The S&P 500 just flashed a highly bullish “Golden Cross” technical signal

The Sandbox Daily (7.2.2025)

Welcome, Sandbox friends.

Quick publisher’s note before we begin today: Friday is Independence Day, so The Sandbox Daily will be taking a short break in observance of the holiday, returning to your inbox on Monday, July 7th with our regularly scheduled programming.

Today’s Daily discusses:

Golden Cross for the S&P 500

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.31% | Nasdaq 100 +0.73% | S&P 500 +0.47% | Dow -0.02%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield +0.19% | 2yr UST 3.791% | 10yr UST 4.283%

COMMODITIES: Brent Crude +3.02% to $69.14/barrel. Gold +0.55% to $3,368.2/oz.

BITCOIN: +3.22% to $109,245

US DOLLAR INDEX: -0.03% to 96.793

CBOE TOTAL PUT/CALL RATIO: 0.86

VIX: -1.13% to 16.64

Quote of the day

“I do the very best I know how - the very best I can; and I mean to keep on doing so until the end.”

- Abraham Lincoln

The S&P 500 just flashed a highly bullish “Golden Cross” technical signal

On the surface, the first half of 2025 has been challenging for investors.

From a trade war and market correction to an escalating Middle East conflict and concerns over the growing national debt, investors may feel as if financial markets are stumbling from one problem to the next.

Daily news headlines often present an endless stream of negativity, making the situation feel worse than it may be.

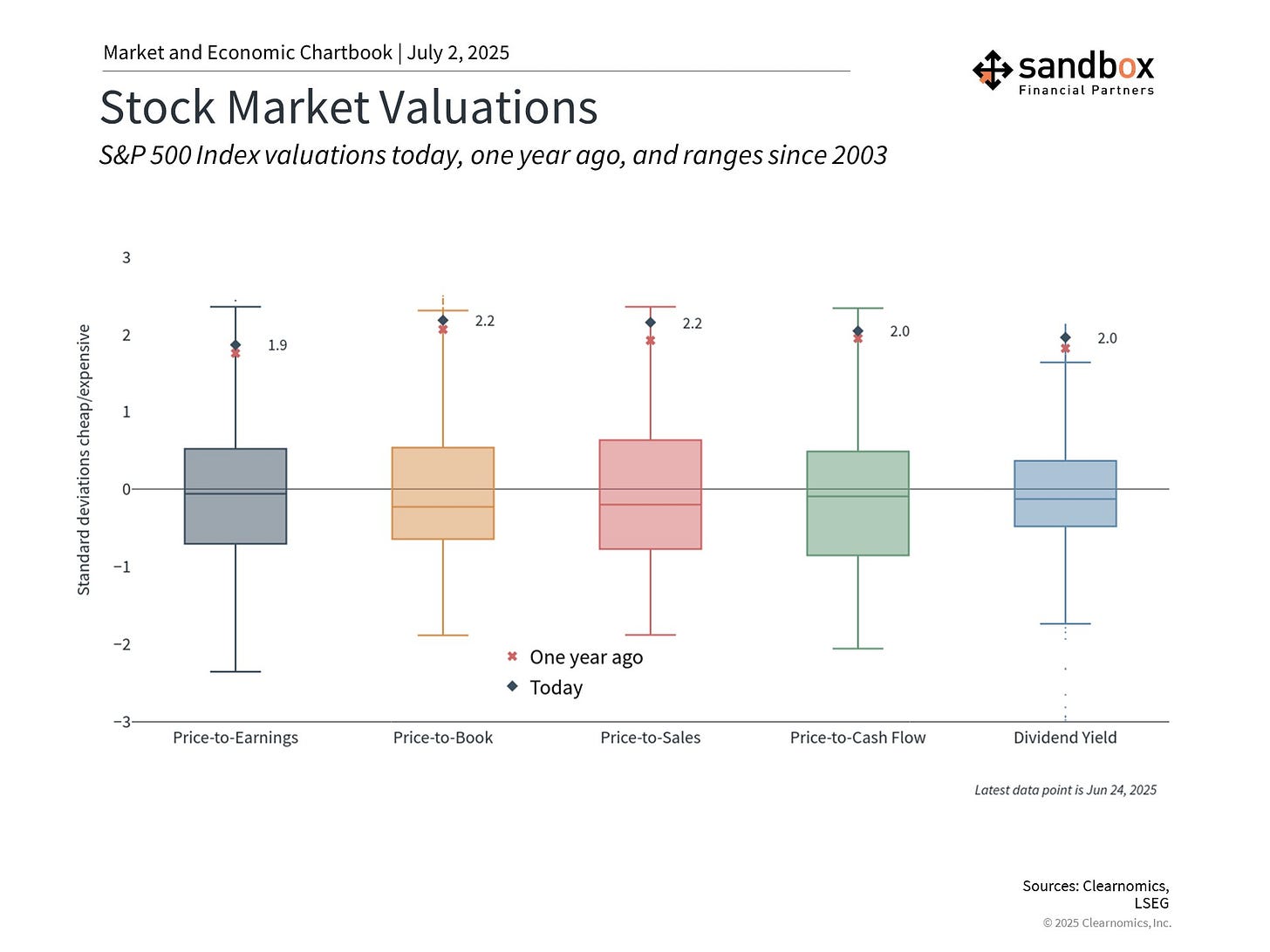

One of the biggest challenges with the explosive move off the April 8 lows is that U.S. stock market valuations are once again on the expensive side. That said, the elevated valuation environment has created opportunities in other areas of the market.

International stocks, small-caps, and value-oriented sectors trade at more attractive multiples, providing potential sources of opportunity for patient investors.

Bond markets also offer compelling opportunities, with yields remaining above long-term averages across most fixed income sectors.

One of the most significant developments of 2025 has been the strong performance of international stocks, with developed and emerging markets experiencing double-digit gains, based on the MSCI EAFE and MSCI EM indices.

This has partly been driven by a weakening U.S. dollar. When the dollar falls, assets denominated in foreign currencies become more valuable.

This serves as a reminder that market leadership rotates over time.

At the same time, U.S. based investors should be encouraged by what’s on the horizon.

More trade deals, the coming Fed rate cuts, and passage of the Big Beautiful Bill all serve as potential second-half catalysts for more rocket fuel.

From a market structure perspective, the weight of the evidence continues to favor the bulls. It’s why I’ve been incredibly bullish since April.

Rotation continues to power the market higher as the baton transitions from one leadership group to another, with bitcoin looking as the next candidate primed to leg higher.

Important offensive groups like Tech, Communications, Financials, and Industrials are minting new all-time highs.

High Beta and Cyclicals are out front as leadership, a classic emblem of risk-on behavior.

The Advance-Decline line is confirming the price action, indicating breadth is durable under the surface and the indexes aren’t overly reliant on specific names.

More stocks are outperforming the S&P 500 index itself than we’ve seen since 2022.

Just this week, the S&P 500’s shorter-dated 50-day moving average crossed above its longer-term 200-day moving average for a Golden Cross signal.

On the Golden Cross signal, Jeff DeGraaf of Renaissance Macro wrote in a note to clients today: “Since 1927, the [signal] has proved better on a CAGR basis than buy-and-hold, but equally important, has provided almost 50% more Sharpe than a buy and hold strategy.”

This chart pattern leans traditionally bullish indicating a strong probability of a longer-term bull market is underway.

Looking at the data below, while data over shorter time frames is a bit noisy, the 3-month, 6-month, and 12-month returns are overwhelmingly bullish with high hit ratios.

Bottom line?

Maintaining exposure to different regions and multiple risk exposures can both enhance portfolio outcomes and potentially help reduce risk through diversification.

For U.S. focused investors who suffered a bruising 1st half, the picture continues to look more encouraging for the months ahead.

Source: Clearnomics, Ned Davis Research, SubuTrade

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)