The rally everyone loves to hate

The Sandbox Daily (9.23.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

riding the tape into Q4

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.19% | Russell 2000 -0.24% | S&P 500 -0.55% | Nasdaq 100 -0.73%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield -0.07% | 2yr UST 3.591% | 10yr UST 4.109%

COMMODITIES: Brent Crude +2.06% to $67.94/barrel. Gold +0.65% to $3,799.6/oz.

BITCOIN: -0.44% to $111,829

US DOLLAR INDEX: -0.13% to 97.215

CBOE TOTAL PUT/CALL RATIO: 0.81

VIX: +3.35% to 16.64

Quote of the day

“Everything in moderation, including moderation.”

- Oscar Wilde

The rally everyone loves to hate

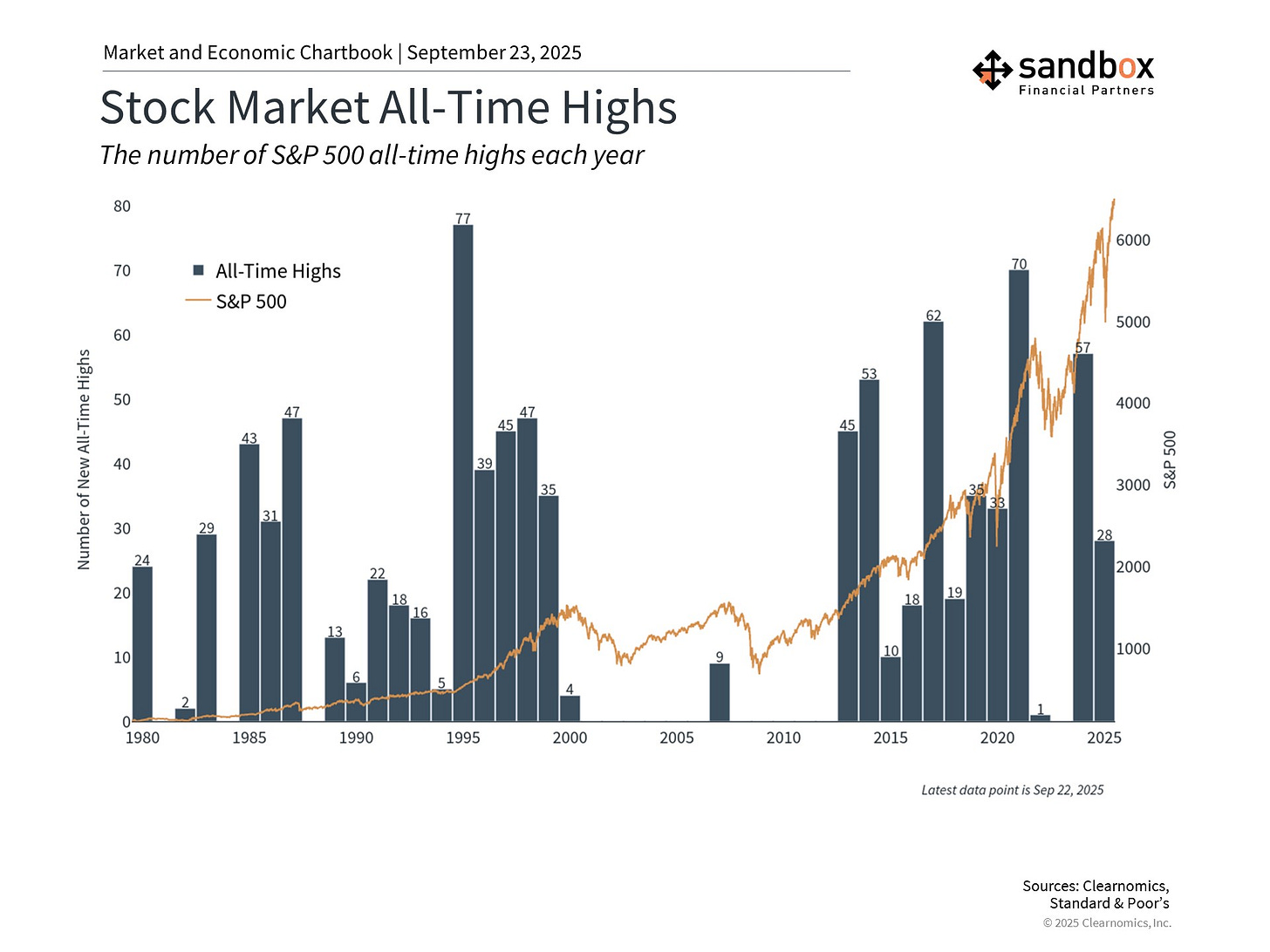

As we approach the final quarter of 2025, nearly all U.S. major averages – including the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, NY Composite Index, both Russell Growth and Value indices, and as of last week Russell 2000 small-caps – have hit new all-time highs throughout the year.

Many of us track the S&P 500 closest, which itself has minted 28 new highs.

Yet, many investors have been marching to the beat of a different drum, choosing to overlook the direction of the primary trend underneath this market.

Those investors who’ve "fought the tape" or remained on the sidelines in Treasuries/money markets are now facing the reality of FOMO, or the “fear of missing out.”

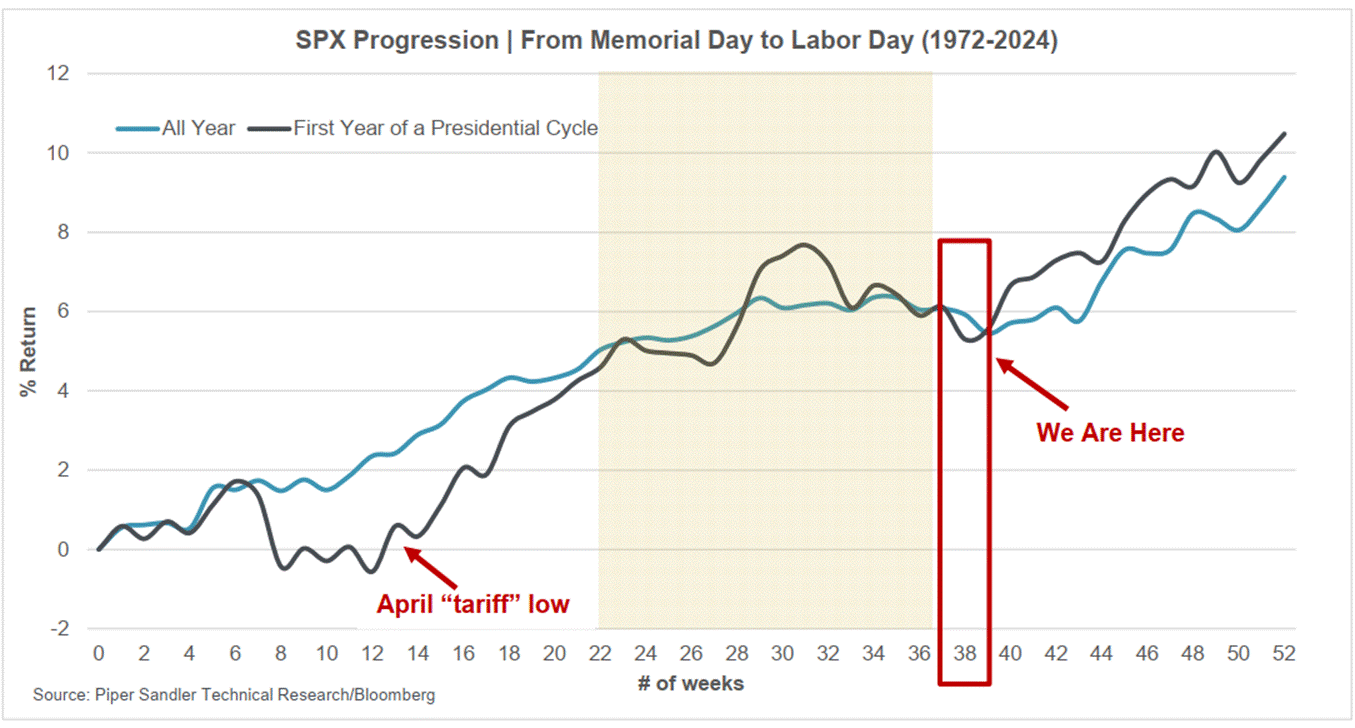

Like many years past, I believe this underperformance through the 1st three quarters versus the different rising benchmarks will oblige many investors to come off the sidelines and play catch-up, which in turn will likely push stocks even higher in Q4.

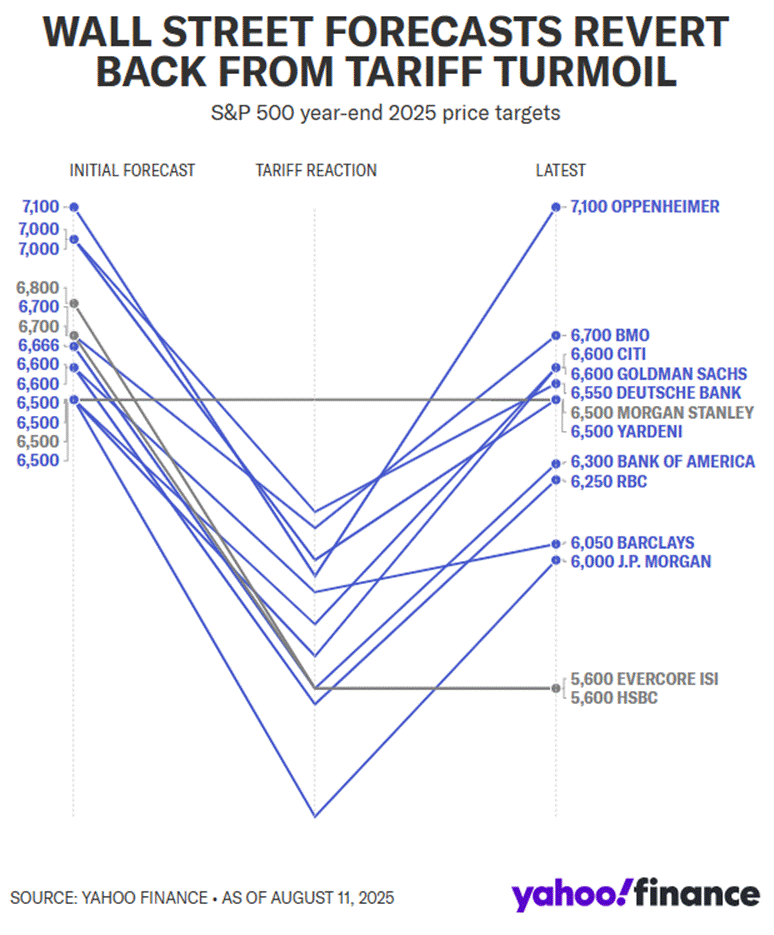

The S&P 500 index has surpassed many year-end price targets earlier than expected.

Given the solid underlying price trends and broadening market participation, along with the Fed resuming its rate cutting cycle to support the labor market, it’s likely the current level of 6,600 will serve as a “pit-stop” before advancing higher during the final months of the year.

Historically, September has been a period riddled with market turbulence and corrections.

However, the current rally has defied the usual doldrums of seasonality, continuing higher for almost five consecutive months since April's Liberation Day low.

When you’re in a bull market, it’s important for investors to ride it – at least until it’s clear that a recession is underway or a bubble is bursting. Right now, I’m not seeing either.

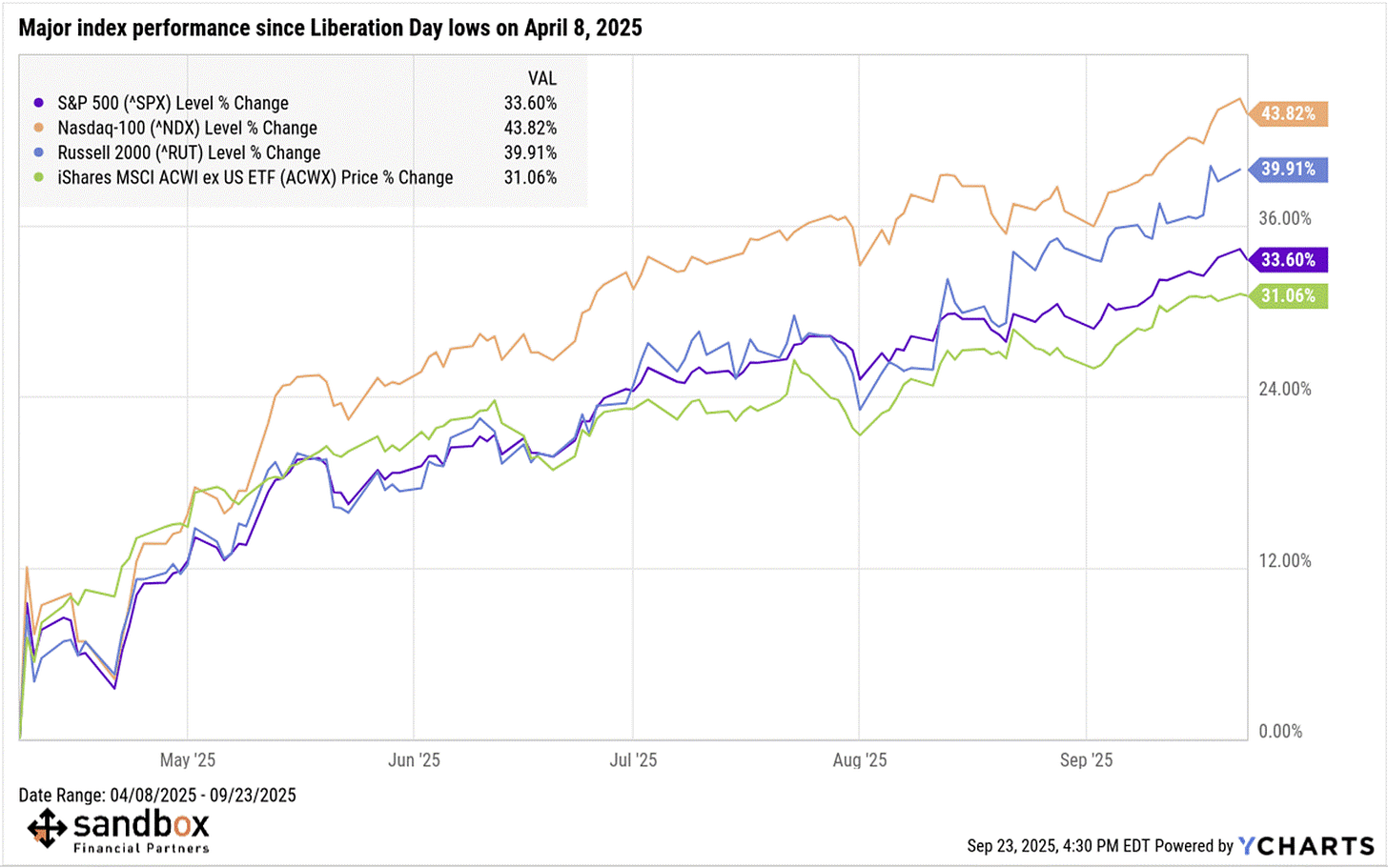

During this time, it’s been money making season. Many different indexes are up 30-40%, an impressive rally that has benefitted long-term investors.

Looking ahead, you can see from the chart below – which shows the average S&P 500 progression over 52 weeks since 1972 – we are about to enter a historically bullish portion of the calendar that races higher following the cycle lows corresponding with the summer doldrums.

It's always important for investors to look for divergences between what people are saying/thinking and what the market is actually doing.

Ignore the never ending parade of doom-and-gloom and stay on target!

Sources: Clearnomics, Yahoo! Finance, YCharts, Piper Sandler

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)