It's been a month since the buyer's strike hit the market. Taking stock of the wreckage.

The Sandbox Daily (3.14.2025)

Welcome, Sandbox friends.

Today is March 14 – a day to celebrate all the wonderful gifts that math has provided us.

Happy Pi Day !

Quick programming note before we get started. The Sandbox Daily will be taking a publishing break next week.

If you are attending Future Proof Citywide in Miami, I’ll be there – come say hi !

Today’s Daily discusses:

taking stock after one tough month for stocks

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.53% | Nasdaq 100 +2.49% | S&P 500 +2.13% | Dow +1.65%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield +0.46% | 2yr UST 4.023% | 10yr UST 4.321%

COMMODITIES: Brent Crude +0.94% to $70.54/barrel. Gold -0.06% to $2,991.3/oz.

BITCOIN: +4.52% to $84,213

US DOLLAR INDEX: -0.13% to 103.693

CBOE TOTAL PUT/CALL RATIO: 1.03

VIX: -11.72% to 21.77

Quote of the day

“Obstacles don't have to stop you. If you run into a wall, don't turn around and give up. Figure out how to climb it, go through it, or work around it.”

- Michael Jordan

Taking stock after one tough month

Several positive developments for equities in 2025, including a solid Q4 earnings season, a softer-than-expected February CPI report, and lower interest rates, have been overshadowed by the constant news flow out of Washington D.C.

The Trade Policy Uncertainty Index is at a record high, while the Economic Policy Uncertainty Index was only higher during COVID. The turmoil has weighed on stocks.

Let’s take stock of the carnage after nearly one month of relentless, albeit orderly, selling pressure.

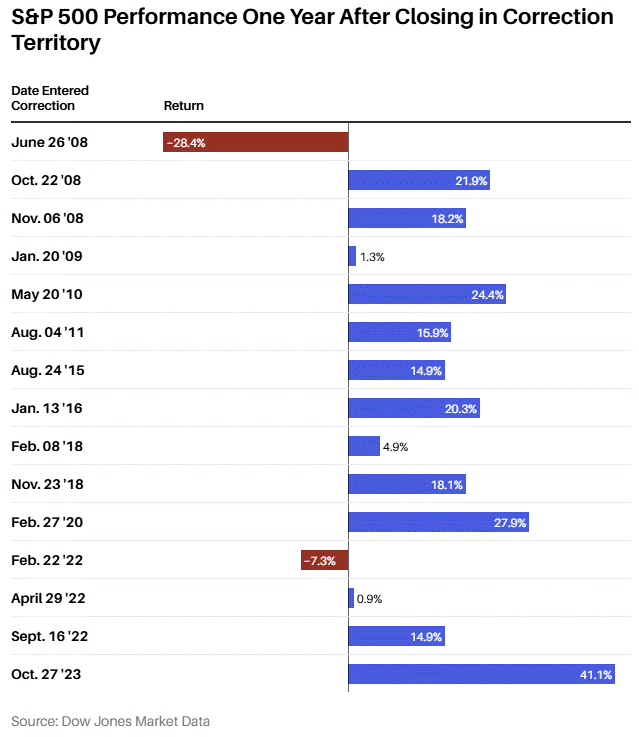

The S&P 500 officially slid into correction territory this week, it’s first downdraft of 10% or more since October 2023 – 341 trading days ago.

In other words, it’s been a minute.

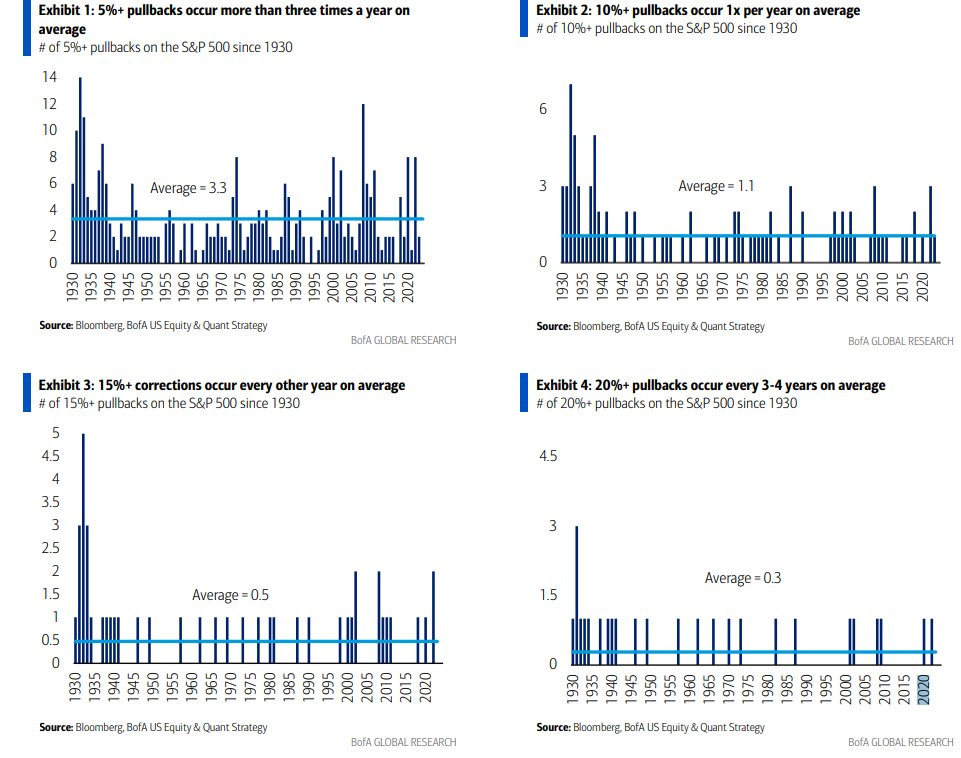

Corrections are a normal part of the investing process for long-term investors.

In fact, we should expect one of these 10% doozies roughly once per year.

The S&P 500’s 10% descent from a record high into correction territory has wiped out trillions of dollars in market value.

The market value of the S&P 500 index at its February 19 peak was $52.06 trillion. Thursday’s decline dropped the index’s market value down to $46.78 trillion.

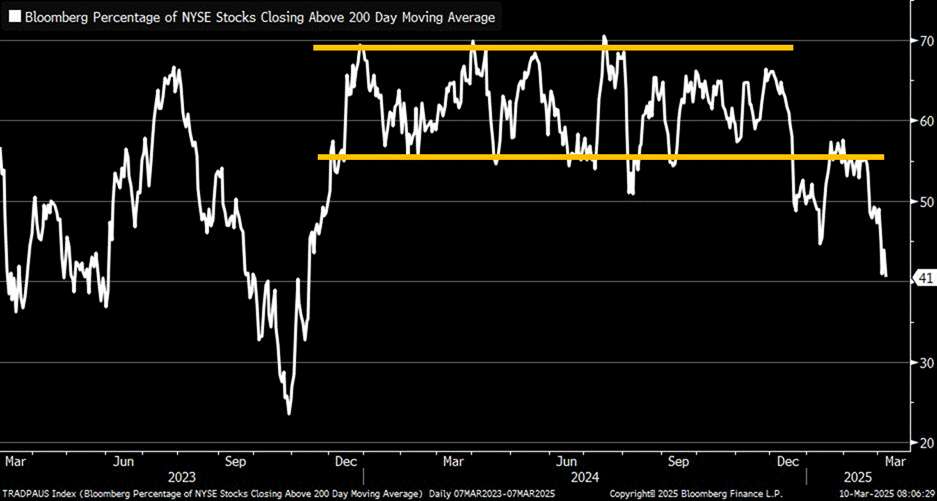

This has happened as the share of NYSE stocks trading above their 200-day moving average dopped to 41%, the lowest since November 2023.

The sudden and swift drop in stocks, as opposed to a slow and steady grind downward, seems to have all the hallmarks of a classic correction.

Now, many are wondering if the market will stabilize here (10% correction), or continue heading lower into bear territory (20% drawdown).

Studying the data, we know that corrections are more common than bear markets. History shows just 25% of all post-WWII corrections metastasized from a 10% correction into a full-fledged bear market.

And investors must remember these corrective waves are healthy, resetting valuations and leading to more dependable gains on a go forward basis.

Following the previous 15 corrections going back to 2008, the S&P 500 was higher by more than 15% over average over the next 12 months.

But, before we can begin pushing higher, we need to see evidence of stabilization. We cannot be certain we’ve seen the low for 2025 considering this oversold condition was shallow and other than Beta/Momentum, there wasn't a widespread flush in the markets.

Some indicators do show today’s bounce could have further room to run.

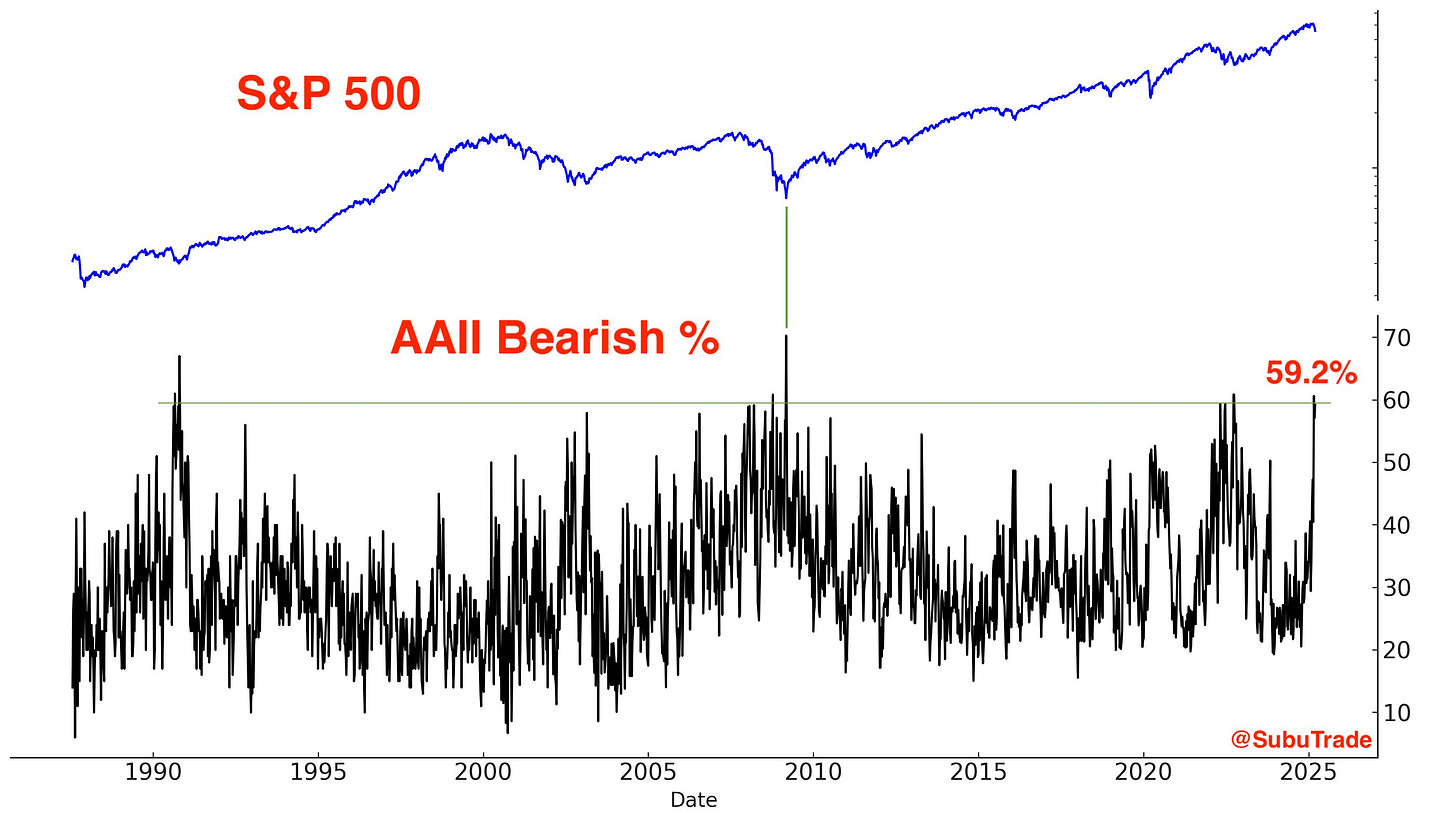

Sentiment is the most supportive for the market in years. The American Association of Individual Investors (AAII) Percentage of Bears has held above 55% for three weeks in a row, an unceremonious record that’s happened just one other time in history: March 2009.

Equal-weight S&P 500 has notched an oversold condition which implies the average stock is now oversold.

Just 18% of issues within the index are trading above their 20-day moving average.

Sure, stocks can bleed lower from here and we see that final flush in the VIX or put-call data, but as you can see below, there’s not much room for more stocks to head lower that haven’t already done so.

Finally, credit remains on firmer footing than equities, which historically is a bullish sign for the broader investing landscape because the signal from the bond market has always been the better tell.

U.S. High Yield corporate bond spreads over Treasuries are still below their 2021 lows (2.99 vs. 3.01 points) and reflect continued confidence in the U.S. economy.

If the economy was teetering, it shows up in credit spreads and copper prices and yet neither signal is ringing alarm bells.

While the technical damage to the charts is significant (as many corrections are) and the economic data has softened meaningfully over the last 3-4 months, there remains ample evidence the bull market has not been cancelled yet – labor market, earnings, tech CapEx cycle to name a few – and this selloff can still be viewed as a cyclical correction in the context of an ongoing secular bull market.

As I stated earlier this week: be patient, pick your spots, and stay on target.

Sources: iCapital, Ned Davis Research, Bank of America, Bloomberg, Ryan Detrick, Dow Jones, SubuTrade, Renaissance Macro, DataTrek

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Wall Street Journal – You Can’t Escape Politics. Your Investing Decisions Can. (Jason Zweig)

AXIOS – A DOGE reality check in Treasury Data (Neil Irwin)

JPMorgan – Fifty Days of Grey (Michael Cembalest)

OptimistiCallie – Precedent in the Unprecedented (Callie Cox)

Meanwhile in Markets – Wall Street is Quietly Hinting at Major Ideological Shift Toward Bitcoin This Year (Dan Runkevicius)

Podcasts

The Prof G Pod with Barry Ritholtz – How Not to Invest (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Gray Man – Ryan Gosling, Chris Evans, Billy Bob Thorton (Netflix, IMDB, YouTube)

Music

Yellowcard & Steve Aoki – Ocean Avenue (Spotify, Apple Music, YouTube)

Books

Vishal Khandelwal – Boundless (Safal Niveshak)

Tweets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: