Markets are looking right through policy uncertainty

The Sandbox Daily (2.11.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

market-based measures dismiss policy uncertainty

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.28% | S&P 500 +0.03% | Nasdaq 100 -0.29% | Russell 2000 -0.53%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.04% | 2yr UST 4.291% | 10yr UST 4.537%

COMMODITIES: Brent Crude +1.30% to $76.86/barrel. Gold -0.24% to $2,927.3/oz.

BITCOIN: -1.64% to $95,795

US DOLLAR INDEX: -0.37% to 107.914

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: +1.33% to 16.02

Quote of the day

“The agony of defeat is as low as the joy of winning is high. However, they are the exact same to me. I'm at the gym at the same time after losing 50 games as I am after winning a championship. It doesn't change for me.”

- Kobe Bryant

Market dismissing economic policy uncertainty

Two themes are likely to drive markets in the coming months and influence the direction of growth and inflation expectations: U.S. policy and the evolving competitive landscape in the AI race. Here we focus on the former.

President Donald Trump has resumed his White House tenure much how the last one ended: dizzying policy announcements and disruptive implementation practices that more closely resemble Silicon Valley’s “founder mode.” Unfortunately, the move fast and break things mentality that works so well for disruptive innovation on the West Coast is up against the sprawling federal government apparatus drowning in bureaucratic red tape and public officials.

In just a few short weeks, Trump’s administration has taken on global trade, immigration, federal funding, tax policy, DEI, foreign aid, paper straws, and a slew of other priorities.

This has led to a tremendous amount of uncertainty.

Here’s the Financial Times:

“Donald Trump’s weaponization of uncertainty has been dialed up in his second term. The ‘will he, won’t he’ prevarication over import duties, and other threats, has left companies and investors in a holding pattern. The observable befuddlement is now being picked up in various gauges of uncertainty.”

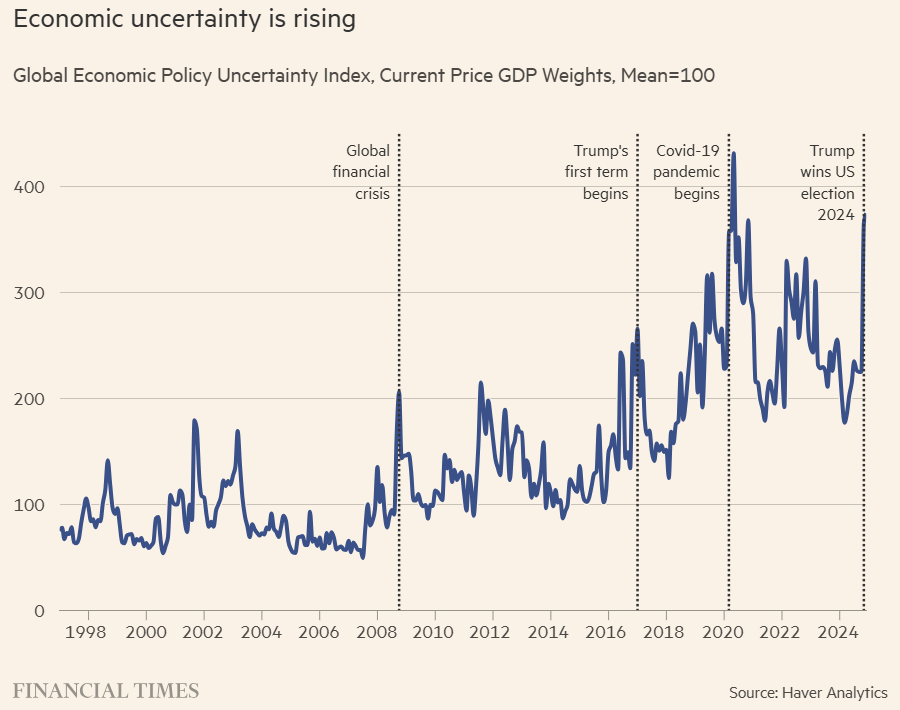

In turn, the Global Economic Policy Uncertainty Index has jumped to an all-time high, save for the one-time surge during the early stages of the Covid-19 pandemic.

We’ve seen this script with the President before.

When policy uncertainty rose in Trump’s first term, the VIX rose alongside it.

Except, this time, the VIX hit the snooze button when the alarm went off.

While policy uncertainty is not the only input into implied volatility, it sure has taken on a near-term elevated profile given the intense focus and far-reaching ramifications of policy administration.

Outside the one-time spike in mid-December when the Federal Reserve pulled back on 2025 rate cut projections in its FOMC meeting, the volatility index has been held in check under 20 – its long-term average.

When markets are under pressure, it also shows up in credit spreads.

The bond market is the biggest asset class in all of capital markets, with a total valuation of roughly $150 trillion. If there’s serious systemic risk in the stock market, credit spreads will notify investors.

So far, these spreads have been narrowing, not widening.

The U.S. Investment Grade option-adjusted spread (OAS) is currently around 81 bps, well below its mean of 130 bps since 1990. The all-time low was 52 bps in August 1997.

Meanwhile, High Yield spreads are currently around 264 bps, well below its mean of 518 bps since August 2000. The record low was 234 bps in May 2007.

One of my favorite intermarket indicators to gauge risk appetite is the ratio of Consumer Discretionary (XLY) stocks to their Consumer Staples (XLP) counterparts.

Throughout history, this ratio has put in divergences at significant turning points, acting as an excellent leading indicator for the overall market.

For example, in the chart below, you can see the ratio peaked in late November 2021 which was a clean signal that market dynamics were shifting prior to the 2022 bear market. The ratio then bottomed in December 2022, roughly two months after the official index cycle low was put in, thus confirming a new trend (higher) had begun.

Over the last year or so, this classic risk indicator was rangebound – until it broke out in the fall.

More recently, risk appetite is coiling – continuing to consolidate sideways while the price action in the major indexes remains a range-bound chop fest.

Rising policy uncertainty will create jarring headlines and cause potentially visceral personal reactions, however the market is looking right past it.

This market remains a choppy tape for U.S. equities in the near-term, as part of a stellar ongoing intermediate-term uptrend, which has shown no material evidence of deterioration despite recent DeepSeek- and tariff-related selloffs.

Remember, only price pays, so trade the tape in the front of you.

Sources: Financial Times, iCapital, YCharts, Ned Davis Research, DataTrek Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: