and sticking to it when it feels hardest. That plan MUST account for tough times. Because tough times are always part of the plan.

Except the financial influencers and the shouting heads on media and social media, no one promised you a smooth ride. In fact, every intelligent investing book, every sensible financial mentor, and every past bad market must have told you this was coming. Maybe not the exact reason and maybe not the timing, but the fact that a downturn or a big crash would come was guaranteed.

So, if you’re feeling anxious, that’s okay. I am too. We’re human. But don’t let anxiety steer the ship. Remind yourself gently: This is what I signed up for.

If your financial goals haven’t changed, your investment strategy probably shouldn’t either.

A market crash isn’t a glitch in the system. This is the system.

And the best path for your plan is not around it, but through it.

So relax. Step back.

And stay the course.

That’s all you have in your control.

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

A great reflective piece