Wednesday's monster intraday reversal and what it means for you

The Sandbox Daily (9.12.2024)

Welcome, Sandbox friends.

** Quick programming note before we begin. **

We’re heading out west to Huntington Beach, CA next week for Year 3 at the Future Proof Wealth Festival. We have some fun content planned while we’re away; more to come soon on that end. In the meantime, we will be lightly posting content Monday-Wednesday of next week (9/16-9/18). Expect the full newsletter to return on Thursday, September 19th.

Today’s Daily discusses:

Wednesday’s monster intraday reversal

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.22% | Nasdaq 100 +0.97% | S&P 500 +0.75% | Dow +0.58%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield +0.14% | 2yr UST 3.648% | 10yr UST 3.681%

COMMODITIES: Brent Crude +2.20% to $72.16/barrel. Gold +1.76% to $2,587.1/oz.

BITCOIN: +1.08% to $58,173

US DOLLAR INDEX: -0.44% to 101.241

CBOE EQUITY PUT/CALL RATIO: 0.60

VIX: -3.50% to 17.07

Quote of the day

Wednesday’s monster intraday reversal: I’m listening. Are you?

Always respect price. Because at the end of the day, that’s the only thing that pays, right?

Yesterday’s intraday reversal is price action that certainly caught my attention.

When the S&P 500 was trading at its nadir on Wednesday morning – right around 5400 and retesting the lows from Friday, September 6 (aka jobs day) – institutional buyers came en masse with a swift buying program that lifted markets higher throughout the rest of the session, with the index closing right at its highs of the day. The numbers tell the story: the S&P 500 initially dropped -1.61%, then rallied 2.72%, and finished the day up +1.07%.

And it wasn’t just me. I know it caught others attention, as well.

Here’s Walter Deemer’s take, leaning into his 52 years (!!) of institutional market experience:

And here’s the masterful market technician, Frank Cappelleri:

How about Callie Cox, newly minted Chief Market Strategist of Ritholtz Wealth Management:

Wednesday’s session is all-the-more impressive when weighed against the uncertain macro backdrop we all face in the short-term.

For a moment, let us consider what the market is currently wrestling with:

the upcoming U.S. national election that’s set to be a tightrope until election day itself (November 5th)

a classic recessionary indicator of an inverted yield, blinking red for the better part of two years, that’s only now dis-inverting and re-steepening

a Federal Reserve that is set to begin its rate cutting cycle next week

a market caught in the throes of a seasonally weak period of the calendar

the labor market that is no longer tighter than an old pair of jeans

So, Wednesday’s price action was notable. And… consider my time horizons are long-term, where the day-to-day noise is often full of candlesticks that I can brush off.

In fact, the last time we witnessed this type of intraday reversal in the market was the bottom of the current bull run, October 2022.

Ryan Detrick quantitatively assessed what yesterday’s signal could mean. Days like September 11, 2024 have historically shown the market to be higher 6-months later 72.7% of the time with an average gain of +9.4%, and higher 12-months later 72.7% of the time good for an average gain of +12.2%.

Thursday’s follow-through confirms Wednesday’s reversal was perhaps the start of a bigger move, or at the very least, a shift in September’s underlying downtrend.

Seeing confirmation of the broader market’s move from a beaten down leadership group like the Semiconductors – SMH finished higher on Wednesday by over 5% – is just the cherry on top. As of September 6, SMH was in a -23.56% drawdown from its recent high. Also, keep in mind that many were perhaps signaling a near-term top in the Semis with this bearish inverse head-and-shoulders pattern, until yesterday.

This is a very strong message that the market is sending.

A compelling inflection point.

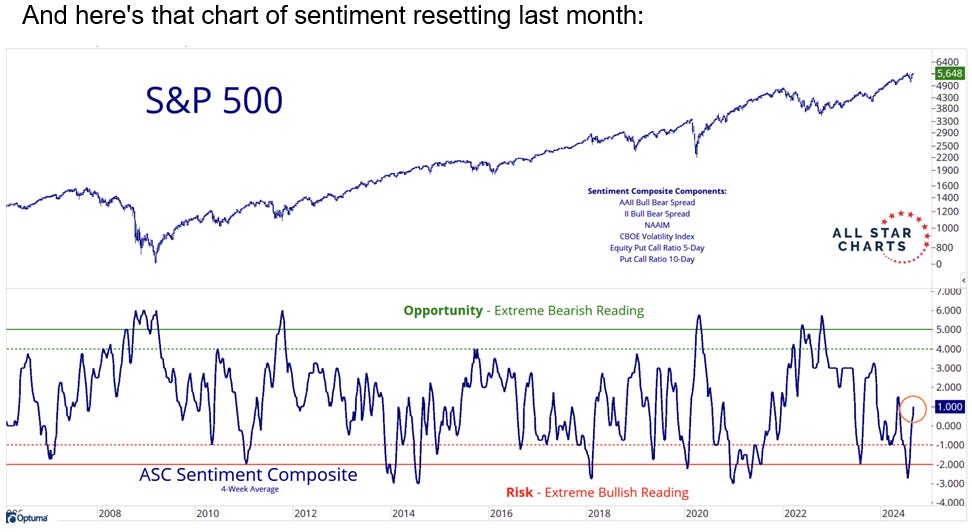

We’ve seen a total reset in sentiment and positioning that had been at a fever pitch in early August.

I’m listening. Are you?

Source: Walter Deemer, Frank Cappelleri, Ryan Detrick, Callie Cox, All Star Charts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.