President Trump’s first 100 days

The Sandbox Daily (4.29.2025)

Welcome, Sandbox friends.

This afternoon I had the pleasure of joining The Watch List with Nicole Petallides on the Schwab Network.

My advice: “We need to stay nimble, be flexible, and stay on target.”

Today’s Daily discusses:

President Trump’s first 100 days

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.75% | Nasdaq 100 +0.61% | S&P 500 +0.58% | Russell 2000 +0.56%

FIXED INCOME: Barclays Agg Bond +0.24% | High Yield +0.27% | 2yr UST 3.652% | 10yr UST 4.175%

COMMODITIES: Brent Crude -2.85% to $63.98/barrel. Gold -0.59% to $3,327.6/oz.

BITCOIN: +0.41% to $95,020

US DOLLAR INDEX: +0.21% to 99.217

CBOE TOTAL PUT/CALL RATIO: 0.84

VIX: -3.90% to 24.17

Quote of the day

“When we are no longer able to change a situation, we are challenged to change ourselves.”

- Viktor Frankl

President Trump’s first 100 days

The first 100 days of President Trump’s second term in office have been among the most chaotic and destabilizing in history among a broad range of measures, from sentiment to market volatility to global trade and everything in between.

For investors, it’s been a bruising ride.

The last time the stock market performed this poorly inside the 100-day window was under President Nixon back in 1973 when the S&P 500 tumbled nearly 10%.

In fact, the 19% waterfall decline from the market peak on February 19 to its trough on April 8 was one of the fastest >15% drawdowns in modern history.

How did we get here?

Uncertainty. Lots of it.

As the old adage on Wall Street says, markets do not like uncertainty.

With the global trade map being redrawn in real time, one thing that is certain at this point is Wall Street is worried. Earnings estimates are falling, inflation expectations are rising, and the bond market is only two steps off the ledge over tariff concerns triggering an wanted bout of stagflation (a mix of rising prices and slowing economic growth).

As David Kelly, chief global strategist at JPMorgan Asset Management, recently stated: “We’ve decided to have a fight with every kid in the playground at the same time.”

With the Trump “put” already exercised following a disastrous trade policy rollout, look for the administration to continue easing up on their aggressive tariff agenda.

While markets have recovered roughly half their losses after the 90-day reciprocal tariff pause announcement, the polls have not been as forgiving.

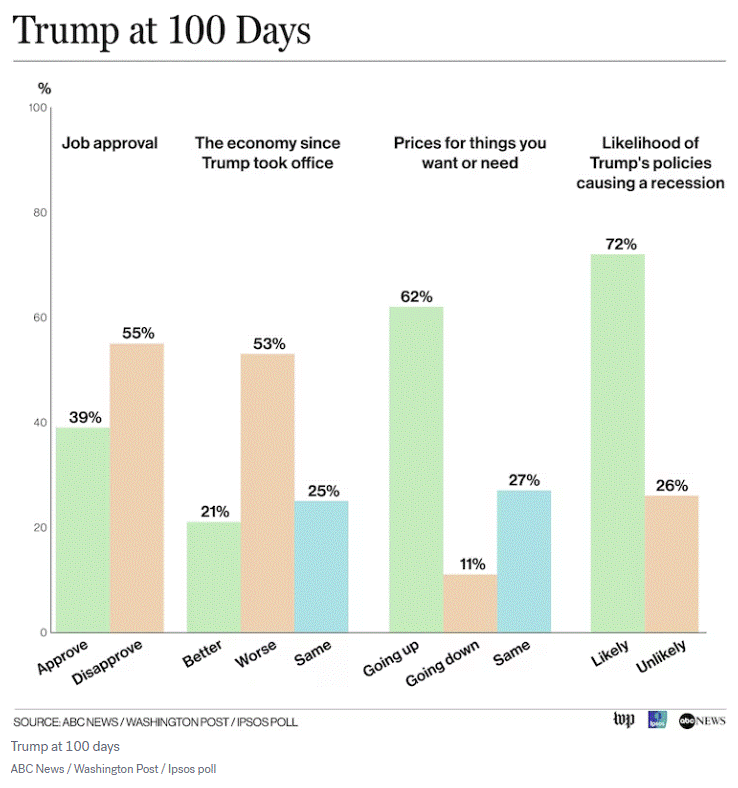

Trump’s waning popularity shows his 39% approval rating is the lowest at the 100-day mark in the past 80 years.

Unfortunately, for the world economy, a lot of short- and long-term damage has already been inflicted. At this point, the extent of the damage remains unknown and will take months, if not years, to be made visible.

Just last week, the CEOs of Walmart, Target, and Home Depot met with President Trump to warn the administration 1) higher consumer prices would be difficult to avoid and 2) certain products could become scarce if retailers decide not to sell them to avoid tariff costs.

Businesses have been rushing to cancel factory orders or halt shipping containers before they leave China. Meanwhile, capital investment and new hiring plans have hit the pause button as the near-term playbook calls for just the bare necessities.

Below is a perfect example of these emerging macro trends – ugly soft data is coming out across the board. This survey comes courtesy of the Dallas Fed, which fell to its worst level since covid-19. Nearly every category is trending in the wrong direction.

Over the coming months and years, look for Mr. Trump to press ahead across multiple fronts – trade policy, tax plans, deregulation, social programs, energy independence, border control, foreign policy, and more – as his priorities take shape.

Sources: Wall Street Journal, Financial Times, Goldman Sachs, Ned Davis Research, ABC News, Bloomberg

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: